Now, more than ever, we are reminded why having an emergency fund is important. You could lose your job, have a medical emergency or a global pandemic could upend your life. Either way, an emergency fund will be the reason why you have a security net that provides you with room to make your next decision.

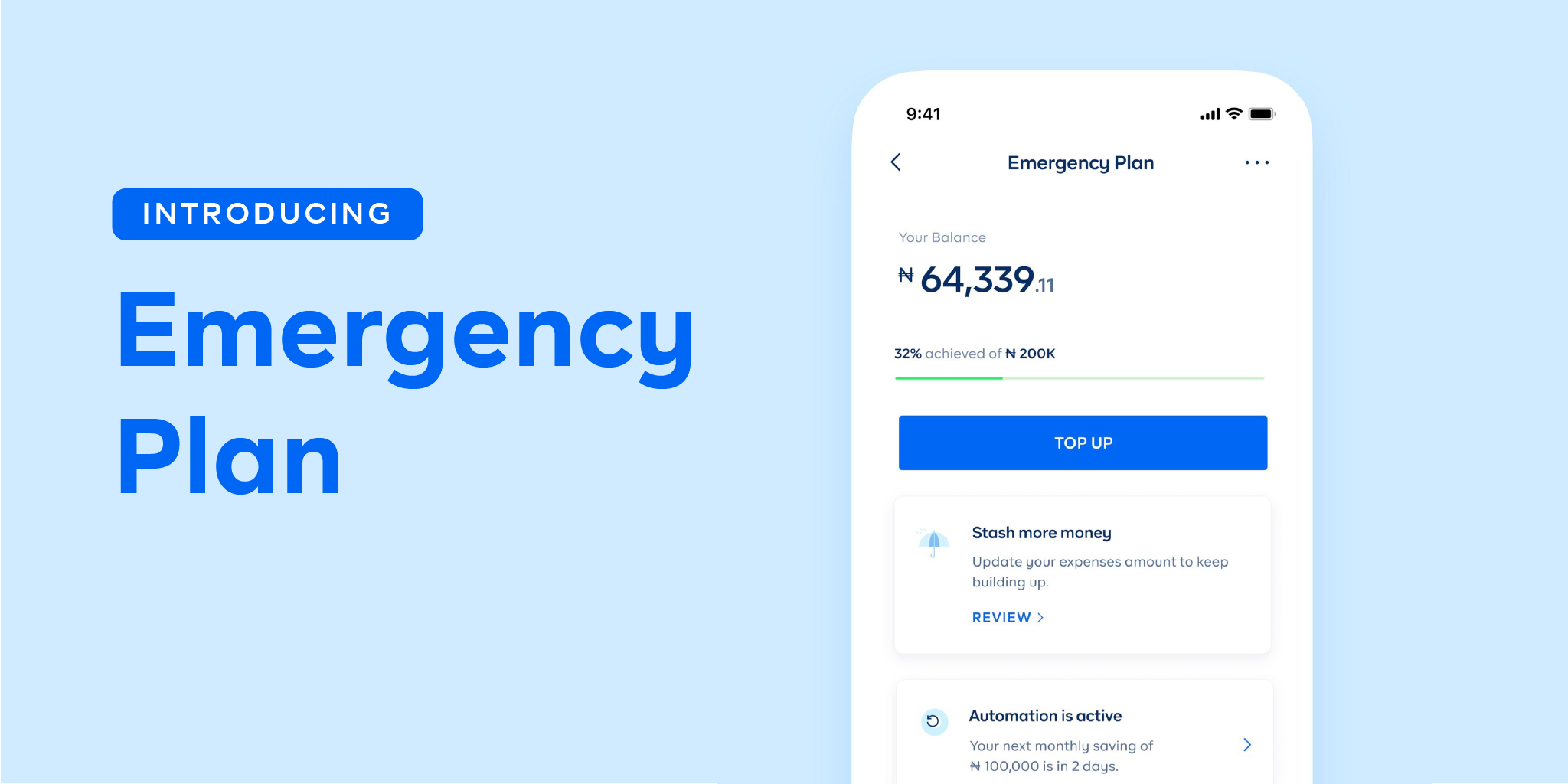

At Cowrywise, we believe in flexibility and providing our customers with diverse options. Yet we did not have a dedicated emergency plan. Sure we have Money Market Funds and Stash which are immensely flexible and funds can be accessed at any time. After much user research and feedback, we learned that there was a big gap that we could help bridge. Thus our new feature, the emergency plan, was born.

In this article, we will cover:

1. What is an emergency fund?

2. Why should you have an emergency fund?

3. How does the Cowrywise emergency plan work?

4. How to set up your emergency plan

What is an emergency fund?

An emergency fund is a pool of money which is set aside specifically to cover the financial surprises life may decide to throw your way. Everyone knows that there’s really nothing worse than having an emergency suddenly occur and not having the funds to cover them.

By building up your emergency fund, you can be prepared to pay for unexpected emergencies without having to turn to loans or other borrowing options that create unnecessary stress. While an emergency fund won’t solve all your money problems, it’s a great start to getting your finances headed in the right direction.

Why should you have an emergency fund?

Having a robust emergency fund gives you peace of mind. No one wants to live one paycheck away from not being able to pay the rent or one car breakdown away from not being able to get to work. It can also be a way to prepare you for something as sudden as the global pandemic like these six Nigerians we spoke to.

It also gives you some freedom. If you decide to leave a relationship or your job becomes so unbearable that you have to leave before finding another or you want to go back to school or start your own business, having an emergency fund gives you the freedom to do those things.

Keeping that money separate from the money you use to pay bills or other financial goals you have can help you resist the urge to spend it on other things. Sometimes when you see a big number in your bank account you get a little too quick to purchase things you really do not need. Keeping this money separate can help you avoid temptation.

Here is a 1-minute video that explains why you need to build up your emergency fund.

How does the Cowrywise emergency plan work?

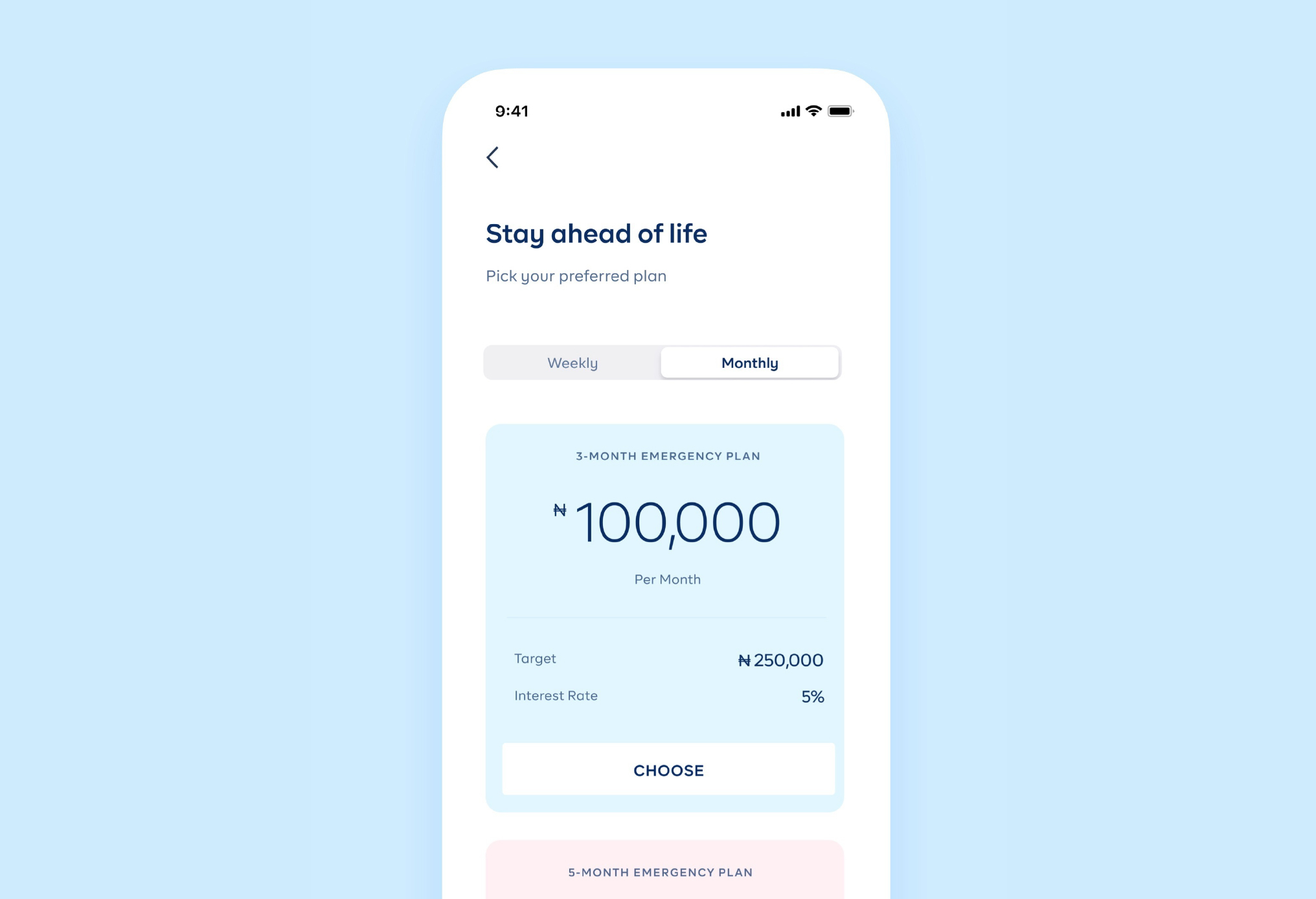

The emergency plan on Cowrywise uses the information about your expenses and income provided by you to recommend an emergency plan that works for you. The recommended target amount of the emergency plan is 5 times your monthly expenses. If you pay rent annually, remember to add the monthly equivalent of your annual rent to your monthly expenses. This means if your source of income disappears, for example, you are well prepared to live life normally for the next 5 months without having financial worries. Hence, we help you estimate a fit-for-purpose emergency fund target that truly reflects your monthly expense patterns.

The recommended target amount of the emergency plan is 5 times your monthly expenses. If your monthly expense is NGN300,000 (remember to include the monthly value of your house rent), our recommended emergency fund target for you is NGN1,500,000.

To build up the emergency fund, our financial tool utilises your income information to recommend between 10% and 20% of your monthly income and gives you an estimated time period over which your customised emergency fund will be 100% funded.

Did you know? Saving into your emergency fund can either be automated on a weekly or monthly basis. You can also top it up anytime you want. It is a taste of freedom! Automated savings is our recommendation.

Here are a few perks of the Cowrywise emergency plan:

- Customised for you: Our emergency plan is customised just for you based on your income level and expense patterns.

- Safety of funds: To ensure your emergency funds live up to its calling, they are invested in low-risk mutual funds managed by fund managers licenced by the Securities and Exchange Commission (SEC).

- Easy accessibility: You can make withdrawals from your emergency fund anytime an emergency happens.

- Real-time monitoring: We keep you accountable to meet your emergency fund target by giving a real-time visual representation of how you are doing towards meeting your target.

- Earn returns: The sweet part is that you earn returns on your emergency funds. The return you earn is determined by the returns from the money market funds the savings are put into.

Please note that similar to purchasing mutual funds on Cowrywise, depositing into Emergency Funds requires a 1.5% payment processing fee. This is however capped at N2000 which means that you don’t get charged more than that, irrespective of the amount you fund your Emergency Fund with.

How to set up your emergency plan

Now we know all about emergency funds and how they work. Here is a step-by-step guide to setting up your emergency plan:

1. Login to your Cowrywise account. Sign up for free if you don’t have an account.

2. Tap the emergency plan card on your home screen.

3. Take the quiz about your income and expenses.

4. Set up your emergency plan by selecting how often you would like to save.

5. Choose your payment method and begin saving in your emergency plan.

Never be unprepared for an unplanned event again, set up your emergency plan and begin saving for rainy days.