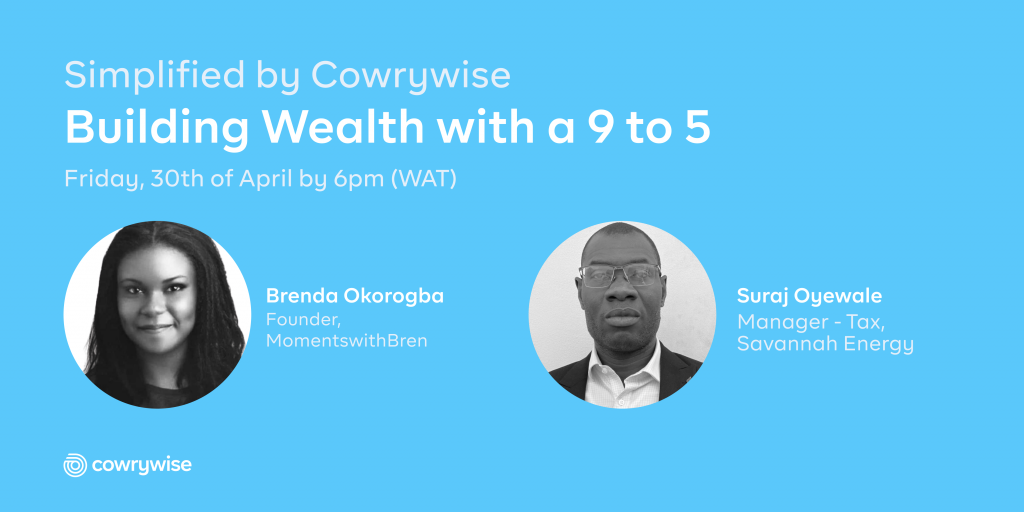

‘Simplified by Cowrywise – Building Wealth with a 9 to 5’ was an interactive virtual event held to help employees attain financial stability. Simplified by Cowrywise are periodically held to help break down how money works for everyday people. At the Simplified event held in April, Brenda Mcwilson Okorogba, Founder of MomentswithBren Consulting and Suraj Oyewale, Manager of Tax at Savannah Energy Plc shared tips on how to build wealth as an employee. This will interest you if you really love your job and do not intend to take the entrepreneurial route to wealth creation. Here’s a summary of both Suraj’s and Brenda’s session, read it till the end to learn how to effectively make, manage and multiply your money as an employee.

Suraj’s Interesting Career + Wealth Building Story

For someone who’s done quite well for himself in the last 13 years since he’s been working, there are many lessons to learn from Suraj. In humility, he shared that he has built five “small houses” since he began his career in 2008, but we all know that owning one house in Nigeria is a big deal, talk less of five!

The interesting thing to note here though is that he accomplished most of this from his 9 to 5. He started his career a few days after his NYSC at 26 in an Oil and Gas firm with his first salary being N163,000.

Join an organization that rewards your results

As shared in this guide about building wealth with your 9 to 5, Suraj talked about receiving salary increases year on year in his company and there’s a lesson here. As long as you put in the work and perform optimally on the job, you should be compensated. Treat your career as a strategic business with periodic growth plans. If you’re currently at a job that has little to no prospects for your professional growth and salary increase, you should begin to make plans to switch jobs or industries.

Lookout for the things that you’re “lucky” to have

Thankfully, Suraj stayed with his brother who stayed at a distance close to his office. This meant that rent cost was little to none (this is considering if he paid for items like foodstuff in the house) and transportation costs were minimal. Cue this article about wealth creation that highlights the benefits of staying with parents/siblings for a while. This is because your rent fee is only the beginning as expenses begin to pile up after your rent itself – light bill, gas, fuel, inverter, foodstuff, etc. If you’re comfortable and are being treated well in your parent’s or sibling’s place, do not let peer pressure drive you out. Take your time to plan your move.

For the first year, Suraj saved money on rent and transportation. However, he realized that he still exhausted his salary before the end of every month. In his words, “despite all these advantages, I was still going broke. So I asked myself what can I do, what can I use this money for“?

I’ll assume you caught the lesson here but I’ll still state it. Even when you have some facts working in your favour, if you don’t take care, you can still end up broke. Instead of always saving to spend (which we preach against), save to invest instead. That way, your money is working to bring in more.

Black tax with love

Will you ever be able to hack black tax? ?

In Suraj’s case, he got calls from friends and family every month which required him to foot one bill or the other. Most of us can relate and in many cases, can’t escape it. The best thing to do is to find a way to manage it without offending people (if that’s possible ?). Even in black tax, there are essentials and non-essentials. Learn to read between the lines and have the confidence to say no when necessary.

Turn cash gifts into assets to build wealth as an employee

After excellently working for one year, the Oil and Gas firm Suraj worked for gave their staff something called “upfront” which was N1.1 Million at the time. Granted, not many companies do this, but there are other gifts such as a 13th-month salary and other benefits that are more obtainable. What you do with these matters.

Suraj used this upfront to buy land and finish the foundation in his state of origin. He was just 27 years then.

“First to do no dey pain”

Buying this land and building the foundation of the house was only the beginning. Suraj spent the next four years building the house and guess how he was able to fund the building process…with his job!

Do not be pressured by what others are doing. What you should do instead is build a long-term financial plan for yourself and then work towards achieving it. As they say “first to do no dey pain” which means that after someone has done something, there usually will be someone else who does that thing better. These most times end up paining the first person that may have been feeling fly. Lol.

Invest in what you understand, while you seek knowledge about investments you don’t understand

This heading is the number 2 habit highlighted in the 7 Habits of Highly Profitable Investors.

Do not invest in things you have little to no knowledge about. Like Suraj, begin by investing in an asset you understand well and then work towards diversifying. He mentioned that buying land was a family culture, which means that he had people ahead of him who could put him through when it came to real estate.

Don’t join bandwagons and end up losing your money, especially if you’re a conservative investor. However, do not be lazy in seeking knowledge too. “I don’t know enough about this asset to invest in it” might just be you being lazy to ask the right people the right questions.

As you take your time, don’t also overdo it so that you’ll not find yourself at a point where everyone is ahead of you because you refused to move with the times.

Scroll to the bottom of this page to find out more about mutual funds.

Be happy with little cash

He mentioned that this is unconventional around here but it works for him. Suraj is big on assets and does not mind living on little cash for living expenses. He will rather have most of his cash working for him in form of investments.

In his words, he’s always “working on one project” where a project here means investments that will bring him more income. There’s a lot to learn here if, like Suraj, you want to build wealth as an employee.

Many Africans feel rich when they’re able to see their bulk of cash in a “savings account”. However, the more strategic thing to do is to begin investing in order to increase your positive net worth. Why leave your money where you continually get bank charges you don’t even understand when you can put those funds to work?

Strategically jump ship

After working a few years in the company he joined after NYSC, Suraj joined another company and in 2012 and his salary increased to N500,000 per month. Even now, that’s considered a lot compared to what most people earn. After you’ve put in your best at one organization, do not be emotional about jumping ship. Of course, you should always way your options. You might benefit more from staying long-term in a company than moving to another. Take time to evaluate and don’t make hasty career decisions.

Brenda’s wholesome finance and wealth creation tips

Finance is not merely about making money. It’s about achieving our deep goals and protecting the fruits of our labour. It’s about stewardship and therefore, about achieving the good society. – Robert J. Shiller

It starts with your mindset

Your mindset is so important to attaining financial stability and abundance. It is possible to make a lot of money and still lose it all when you have a bad relationship with money. You must have heard of people who were “living” the life but eventually had to file for bankruptcy.

In her words, “What is your mindset and behaviour as it relates to spending, saving and investing decisions? Taking the time to learn how to manage your money is a great idea, no matter your current financial situation.”

It’s not just about “building” wealth which to most people is only futuristic. It begins with how you’re managing money. This is the foundation to build wealth as an employee.

Implement financial care practices

This involves thinking of your finances as one whole where everything is intertwined. Some benefits of financial care practices include:

- Getting a higher return on investment

- Understanding why you make decisions that are bad for your finances

- Overcoming financial obstacles

- Increasing your awareness of your finances

- Understanding the behavioural problems that lead you to make bad decisions

- Exploring your financial behaviour

- Understanding your relationship with money

- Identifying the psychological barriers that affect your money-related decisions

- Learning from your financial mistakes

- Becoming more resilient

- Releasing tension

- Identifying your most common investment mistakes

Use SWOT analysis for your finance

SWOT stands for Strengths, Weaknesses, Opportunities and Threats.

People often use the SWOT analysis when creating a business plan, but it also comes in very handy when you’re trying to understand your financial state and what achievements are possible for you.

What are your strengths and skillsets? What is your competitive edge in your industry or company that will bring you closer to your financial goal? Is it the connection you have, your level of expertise in your industry or your work experience?

Be honest about your weaknesses. Do you spend more carelessly and live without a budget? Are you the type of person who makes hasty decisions when planning your finances? Weaknesses aren’t to make you feel bad. Remove the idea of shame and guilt and don’t be too hard on yourself. Instead of looking at weaknesses as flaws, look at them as areas of improvement.

Take advantage of your opportunities. Are you in a growth-based company or industry where you will be rewarded for your results? What are the benefits of the skills you currently have and how can they fetch you more in terms of career development and wealth creation? We all have opportunities but not everyone uses them optimally.

What are your threats? Are you in an industry that’s slowly becoming extinct? Will your skills still be relevant in 5 years or more? If you ever lose a job, will it be very hard or almost impossible to get a new one because your skills are not as relevant as others? Those are threats that you have to eliminate so they don’t hinder you from your financial goals.

Have a growth mindset

“It is somebody who wants to grow that will work towards attaining financial independence.”

When you wake each day, you should be thinking of how to do better financially and build wealth as an employee. A part of feeling fulfilled with the job you do is monetary compensation. It might not be everything, but it is definitely something!

Set AGILE financial goals

Wishful thinking wouldn’t help you achieve your financial goals. Instead, take control of your finances and use your financial goals to create a roadmap to where you want to be. Develop simple daily habits that result in wealth accumulation. Also, remember that your goals have to be very specific and measurable.

Visualize your financial goals and categorize them into short-term, midterm and long-term.

Practical tips to help you build wealth as an employee

- Spend less (be frugal)

- Earn more (you can change jobs, get a raise, or start a business on the side that does not interfere with your 9 to 5)

- Invest wisely (do your due diligence and invest in assets that make your money make more money)

Know your financial stage

There are different financial stages and some of them are listed below.

- Financial dependency (dependent on someone else)

- Financial solvency (you make enough to pay your bills)

- Financial stability (you’re able to keep up with debts repayment and have an emergency fund)

- Debt freedom (you have paid off 100% of your debt)

- Financial security (your investments provide enough to cover your basic survival expenses)

- Financial independence (your investment income covers your current lifestyle not just your survival expenses)

- Financial freedom (your investment cashflow is greater than your current lifestyle

- Financial abundance (you have more investment cashflow than you would ever need)

What’s your bottom line?

The idea of Simplified by Cowrywise events isn’t to make you adopt the exact way a speaker has built wealth. Instead, get the lessons from their stories and then tweak them to your lifestyle. Someone might read this and think “I need to join an Oil and Gas firm”, or “I need to be just like MomentsWithBren” but what if you do and hate it?

Instead, think “I need to join a growth-based firm or industry”, one that gives you long-term professional and personal growth.

Again, not everyone will take the entrepreneurial route to financial freedom. If it is your desire to build wealth as an employee, then I hope you’ll take these lessons and begin to implement them.

What tips will you incorporate going forward?

Share with us in the comments.

To watch the full session, please click the link below and subscribe!

For partnership