In this article, we will break down what it means to trust Cowrywise with your money. We will highlight the dynamics of building wealth safely and securely, the distinctions between your regular bank account and an investment account on Cowrywise, how we can offer higher returns than your bank, and the technicalities of the disbursement process.

Cowrywise is an asset manager, not a bank

We are an investment company, not a bank. So far you have a plan on Cowrywise, the mechanics of operating it, and how funds are disbursed are the same. But, before we discuss this, let’s highlight some key distinctions between a regular bank account and an investment account on Cowrywise.

Licensing

Cowrywise is licensed by the Securities and Exchange Commission as an asset manager, and the core of our business is managing investments on behalf of our users. We are not a bank, and as such do not have a license to operate as a bank.

In a nutshell, Stash was built as a funding channel to save and invest, as an alternative to debit cards. This means the flow of funds should be from your bank account to Stash to an investment plan and back again. Depositing money in Stash only to withdraw it again defeats the very purpose for which it was built. Therefore, from a legal and regulatory perspective, Stash is not a substitute bank account, and should not be treated as such.

Any plan you have on Cowrywise is an investment account

Insurance Coverage vs Custody Structure

An attribute of a typical savings account offered by banks is deposit insurance coverage to protect your funds from loss. As such, any entity (banks and neo-banks) with a banking license from the CBN, is also required by law to have coverage from the Nigerian Deposit Insurance Corporation (NDIC), whose mandate is to safeguard deposits in case of a bank failure. The maximum insurance coverage for depositors in Deposit Money Banks in Nigeria is capped at ₦5,000,000. The equivalent of deposit insurance for an asset manager like Cowrywise is the custody structure.

A custodian is a regulatory requirement from the SEC for every asset manager. The custodian serves as a third party that holds 100% of the assets of an asset manager’s customers for safekeeping. One of the roles of our custodian, Zenith Nominees, is to hold your investment securely on your behalf. This means that at no given time, are your funds ever in our possession. As a result, when a withdrawal request is made, it has to be processed by the custodian to ensure you get value in your account. This process takes time, but more on this later.

For more details on the role of a custodian, check here.

Instant vs time-based settlement

A fintech’s operations are heavily dependent on its industry and licensing type, as this affects the entirety of its business model. Banks can facilitate payments and instant settlements because that is what they were built to do. They have the infrastructure to manage it; their license permits it and their direct connection to the Nigerian Inter-bank Settlement System (NIBSS) empowers them to do so.

Cowrywise on the other hand, is licensed by the SEC to manage investments on behalf of its customers. We are not a bank, and as such we are not directly in the business of payment facilitation. We partner with third parties to facilitate the payment component of the process of investment.

We are primarily in the business of managing your investment portfolios. All our products are registered with the SEC and have to pass through the custodian structure to ensure the safety and security of the assets your funds are invested in.

How the disbursement and settlement process actually works

As stated earlier, we are an investment company, and our major responsibility to you is to invest and manage your funds. Have you ever wondered why we can offer higher interest rates than your regular bank savings account? That is because your funds are not in our possession, but are invested in low-risk assets to generate returns on your behalf. These assets, by regulation, are then held by the custodian on your behalf.

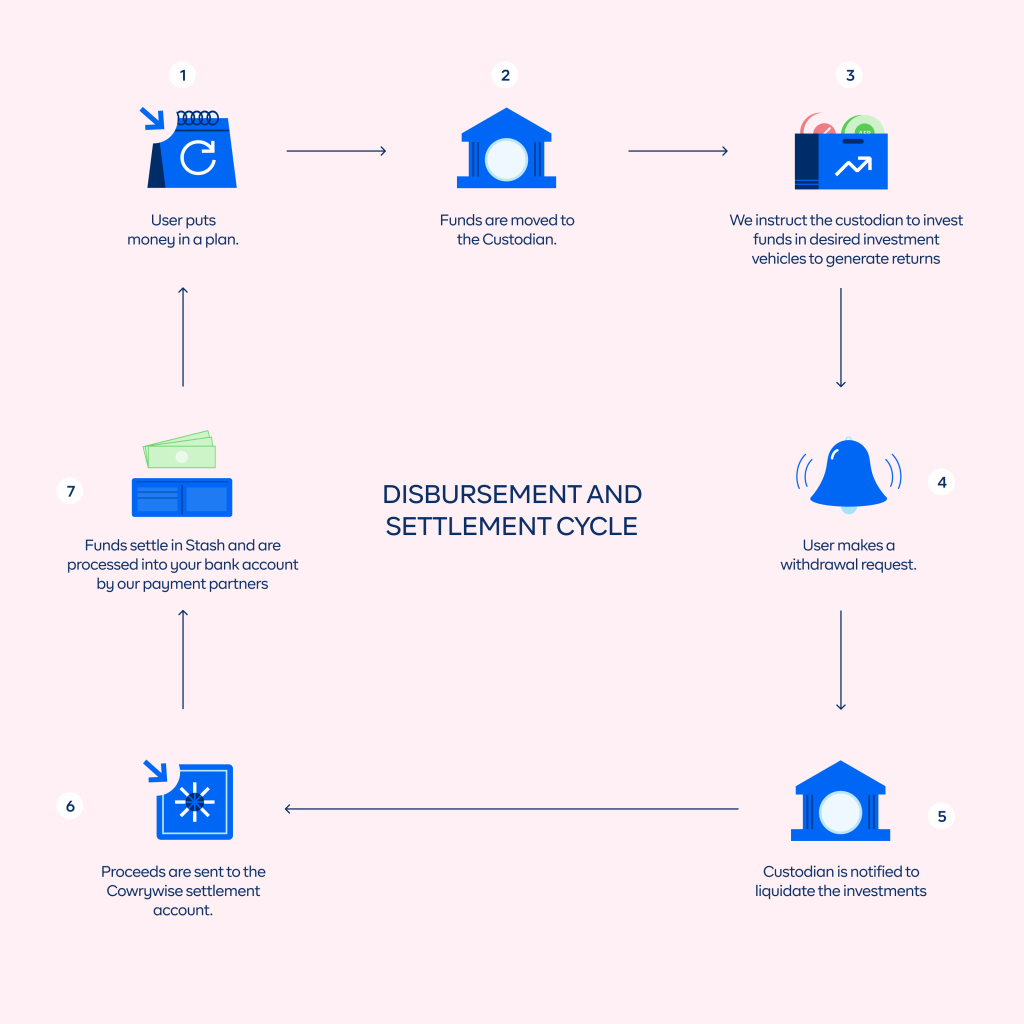

Here’s a simple illustration of how this works. Remember, we mentioned it works the same way as an investment since the goal is to build wealth.

Illustration 1: Flow of funds from top-up to withdrawal into regular bank account

This is the typical disbursement cycle for an asset manager. As a result, the disbursement of funds from any plan or portfolio MUST follow the same process that involves the custodian. In a nutshell, if it generates returns, it is being invested. And if you are regulated by the SEC, customers’ funds and assets must sit with the custodian.

I see you nodding. You understand the entire process better, but you still aren’t clear on why it should take 24 hours to process your withdrawal requests.

Based on the regulatory requirements, it is imperative that as we scale, we continue to comply with the dictate of our license and the regulatory frameworks that guide our operations. Again, we are not a bank and do not have your money sitting in a vault. Every withdrawal request must follow the process explained above which is part of the regulatory framework to protect you as an investor. You should have serious concerns if your asset manager does not have a custodian.

Responses to some comments and questions

Some customers have asked us questions or made comments about their experience with this process. The following responses should provide additional clarity.

“The processing period is too long. I’ll rather remove all my funds. Why would I keep using Cowrywise?”

Ultimately, it’s your money, and we have no right to tell you what to do with it. We can only advise you within the confines of our core vision which is to help you build wealth. We appreciate every single customer we have. But, we have kept true to our word of building, preserving, and protecting your wealth. This is why we have worked tirelessly to introduce measures geared toward beefing up the security of your account.

Everything we do is to PROTECT your wealth.

When you decide to stay, know that the 24-hour processing period, though inconvenient in the short term, will be beneficial in the long run, and our advice is that you plan ahead as much as you can, and withdraw wisely.

How does this process affect Stash since it doesn’t offer any returns?

All funds are held with the custodian and must go through the highlighted channels. We do not advise you to leave funds idle in Stash. Rather, you should put it to work. Stash isn’t a bank account to hold your funds. It’s an in-app wallet to fund your plans and receive payouts, which can then be sent to your regular bank account.

Final words

We are reiterating our commitment as your trusted wealth manager to providing you with the best possible means to build wealth safely and securely. Our goal as always remains the same; to help the young generation of Nigerians build wealth by cultivating and making better financial decisions.

Keep planning. Invest wisely. Grow wealth.

ALSO READ

Wow! This is well explained.

Thank you for the clarifications. You guys are truly reflecting your core values. Good job!

Please do not go ahead with the mandatory 24 hours wait period during the withdrawal from stash to a personal bank account

It is too much of an inconvenience to be a feature. Please do reconsider.

Some of your competitors do not have this restriction in place

It would be very much appreciated if this can be an option we users can select in terms of security

Good , my very concern is that I have been using Cowrywise in order to discipline myself in saving for my yearly house rent now that am in need of fund , hoping of transferring from stach to my bank account

My concern now is how much can someone withdraw from stach account without flagged , currently am in emergency and the only hope is Cowrywise

Yeah, the 24hrs is not bad but at the other hand, 24hrs withdrawal in case of emergency will be the worst thing so far because nobody knows what is going to happen in the next few minutes or even seconds

I think your suggestion is very okay by me.

I really enjoyed the short brief lecture but still hoping on the higher investment like the bill gate etc.risky I think

Wow I think I love this app my first time to save money in cowrywise i will trust them

Excellent article, investment lifecycle gibberish on cowrywise was well explained ?

The ideal of 24hr waiting time to withdraw from stash is still not explain here, even though u said it might be inconvenient for a short time but on the long run the customer will appreciate it doesn’t answer the question of why the long time (24hr) withdrawal will be appreciated.

What is the sole reason for 24hrs delay, even if my fund are in the care of third party custodian. What are modality of updating withdrawal time of 24hr when I can make a withdrawal in few minutes. It still not clear.

I believe we are supposed to be going forward here, not back ward. Technology is advancing that why we on the era of 5G.

Pls it doesn’t sound healthy.

Really good, have been using cowrywise pass a year and I don’t know issue with my investment acc, but last month on my willdraw date I willdraw to stash and instead for me to press transfer to bank account I mistakenly press transfer to plan, so painful because the money was refunded to the plan and i have planned on the date already, well that is on that, I just want to say you should keep Doing good work , helping us to do it well on the plan account,leave the willdraw date for us , where by if we mistakenly resend back the to plan please let us be able to willdraw back to stash at desame day . Thank you

Love this application

Cowrywise to the world✈️✈️

You guys are really doing a great work out there?…keep it up?

Wow. I think with this explanation, I’m getting somewhere

This is smart! Thank you cowrywise for your services, it’s 100%

A write up of how cowrywise is just an investment company and not a bank.

You kept repeating you are not a bank but an asset management…were you bank 3 or 4 years ago that i have been using cowrywise and there was instant withdrawals. I really do appreciate cowrywise because I have really cultivated the attitude of saving but am not cool with this recent development. There’s a reason for locking my savings to a particular day.

Keep up the good work

The investment part is well explained, thank you cowrywise for always doing a good job, however the reason for the 24-hour window for withdrawal is still not explained here. Withdrawing from stash should be quick as possible, at max should happen the same day. You say we shld plan ahead, we never can tell what may come up.

24-hours is a really big deal.

Insightful, I think you are doing really great.., thank you for always

Keep up the good work .

I like the investment

Appreciation to the detailed article,however the 24hours new approach on withdrawals may not be ideal for emergencies. Kindly take a second thought on this even in the midst of risk exposure. Thank you

Thanks for your help Cowrywise I have been using for a year and I have no problems, please keep up the good job?

But the ideal of 24 hrs honestly I don’t like it, I noticed it today when I make a withdrawal from my stash , please it’s so embarrassing

I beg you see to that.

I really don’t like that 24hrs withdrawal because the date I’m to withdraw my funds I know why Input that date there why must it be 24hrs I don’t accept this one

Honestly this 24 hours withdrawal is not making any sense to me.I have been using this app for the past 4 years and why I feel comfortable with it is because once withdrawal is made it’s being credited asap so you have nothing to worry about and that’s how I was able to invite others to join because they know they can access their funds asap .

Hello Guys,

I appreciate you guys alot. Been using cowrywise i think about 3yrs now.

This idea of 24hrs in stash is not buyable . I set the date for a particular reason. Kindly review.. i should be able to use my set saving on the proposed date set.

Thanks

U guys are so amazing Thank alot?this app is good

Keep up the good work