The Nigerian gambling industry, like a shadowy figure in the night, looms large yet remains elusive. While its presence is undeniable, quantifying its size and discerning its impact remains a Herculean task.

To understand this elusive industry, we sent out a survey in which about 3000 people responded. From the survey, it is clear that people have an understanding that gambling might not be a brilliant idea yet many still dabble in it. The reason for this is a question that many have pondered with varying results due to several factors ranging from motivation to the time horizon of participants.

In this report, we take a look at some of these reasons, explain elusive concepts like the house edge and proffer a sustainable alternative to gambling.

Gambling versus investing: A Deep Dive

Gambling in Nigeria has its roots in the pre-colonial era, with activities involving chance, like dice games and pool betting, being prevalent sources of amusement. Pools betting which involved prediction of the outcomes of matches or races however soon became the most popular form of gambling in Nigeria after being introduced in the 1920s. Though initially targeted at expatriates living in Nigeria, it soon gained popularity among Nigerians as well. This strong growth and interest led to the creation of the Nigerian Football Pools Association (NFPA) in the 1950s. The NFPA was responsible for collecting pool entries and distributing the proceeds to the winners.

Throughout the 1960s and 1970s, pool betting maintained its popularity, while the NFPA remained influential within Nigerian social circles. The NFPA arguably forestalled the rise of a new form of sports betting in Nigeria. However, the betting scene underwent significant changes in the 1990s with the emergence of sports lottery. Like pool betting, sports lottery entailed betting on the outcomes of sports events, especially football matches. Despite similarities to pool betting, sports lottery differed in that private firms operated it, offering larger payouts.

After a decade of iterations, Baba Kessignton and his premier lotto quickly became a household name and arguably laid the groundwork for the digital revolution that was to come, catapulting sports betting into the digital age and making it accessible to millions of Nigerians online.

“Whether you are at the poker table or the stock market, emotions can cloud your judgment and lead to poor decisions”

Current Industry Landscape

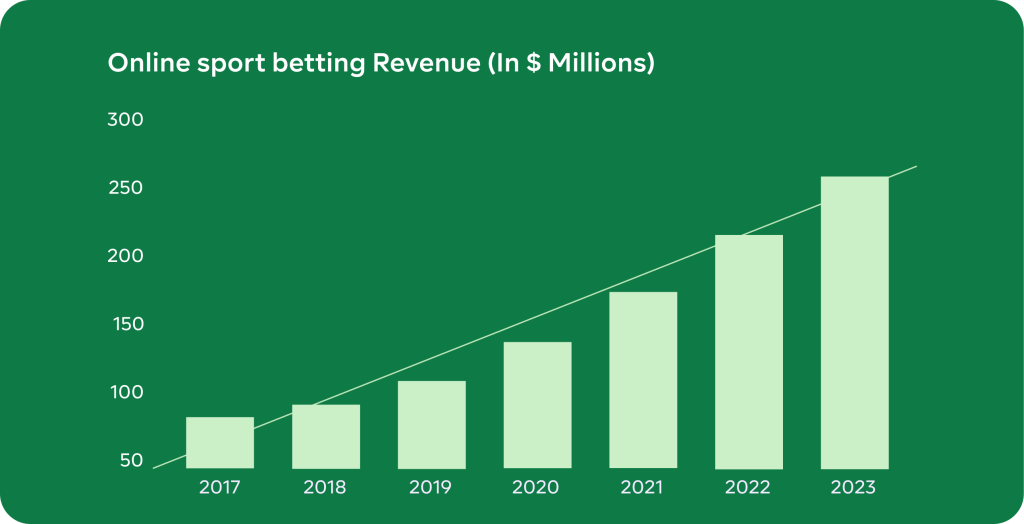

Since the commencement of the National Lottery Regulatory Commission in 2005, the betting industry has witnessed strong growth, with the number of sports betting permit holders growing to 59 currently from only Nairabet in 2009. According to Statista, the total revenue of the online sports betting industry grew from $85 million in 2017 to $257 million in 2023.

Revenue from online betting growth. Source: Statista

From an industry structure standpoint, the Nigerian gambling industry shares some similarities with monopolistic competition. Characterised by numerous sportsbooks and betting platforms operating in the market, each offering slightly different odds, promotions, and user experiences.

While the basic product (betting on sports events) is similar across platforms, there are variations in odds, betting options, bonuses, and user interfaces, creating product differentiation. Larger, well-established firms like NairaBet and BetNaija have a significant market share and wield some market power, particularly in terms of setting odds and attracting customers through branding and marketing efforts. Still, there is no clear-cut leader in the gambling industry. And this explains the heavy reliance on advertisements to influence customer behaviour.

The industry however has some relatively high barriers to entry, like the N30 million capital requirement for market participants. There is also a payment for permit Fees which cost about N100 million and is valid for 5 years.

The High Stakes Game: Delving into the Differences Between Gambling and Intelligent Investing

Gambling and investing, share intriguing similarities rooted in the fundamental concepts of risk and reward. Both involve allocating resources with the hope of gaining a positive return. Both share elements of risk, have uncertain outcomes and require strategic decision-making. Despite these similarities, the principles at the core of these two seemingly similar acts are essentially different. These different core principles range from motivation, time horizon, risk mitigation, and the degree of outcome dependency on chance.

Let’s take a deep dive into these principles.

Motivation: Whether at a casino, on a sports booking website, or in a poker game, individuals engaging in gambling activities almost always seek excitement, cheap thrills from the potential of a quick win or succumbing to social pressure. The allure lies in the prospect of a quick windfall combined with the associated adrenaline rush of the unpredictability of outcomes. And though cheap thrills by themselves are not dangerous, it has the potential to become very addictive. On the other hand, individuals typically engage in investing with a motivation for long-term financial growth, wealth accumulation/protection, financial freedom, or even the intellectual challenge it presents.

Time and chance: Anyone who has rolled a die before knows that the results are majorly determined by events that elude any form of prediction and control. Though you might think that there is some skill to certain gambling outcomes particularly in sports betting, the reality is that luck remains a key component. The unpredictability of human nature and team dynamics for example ensure that no amount of skill can guarantee success.

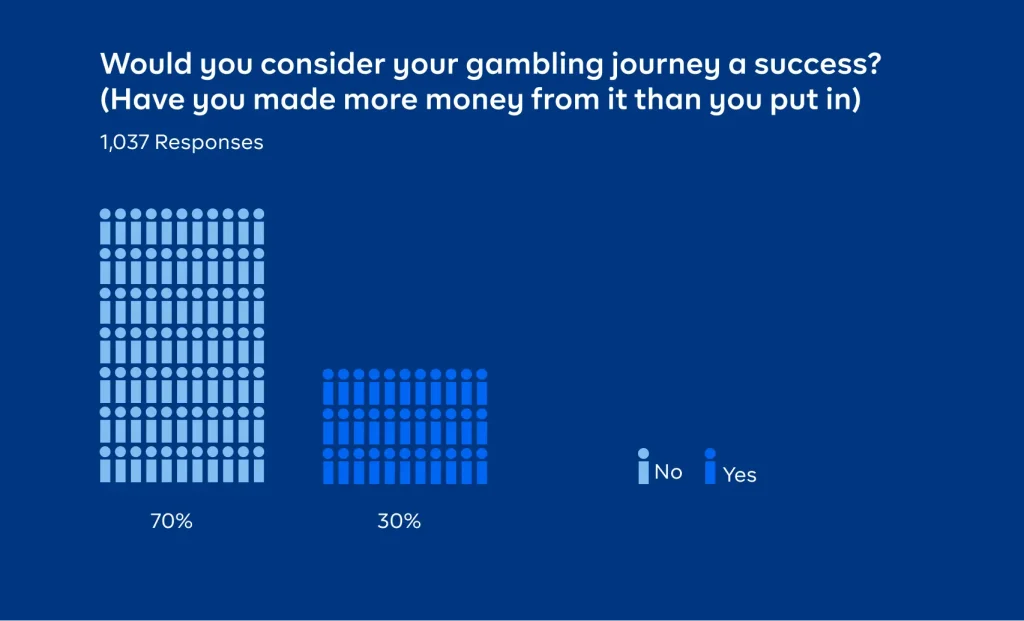

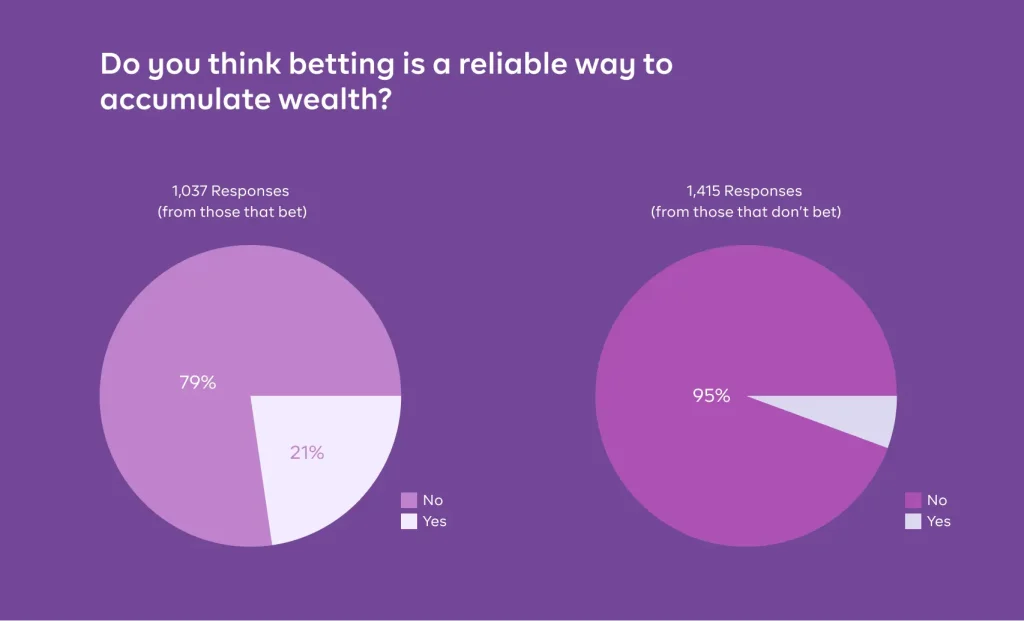

The erratic nature of gambling could explain why 89% of gamblers end up losing their money according to the Wall Street Journal. From our localised survey, the numbers are not so different. 70% of people who claimed to gamble said they had lost money from gambling. Meanwhile, 79% said they do not think it is a reliable way to accumulate wealth. For those who do not gamble, 95% said they do not consider it a reliable way to accumulate wealth. For the overall, survey, 88% of respondents said they do not think gambling is a reliable way to accumulate wealth.

Source: Cowrywise survey

In contrast, investing involves a more calculated and strategic approach. While there is still an element of uncertainty in investing, the outcomes are not solely dependent on chance. Investors can conduct research, analyze financial data, and make decisions based on their analysis to potentially influence their investment outcomes.

Time Horizon: Compared to investing, people usually know the outcome of a gamble quickly. This immediacy can be appealing to individuals seeking quick thrills and rewards without the need for a long waiting period. And though cheap thrills are in themselves not necessarily a bad thing, they tend to be very addictive as gamblers get hooked to the dopamine rush from the potential winning from bets the same way drug chasers chase the immediate high from a harmful substance despite the harmful long-term consequences.

On the other hand, a long-term focus on wealth creation is a core tenet of investing as investors understand that the journey toward financial prosperity is a marathon, not a sprint. This is because investments tend to be very volatile in the short term. However, discipline combined with the power of compounding become potent tools for wealth accumulation in the long term. As returns generate more returns, the snowball effect contributes to the gradual accumulation of wealth. This compounding magic is best realized over extended periods, rewarding those who patiently allow their investments to grow with time.

“The stock market is a device for transferring money from the impatient to the patient.” – Warren Buffett

Risk perception mitigation and management (Qui bono): The perception of risk differs between gambling and investing. Gamblers may embrace risk for the thrill it provides, while the house has mechanisms to protect themselves. Investors on the other hand aim to manage and mitigate risk to safeguard their financial future.

In investing, there are many ways to protect your investment from downside risks such as diversification, hedging, and options contracts. These protection mechanisms are availed to investors to protect them from losses. This is because the entire investment industry is by design based on symbiotic trust. To put it simply, it is in the best interest of the issuing house to sell you an investment that you profit from your investment, as people tend to stay away from investments that do not yield returns.

For example, companies that have a record of not paying their debt are unlikely to be able to raise money. The same goes with equity investing as stocks that don’t do well will have problems raising equity capital. This is unlike the zero-sum business model of gambling, where the house profits only when players incur losses. The dealing house in a gamble usually has mechanisms in place which ensure that the average/expected outcome is that they win. This phenomenon is called the house edge, and it ensures that the probability of losing on a gamble always exceeds the probability of gains.

Though there are exceptional cases where agents acted in ways that are not in the best interest of investors in pursuit of short-term gains (think Enron, Oceanic Bank et al), that is not the general idea with investing as the odds are literally in your favour in the long term as over long periods.

The house and its edge

You must have heard the saying “The house always wins” which is an encapsulation of the pervasive concept known as the house edge in the realm of gambling. The House Edge is defined as the casino’s expected profit expressed as a percentage of the player’s original bet. It is the average profit the house stands to make on every bet. To illustrate how the house edge works, let’s take a look at the dimensions and set-up of a roulette wheel. Many people play roulette because they think they have an even chance to win as there are only two colours. But this isn’t the case for a roulette wheel, two green colours bring the total roulette wheels to 38 different numbers with 18 red and 18 black.

House Edge = (Number of pockets with Zeroes/total number of Pockets) x 100

The house edge in this case is simply 2 divided by 38 or 5.26%. This means that for every N100 bet that is placed, the house is likely to walk away with at least N5.26. For every N1 million that’s bet at the roulette tables in a casino, the house makes at least N52,600. The other approximately N947,400 is returned to the bettors.

In sports/football betting, this concept is best illustrated by analyzing the point spread in any game. We first arrive at the implied probability which is the inverse of the odd. For this analysis, I will be using the Lazio-Roma game played on January 10, 2024. The odds for a home team to win a draw and an away team to win are 3.50, 2.24, and 3.10. These odds have an implied probability of 28.57%, 44.6% and 32.25% which brings to a total of 105.55%.

House Edge Formula

The House Edge (Y) is calculated using the following equation:

(100/Home Win Odds) + (100/Draw odds) + (100/Away Win odds) – 100%

The house edge in this example is 5.55%. You might interpret this as expecting to sit with N100,000 and gamble for a while, with the odds being that you will likely lose only about N5,550, but this is not the case. This is because compounding also has the same effect on gambling that it has on investing.

To put it simply, the house edge means that if you play long enough, the house will almost always get all your money. Using the 5.55% from above, after one game, your average expected return is 94.45% of your initial investment and 57.1% after ten games. After 100 games, the expected return on your initial N100,000 capital would be N360 or 0.36% (essentially nothing). Compare this with investing N100,000 in equity of a fixed income or equity mutual fund. It is highly unlikely that after 100 iterations you will have lost all of your money.

Football Savings Goal: An excellent alternative

Sunk cost is a major reason why a lot of gamblers refuse to abandon their betting addiction. Imagine Mr Timi, a financial analyst who has lost close to N200,000 to gambling. He is very likely to continue to continue with the hopes of recovering his lost money. As we have however mentioned earlier, the chances of that happening are very slim. Compare this with Mr Kayode who supports Manchester City, and decides to save N3,0000 for every goal they score. In the current season, Mancity has averaged 2.27 goals per game. At the current run rate, they would have scored a total of 86 goals and Kayode would have saved a total of N258,780. After 5 years, this habit would have made him a millionaire as he would be worth N1.42 million.

How does the Football Savings Goals work?

We created a savings circle for 8 popular teams, so you get to save together with other fans of your team. These teams are Chelsea, Liverpool, Arsenal, Manchester United, Manchester City, Barcelona, Real Madrid and PSG.

You can save a minimum of ₦1,000, for every goal your team scores!

You can also add Triggers for when your favourite player scores!

For these plans, the odds are always in your favour. Why lose your money to betting when there’s a better way to grow it?

So, how can you join your favourite club?

It’s easy. Click on your preferred team below, create an account or log in and start saving.

- Liverpool

- PSG

- Manchester United

- Real Madrid

- Manchester City

- Chelsea

- Arsenal

- Barcelona

- Sporting Lagos

The Premier League continues to captivate a global audience. The passion of fans, whether watching from the stadium or their living rooms, highlights the sport’s unifying power. We know that this season will be another rollercoaster of emotions but not just that; it is another avenue for you to build wealth supporting the club you love.

In conclusion, the exploration of gambling versus investing reveals a stark contrast in principles and outcomes. While both activities involve risk and the potential for gains or losses, the motivations, time horizons, and risk management strategies differ significantly. Now armed with this information, what happens next is up to you. At Cowrywise, we are hoping that you will make the right choice and start building wealth for your future self.

Don’t have a Cowrywise account yet? Then, start building wealth that lasts here.