2 months ago, we launched Streaks. The goal was simple – help customers track and improve their finances by encouraging them to save or invest consistently every month.

A Streak is an indicator of your overall financial health and tells you at a glance how long you have successfully saved or invested – a visual time-based representation of your consistency in meeting your financial goals. With Streaks, you can take pride in knowing you saved or invested every month for the past seven years (well done Bukky), or be inspired to do better even if you have only one Streak or have lost 27.

This report captures interesting insights we have found fascinating regarding financial behaviours from a sample size of our top 100 Streakers – from the sheer consistency of some investors to gender distribution, generational segmentation, and much more.

Streakers are Cowrywise customers who have at least one active Streak. This means they have saved or invested at least once, and have continued to do so every month since then.

Let’s dive in!

The earliest Streak goes back seven and a half years

Consistency is the name of the game. To truly maximize the power of Streaks, we built the feature to capture historical data. Streaks captures your saving and investing behavior from the moment you signed up and made your first deposit to date. You can see how many times you saved or invested within any given period. For example, if you signed up in January 2023 and saved/invested every month since then, you would have unlocked 18 Streaks by now – all visible on a dashboard within the app.

Image 1: Streak count for different members of staff at Cowrywise

So far, as of the time of writing this report, the customer on the top of the leaderboard has 94 Streaks to her name; and that’s a big deal. Bukky (real name), has been saving and investing consistently since 2017, without missing a single month.

Now, that’s how you build wealth over time.

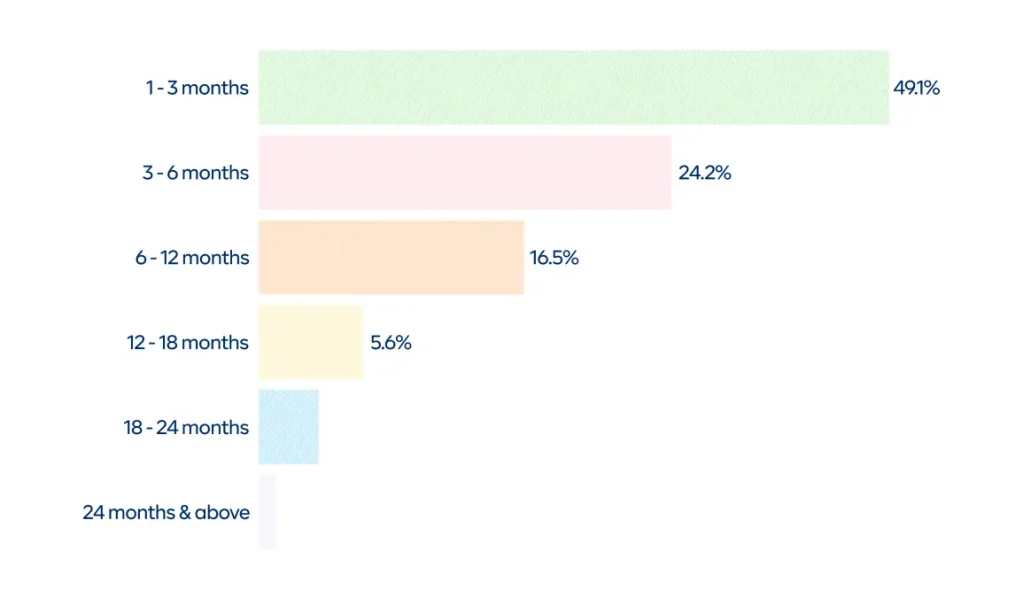

The benchmark for consistent saving is 3 months

The bar chart below shows the maximum duration customers have saved or invested consistently over time. Of the hundreds of thousands of customers in this category, 49.1% have saved for 1-3 months at the minimum. This means that out of 100 people, 49 have saved at least once since signing up – this is consistent with the existing product data, as more people create short-term 3-month plans for their saving needs.

Customers are more likely to create a short-term savings plan (3 months), compared to more long-term plans. Click here to create a savings plan and get up to 14% P.A.

Another 16.5% have unlocked Streaks for saving/investing for 6-12 months, while 4% have saved/invested for 24 months and above.

Image 2: Breakdown of Streak behaviour among Cowrywise customers

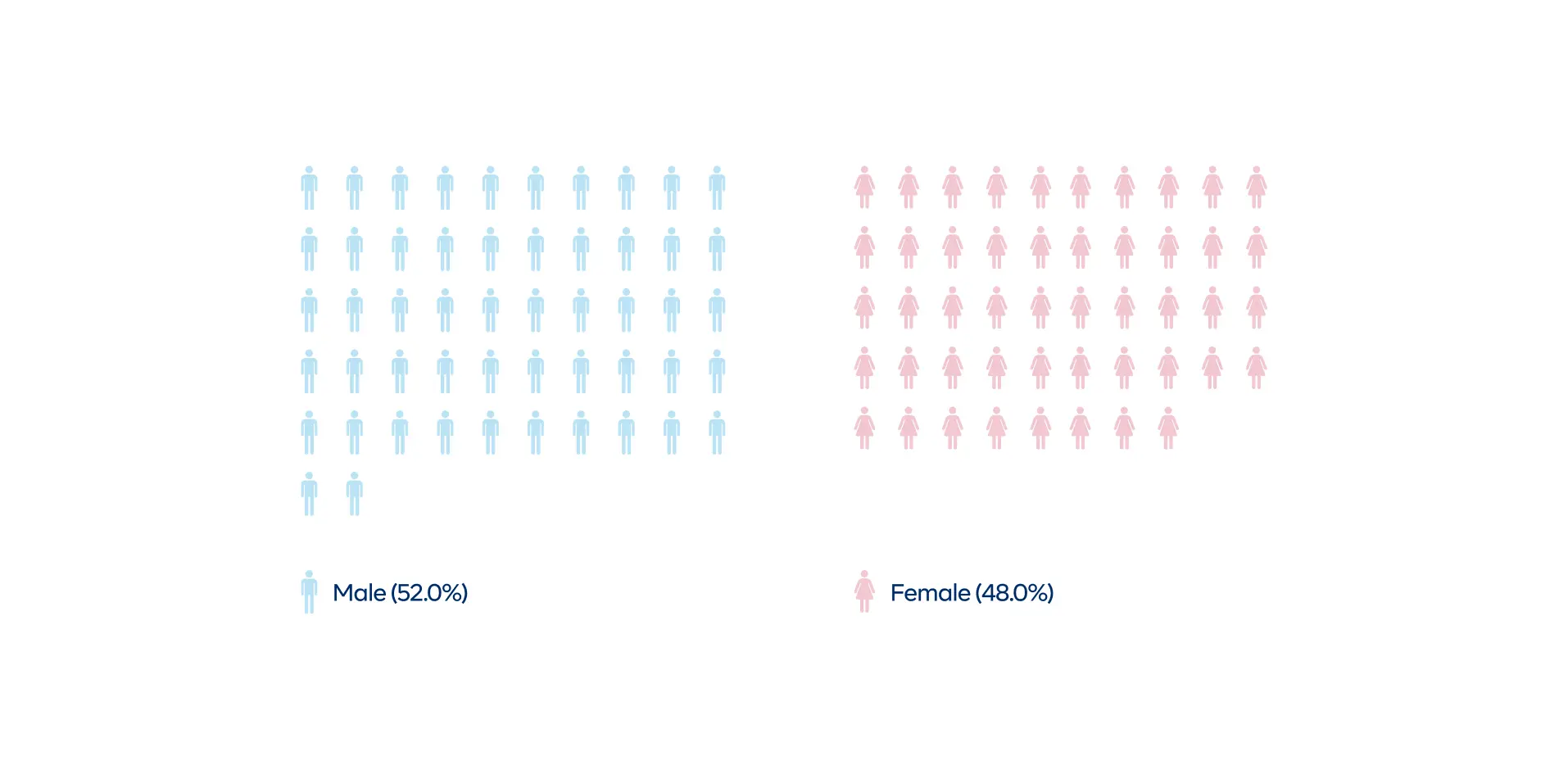

In the battleground of consistency, women are in the lead

In terms of number, women may be slightly behind their male counterparts, but they make up for it in consistency. Of the top 100 Streakers, women have unlocked more Streaks – between 62 and 94 Streaks as of the time this article was published. Of the women in this category, 16% have saved or invested consistently for up to 6 years. In fact, Bukola has the highest streak count on record, with 94.

You go, girl!

Men, on the other hand, account for half of the top 100 Streakers and have unlocked 61 – 82 Streaks to date, saving or investing for at least 5 years straight! Some have been diligent for close to 7 years too! Not bad!

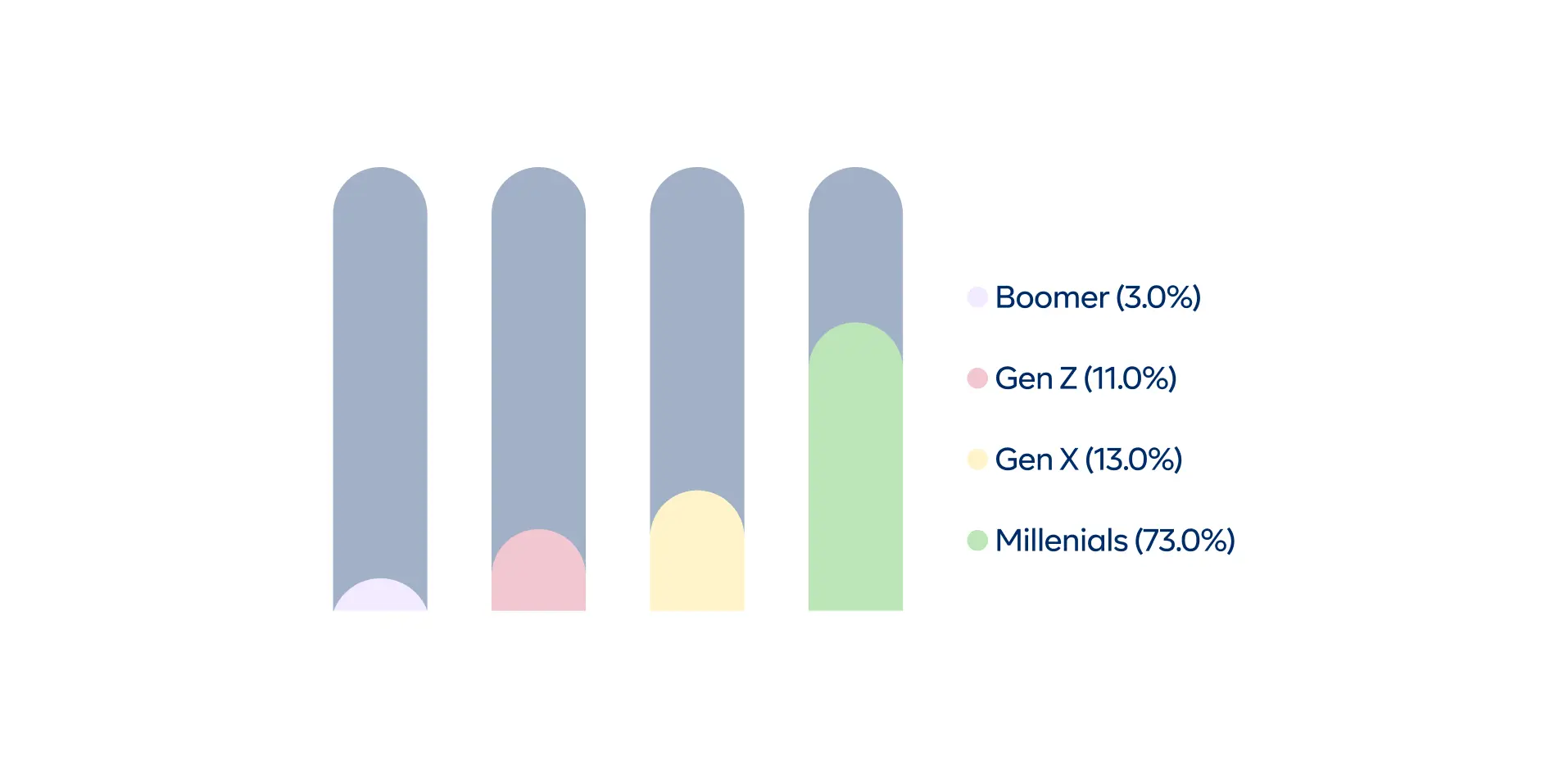

Millennials appear to be more consistent investors. Sorry Gen Zers!

Millennials have unlocked more Streaks than Gen Zs, Gen Xs, and Boomers combined. Of the top 100 customers with the highest Streaks, 67% are millennials – unlocking between 61 and 94 Streaks to date. 11% are GenZs, and the remaining 16% is distributed between Gen X and the Boomers. We tried to understand why this is the case. Our hypothesis here is that there is most likely a direct correlation between time of stable employment, higher disposable income, and financial consistency, but this will be the subject of another report.

17% of the top 100 Streakers were born between 1962 and 1980

The OGs have this one! Of the top 100 customers with the highest Streaks, 17 of them were alive when Shehu Shagari was president in 1980. Imagine that! Who says the older folks can’t use investment apps? 62% of our top 100 Streakers are between 30 – 41 years old, 10% are between 51 – 60, and 11% are between 23 – 27. Our youngest Streaker is 23 years old and has been saving with us since 2019. He has 62 Streaks so far. If this doesn’t inspire you, I don’t know what else will.

For Streakers and anyone serious about financial progress, age is just a number, and it shouldn’t be a barrier to financial freedom. When we launched Cowrywise, we had one mission. To democratize access to investment opportunities and make it accessible to all, regardless of age, gender, and financial capacity. So far, the data shows we have kept true to our promise, and our side of the bargain. Will you keep yours?

We are looking for more Streakers ?

It’s not easy to be a Streaker in the current economy. You need to have a balanced dose of a stable income, moderately high disposable income, manageable responsibilities, and even luck. To all our current Streakers, we say well done. It couldn’t have been easy, but you have prioritized your financial well-being above all else and we are certain it will pay off in the end.

As such, we are looking to send gift boxes to top Streakers, complete with a personalized note, and items you typically use every day; a reminder to start consistently as you have with your finances. If you think your current Streak count is noteworthy, log in to the app, share your Streaks on Twitter, and tag @cowrywise.

We even wrote appreciation letters to some of our Streakers. Here’s what we had to say to Joseph and Godwin, two of our top Streakers.

We hope these notes (and many others like this you will come across online), will inspire you to forge ahead and keep saving and investing!

Dear Godwin,

When Korede Bello sang the popular song, Godwin, he was talking about you! But he forgot to add this to the lyrics – ‘I don see returns, Godwin!’. LOL. It’s clear you are on a mission to become financially free. Like any trained soldier, you came prepared. You have saved/invested every month for the past six and a half years. Godwin, you deserve a gift!

Silver and gold I have none, but what I do have is a specially curated box – just for you!

What if I haven’t unlocked a lot of Streaks?

Regardless of the number of Streaks you have unlocked, we are still super proud of you; even if it’s just one! You should be proud of yourself too. It’s not easy, and we know your consistency and compounding will work in your favour.

A lot of customers have already started sharing their Streaks on Twitter. So don’t be shy! Surprise yourself at your level of discipline and share your Streaks to encourage someone to start their financial journey today.

Here’s how you can view and share your Streaks.

- Log in

- Tap the Streak icon on the blue portfolio card on your Home screen

- Tap the share button to share with your community on WhatsApp, Twitter, or Instagram

- You most likely have a friend that needs to start investing. Share the link with them

- Take pride in your Streak count

If you haven’t unlocked a Streak yet, that’s ok too. It’s not too late to join the movement! All you have to do is make a deposit into any of your savings or investment plans, unlock a Streak and share. Click here to top up.

Tips to help you maintain your Streak

- Stay true to your budget: Dedicate at least 20% of your budget to your financial goals. More importantly, ensure you stick to it. Start with smaller amounts, and increase them as you continue to strengthen your financial muscles over time. Remember, tiny drops make a mighty ocean.

- Maintain a long-term horizon: Time is money, and if you are young, of working age, gainfully employed, running a business or side hustle, and earning an income, it’s important that you see the bigger picture so you can invest consistently, and take advantage of compounding. No matter what, ensure you save or invest at least once every month, no matter how small.

- Turn on automation: This is probably the most effective hack to unlocking and maintaining your Streaks. Turning on automation and having recurring deposits on your plans ensure you can make deposits into your savings or investment plan on a specific day every month, increasing the chances of maintaining your Streaks.

- Set up your deposits for success: Add a funded debit card to all of your automated plans. Or better still, link your bank account. This is a new feature we recently introduced to our payment infrastructure, so if your debit card fails for technical reasons, we make a charge directly from your bank account. This way, nothing can stop you from unlocking a new Streak every month.

Who’s ready to get their Streak on? A Streak in time saves nine. Gerrit? ? Click this link below to log in, top up, and check your Streaks.