United States Dollar: The national currency of the U.S

Key takeaways

- The United States Dollar is the national currency of the United States of America.

- The United States Federal Reserve System is responsible for the issue, circulation, and regulation of the U.S. dollar.

- Many countries hold significant reserves of U.S. dollars, and it is commonly used as a reference currency for commodities and financial transactions worldwide

Source: Corporate Finance Institute

What is the United States Dollar?

The United States Dollar (USD), often referred to as the “dollar”, is the official currency of the United States of America and is one of the world’s most widely used and recognized currencies. It is abbreviated as “USD” and is denoted by the symbol “$.” The dollar is subdivided into 100 smaller units called cents, symbolized by “¢.”

The U.S. dollar serves as the primary medium of exchange for goods and services within the United States. Many countries and international organizations hold significant reserves of U.S. dollars as part of their foreign exchange reserves, making it the world’s primary reserve currency.

The U.S. dollar is a critical component of the global economy because of its status as a global reserve currency and its widespread use in international trade and finance. The United States Federal Reserve System is central to the dollar’s value and stability, as it regulates the supply of money and implements monetary policy to control inflation and support the stability of the economy.

History of the United States Dollar

Before the American Revolution, the American colonies used a variety of foreign currencies, such as the Spanish dollar and the British pound, for trade. Some colonies also issued their own paper money. These colonial currencies were often subject to inflation and counterfeiting. During the American Revolutionary War, the Continental Congress issued the Continental Currency to finance the war effort. However, due to rampant inflation and lack of backing, the currency depreciated quickly.

After gaining independence from Britain, the United States established a new monetary system under the Coinage Act of 1792. The act created the U.S. Mint and established the U.S. dollar as the standard unit of money.

The Gold Standard Act of 1900 officially established gold as the sole standard for redeeming paper currency in the United States. Under this system, the value of the dollar was directly tied to a specific quantity of gold.

The Great Depression of the 1930s and the economic challenges of the 20th century led to the abandonment of the gold standard. President Franklin D. Roosevelt took the U.S. off the gold standard domestically in 1933, and President Richard Nixon ended the international conversion of the dollar into gold in 1971, effectively ushering in the era of fiat currency.

Since the early 1970s, the U.S. dollar has been a fiat currency, which means that it is not backed by a physical commodity like gold or silver. Instead, its value is based on the faith and credit of the U.S. government. The Federal Reserve continues to play a central role in managing the money supply and influencing the value of the dollar.

The U.S. dollar has become the world’s primary reserve currency, used in international trade and finance. A lot of other currencies in the international scene are often affected by the stability of the dollar. Many countries hold significant reserves of U.S. dollars, and it is commonly used as a reference currency for commodities and financial transactions worldwide.

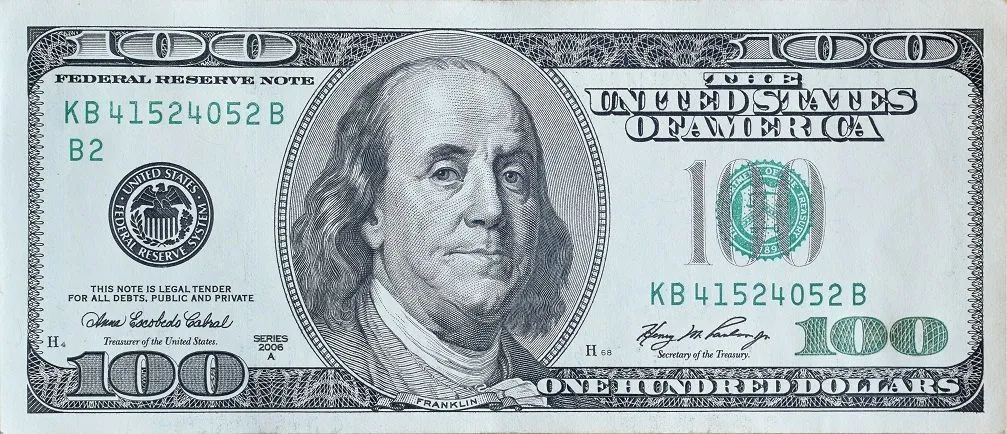

Current United States Dollar Notes

- $1

- $2

- $5

- $10

- $20

- $50

- $100

The dollar also has coins like the 1¢, 5¢, 10¢, 25¢, 50¢, and $1 (50¢ and $1 are rarely used but they are still minted) in circulation. Although the 1⁄2¢, 2¢, 3¢, 20¢, $2.50, $3, $5, $10, and $20 coins are still legal tender, they are no longer in use.

Some facts about the United States Dollar

- The symbol for the U.S. dollar is “$,” which is derived from the Spanish dollar sign “Peso de Ocho” or “Piece of Eight.” The dollar is often referred to by the nickname “buck,” which has its origins in early American history.

- U.S. banknotes are known for their distinct colours. For example, the $1 bill is predominantly green, the $5 bill is blue, the $10 bill is orange, the $20 bill is green, the $50 bill is pink, and the $100 bill is teal.

- U.S. banknotes have series dates that indicate when the design was last updated. The series date can be found on the front of the bill and may change when new designs or security features are introduced.

- While paper currency is more commonly used in everyday transactions, the U.S. Mint also produces coins in various denominations, including pennies, nickels, dimes, quarters, and dollar coins.

- The phrase “In God We Trust” is printed on all U.S. currency and coins and has been the official national motto of the United States since 1956.

Conclusion

The United States Dollar (USD) is not just a unit of currency but a symbol of American history, culture, and economic influence. With its global importance as the primary reserve currency, the U.S. dollar plays a central role in both everyday transactions within the United States and international trade and finance. Its evolution from colonial and early American currencies to a fiat currency with a rich history is a testament to the economic and historical developments of the United States.

Start building wealth on Cowrywise

ALSO READ