“What are mutual funds?” This is a question we get asked every other day in Cowrywise.

In this article, I’ll use my love for Ice Cream to break down exactly what this concept means.

Before we dive in though, please, do me a favour. After reading this article, kindly leave a comment saying “I understand mutual funds better now”. It’ll help me know that this was simple to digest. And if you have any questions, feel free to leave them in the comments too.

What are mutual funds? ?

Mutual funds are a type of investment that allows you to invest in different types of assets at once while allowing you to be as hands-off as possible with paperwork and other intricacies. It’s a basket of different investments put together to form one asset group. That asset group is called the mutual fund and the professionals who put the different investments together are fund managers.

Who are fund managers?

Fund managers are investment experts who work as professional asset managers to help meet specified investment goals on behalf of investors. They use their expertise and experience to determine what a mutual fund should comprise and how a fund should be invested profitably.

Back to mutual funds, let me break it down with ice cream.

Mutual funds are like ice cream ?

Here’s how I like my ice cream: Instead of buying 4 cups with just one flavour in each, I prefer to buy a cup with different flavours and toppings in it. I never buy strawberry, vanilla, cheesecake and my absolute favourite chocolate flavours in 4 different cups. I buy the biggest cup or cone and then put all my favourite flavours in it with any topping I’m craving at the time.

Investing in a mutual fund is like that. It’s a simple way to diversify without the hassle of buying and managing the assets one after the other. A fund manager does the “hard work” of putting different assets together; you then buy shares from the “basket”. Simply put, a fund manager brings together cash from multiple investors and uses the bulk amount to buy carefully selected assets.

With mutual funds, you’re diversifying in a quick way but only buying one thing.

You’re investing in bits of everything. Just like enjoying different ice cream flavours in one cone! ?

Understanding the different risk levels ?

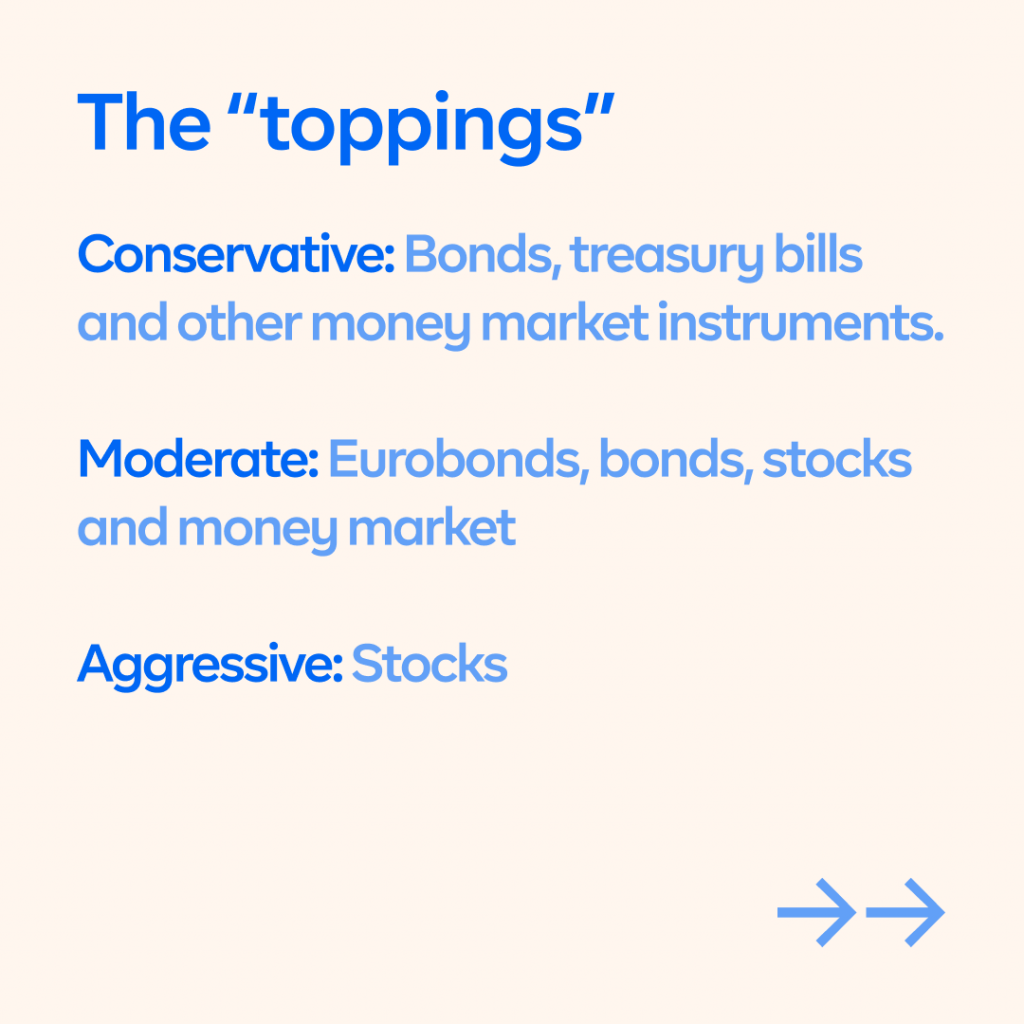

Mutual funds are universally separated into three risk levels: low, medium and high risk. You’re advised to stick to certain types of mutual funds, depending on your risk profile as an investor.

When you invest in equity mutual funds (Aggressive Funds), what you’re investing in are company stocks. So you’re buying a piece of companies like GTB, Access, Nestle, Dangote, MTN, Total, etc.

When you invest in conservative funds (low-risk funds), you’re investing in low-risk instruments like treasury bills, bank deposits, commercial papers, bonds, and call cash.

When you then invest in balanced (medium-risk) funds, you’re investing in a mix of both high-risk funds and low-risk funds.

Back to ice cream flavours. Let’s say regular flavours like strawberry, vanilla and chocolate are conservative. They’re for people who don’t like to explore or try out “new things”. It means that your cone here will only have these flavours that promise you a certain taste back.

But high-risk flavours are flavours like mint, buttered pecan, and cookie dough because they can taste great today and taste really bad tomorrow. So they’re for adventurous people.

Investing in medium-risk assets is you then buying a mix of chocolate and buttered pecan in your cone. You’re in the middle, like the people who eat Jollof rice with stew. Did someone say trust issues? Ok ok, moving on!

Can you explain the risk levels to me? ?

Of course!

- Aggressive Funds: They contain a higher mix of stocks and are usually called high-risk funds.

For example, the ARM Aggressive Growth Fund is made up of 79.59% equities and just 20.41% of fixed income instruments. If the percentages were vice versa, this would have been a low-risk fund because it’ll have a higher percentage of conservative instruments.

Anyway, when you go deeper into the assets under the ARM Aggressive Growth Fund, you find that it is spread into the Banking, Consumer Goods and Industrials industries. When you go even deeper again, you find that it has companies like MTNN, NESTLE and DANGCEM in its portfolio.

So when you invest in this specific ARM fund on Cowrywise, you get shares in MTN and NESTLE without having filled out long forms or stood in queues.

- Balanced Funds: These are usually referred to as medium-risk funds and they contain a mix of stocks and low-risk instruments like bonds and money market

- Conservative Funds: They’re usually called low-risk funds and contain assets like treasury bills, bank deposits, commercial papers, bonds, and money market instruments.

Who are mutual funds for? ?

Mutual funds are for investors who have money but don’t want to do the stressful work of investing in separate assets and managing the paperwork of buying each, one by one.

They’re great for first-time investors or people who just want a more seamless investing experience where the fund manager is in charge of managing the performance of the fund.

If you have to create your own mutual fund, you’ll have to personally go buy Total stock, GTB stock, treasury bills, and bonds, then manage the performance of the mix of all these yourself.

By investing in mutual funds, you give your money to a fund manager and ask them to invest it in various financial instruments for you.

What are the pros and cons of mutual funds? ?

Pros of mutual funds

- Provides Options

In life, having options is crucial. On Cowrywise alone, there are over 20 types of mutual funds available for you to choose from. Each one has a different investment strategy and risk level and anyone can find one that meets their investment needs.

- Professional Management

Fund managers are the professionals in this case and they know a lot about putting various assets together. You don’t need to worry about buying shares in the nick of time or watch closely on a daily basis to balance your portfolio out. That’s the job of the fund manager.

- Inexpensive

One of our major goals at Cowrywise is to give retail investors access to profitable investment opportunities and mutual funds are the major way we get that done. Mutual funds allow you to start investing with what you can afford while you work to grow your assets. They’re one of the most inexpensive ways to invest in a diversified portfolio.

- Diversification

As stated earlier, you’ll have to do a lot of work to build a diverse portfolio without mutual funds. By investing in one mutual fund, you can easily diversify your investment into different asset types.

- Easy to convert to cash

If there’s a need for quick cash, you can easily sell your shares in mutual funds. They’re also very easy to buy.

- Generally low risk

Investing in mutual funds generally comes with less risk of losing all your capital, compared to investing in stocks or cryptocurrency directly. The stock and crypto market is much more volatile and not really for the faint-hearted.

Cons of mutual funds

- Fund manager fees

Fund managers in Nigeria usually charge between 1% to 2% to manage mutual fund investments and this can be a turn-off to some investors. However, when comparing this to the work a new investor will have to do themselves, this is a little price to pay. The middlemen in any sector have to make some profit and it’s no different in investing.

- Little control over your portfolio

With mutual funds, you have to rely on fund managers to create the mix that will make up your portfolio and you also rely on them to make informed decisions. You can’t decide to invest more in a particular asset unless you buy mutual funds that have more of those kinds of assets.

Now that you have answers to the “What are mutual funds?” question. What should you do next? ??

I could end this with a lot of aspire to perspire but I’ll be straightforward and say – start investing in mutual funds now.

When you start investing early, you learn much more than the person who’s sitting on the sidelines. There are insights about investing you can never learn until you actually take action. You can choose from the 31 mutual fund options on Cowrywise right now.

Cheers to your financial success! ?

ALSO READ

Thanks for this.

My pleasure ?

Not bad, but this isn’t extensive enough, it doesn’t contain how many percent does each Mutual fund pay and does investing in higher risk mutual funds bring higher returns, I’d appreciate if an article of this nature is published, thanks

I agree with you

??

Hi Ebubechukwu, every month on the blog, we do a roundup of top-performing mutual funds with all the details you need. It’s called “Market Slice”. In addition, we have a long list of articles on mutual funds that you will find most helpful. You can find all these here: https://cowrywise.com/blog/?s=mutual+funds

Information is helpful

I agree with you. And what’s the minimum amount you can invest with

Thank you I initiated a 10k mutual investment today when are you going get it started

I understand it thanks

I understand mutual funds a lot better now

Yayyyyyy ????

Yea, great one. I understand better now

I understand very well but what’s the duration in which I can invest?

There’s none, strictly speaking, but for you to reap the benefits of compounding, I’d recommend that you think long term – years, not months.

Make sense. I now understand. Make I go teach person son too…

Energyyyyy ?

I understand now ?

I understand mutual funds a whole lot better now

Wow that is good

??

I understand alot better now

This is really interesting and I love cowrywise??

I understand mutual funds a whole lot better now

Great!

I understand mutual funds a lot better now

Uhm…

How does the interest add up?

You didn’t include that part.

Hi Solomon, I wrote a very detailed post on that. You can check it out here https://cowrywise.com/blog/mutual-fund-returns/

Thanks for this. It was helpful

Wow this is good

Yayyyyy!

Thanks Ope, I understand quite better now

Happy to hear that ?

I understand mutual funds better now

Whoop Whoop ??

I understand mutual funds a lot better now

Yayyyyyy! Time to make some money moves ??

I understand mutual funds a lot better now.

??

I understand mutual fund better , with appreciate

Yayyyy!

I now understand mutual funds better! Thanks

Anytime!

I don’t understand?

Hi Peter, please what part isn’t clear? I’d be happy to clarify.

I understand it so mcun

Yayyyyy ??

Thanks it was a nice breakdown

My pleasure ?

I understand it so well. How do I start investing in mutual fund? Can I start with the little fund I have in the celery fund? Please teach and direct me.

I understand mutual fund a lot better now. Thanks

I got you!

I know a little more about mutual funds now

Yayyyy ?

i need load for my Agri farms

Thanks for the detailed information and illustrations in the article. I now understand Mutual Fund better. I will take decision very soon by investing.

Great! The time to take the decision is now ?

How much can I use to invest in mutual.

I understand mutual funds better now.

Happy to hear!

You can start with any amount you have at the moment!

Thank you very much!

I now understand mutual funds better

My pleasure!

Thank you very much for the great insight on Mutual funds. I now understand better but I have a question.

What is the difference between mutual fund and Investment/Saving plan in a insurance or assurance company

Great question. I’m guessing you now understand mutual funds, so I’d just put this side-by-side.

At a basic level, insurance companies typically offer products that are hinged on specific events – death, damage, retirement etc. So savings products from insurance companies are similar to pension funds, where you make a contribution over a period of time and after that period you begin to get claims on a monthly or yearly basis depending on your contract.

Can you tell the difference now?

I understand better now. But do I have a say in the kind of company my money will be invested?

Okay. Thanks Ope.

But what determines the interest?

Hey Marvelous, I broke this down in this post- https://cowrywise.com/blog/mutual-fund-returns/

I’m sure you’d find it helpful in answering your question ?

Thanks Ope!

I understand mutual funds a lot better now! ☺️

Yayyy!

Wao! Very Interesting….. I really understand it all…. Thanks Ope

You’re welcome!

I understand mutual funds better now

You’re welcome!

This is a more detailed explanation on mutual fund but your start up requirements is my problem.

I understand mutual funds better now. Thanks

Happy to hear this, Taofik ?

Uhmm Ope in my mind we are already gees ?

Buh i need some answers ..

Been trying to save in dollars since for a while now

But I’m confused ?care to put me through?

Theo my G ??

Your best bet would be to take advantage of dollar mutual funds. You can find out everything you need to know here: https://cowrywise.com/blog/invest-in-dollar-mutual-fund/

Thanks a lot for ur help with this info looking forward to knowing more about mutual fund

I understand mutual funds better Now.

Great ?

I understand a lot better now. Thank you.

However, some questions:

1. Is it possible I lose all my money or run at a loss on mutual funds? Or is it a situation where, as long as I leave it long enough, I’ll bet my money back?

2. Also, can I invest in different level risks, e.g aggressive and balanced, at the same time?

I hope I don’t miss the answers.

Thank you.

Great!

1. Chances of losing all your money are quite slim, but, I’d advise that you invest based on your risk appetite because no investment, however safe, is without risk. In terms of long term investing, compounding really helps.

2. Yes, you can invest in funds across board.

I Understand a little bit better..

but one question I have is when we say ‘low risk in loosing all your capital’. Does it mean it is possible to loose all the money one used to save in mutual funds. Or just the interest would be lost?

Chances of losing all your money are quite slim, but yes, you may lose some of your capital in some cases.

Thanks for the article. Self explanatory

You’re welcome

I understand but how many days will it take for the investment to return

Thank you much much. This was really helpful.

I now understand mutual funds better

Thanks a lot ope

I understand it now and I will make sure people around me do this

Nice and good explanation, I loved it

Nice break down of mutual funds

Thank you!

Thank you so much for this.

My pleasure ?

I now. Understand

Greatttttt!!

I now understand better, thanks

??

I understand mutual funds better now.

Yayyyy!!

Simple to understand thanks

?

I understand mutual fund now

Great! ?

Thank you so much. I now understand what a mutual fund is.

You’re welcome!

What happens when the fund manager ran into a loss??

I just want to be sure

There are policies set by the government to protect users, and “customers” of these fund managers, but it only covers those who use licenced management companies. Guess what? Cowrywise has a SEC (Securities & Exchange Comission) licence in the fund/portfolio management category, so you can go to sleep knowing your money is safe ???

Okay,I will try

I understand mutual funds a lot more better now

I really understand mutual funds much better now with these ice cream illustration. The best presentation I’ve ever heard on investment

Thanks…this was good for starters

I understand mutual funds now. The breakdown was amazing. I’ve invested in mutual funds before using the app but honestly, I was just investing without a clue because I trust you all but knowing all this, I get it now and I’m definitely going to be more consistent with the investments. Great one Ope

Exactly what I did earlier today… I merely just invested because I believe in the visions and word of mouth from the many people using the platform. ?

This article didn’t state the percentage you’ll be earning when you invest in mutual funds.

I know what mutual fund is about now.

Thank you

Yea that was helpful

Well, I really hope to understand mutual fund more as my investments blossom.

Am new in this ,the bottom line for me is that Mutual funds will help me grow my money while I relax and watch and pray.

Thanks alot ope,I understand better now..

Thank you . I understand mutual funds now.

I understand better. Thanks

It is quite informative.

I understand mutual funds so much better now…nice one, I like ur explanation.

I totally understand better now..it really pays to read through.

Nice one,but if one what’s to quit before the due time, what is the process please

Sure, I understand better now… I already started investing by the way and it feels so great! ?

Is the interest rate every year only??

thank you so much for sharing like this article. Please click here , https://einvestment.com l,

After transferring money for investments, what follows?

Thanks so much for the enlightenment, I clearly understand.

These are my little questions:

✓ if I start my investment with N50,000 (for in stance), do I have to be paying the N50,000 every month ?

✓ when exactly will the returns be paid? Annually or Quarterly?

Thanking you as I await your response

Thanks for the explanation. I will make investing in mutual funds my next point of call.

Great to hear that!

Hi Ope, is there any form of cash out in mutual fund investment?

Hi Femi, could you please rephrase your question so I can understand you better?

I believe what Femi is trying to say is, at the end of the mutual fund investment, will there be any money paid to we the owner of the investment? Is it possible to withdraw cash?

Yes i really understand,,,.

Thanks a lot,,

You’re welcome!

I understand mutual fund now

Happy to hear that!

Thank you for this explanation, I think I’m ready to start investing in Mutual funds.

Great to hear! You can start by signing up here http://cwry.se/blog_signup. After you have signed up, this video has all the steps you need to get started: https://youtu.be/1CAJplBSpUw

I understand mutual funds better now.

While going through the write-up, I discovered some investments under the “conservative” category have a reduction in the returns over the years. Please can you help explain the meaning of those trends?

Now I understand what mutual fund investment really means.

Thank you for the update.

I will give it a try soon

Well explained. Can I get a phone number for direct contact with any of the cowrywise agent?

The lessons are educative. I am already giving it a trial with Mango savings. Thanks.

Thanks alot. Now I understand.

I understand mutual funds better now, thank you.

I understand mutual funds a lot better now

I understand mutual funds better. What I do not understand is what to do when your investment is “free falling” – losing money. It would be helpful of you do an article on that, Ope. Another thing you could do is to do an article on what to look out for when shopping for a mutual fund manager or mutual fund asset. Thank you for all you do, Ope. Happy 2022!

Thanks for the suggestions! I’ll definitely consider this.

This article was really helpful and educating. I now better understand mutual funds

It was helpful but I will like your opinion or let me say guidance of each funds, like u made an example with the ice cream u should be abel to say this sweet for try it out u will like it

Thanks ope,I understand mutual funds better now.I have a question though, what’s the minimum amount investable in these mutual funds?

Hi Joy,

Thanks for your comment.

There’s no minimum amount, you can begin small and grow your investments from there.

I understand mutual fund better now

Thanks so much. I understand this better. Hope to invest soon.

Thanks. I now understand mutual fund now!

Thank you very much. I understand better now what mutual fund is.

Thank you for this..Now understand mutual funds

Hey. I’m Abdulrahman Malami and i really appreciate for the information and me gonna ask a single question, what’s the minimum amount of money for the investment? Thank you

I now understand mutual funds better now

This information has helped many clients in the investment. It is a type of investment that allows the client to invest in different types of assets. There is nothing to worry about the procedures, the fund managers will administer your money.

I understand mutual funds. Now I’m craving ice cream.

I do understand now what mutual funds but how do I start

Diversification and expert management is probably the best thing about mutual funds. Right now both passive and active funds are getting traction.

I understand it a bite but I still have some question? Mr Ope all the investment you analysed through the ice method all are still risk taking what is the difference is that some are high risk why others are low risk? I have your app the person that introduce me to it only told me the 3 months savings plan which I just gave it a try now. I saw others stocks so I needed more clarifications so that I know what to do. Thanks for your explanations pls I still need a customer service number for more guard.

Thanks Ope for this insight, I now have an understanding of what mutual fund is about though more information is still needed

When am I going to get my investment money back

Thank you very much. Very insightful and so fun to read.

I understand mutual funds now, thank you .

I understand