Depending on who you ask about push notifications from Ope you’ll find excitement, eye rolls, and the occasional dismay at once again being reminded to make good financial decisions. But beyond the buzz of witty push notifications, they play a critical role in boosting the growth of our bottom line.

Just as people forget friends, in today’s fast-paced world, they also forget even the most helpful of apps. Regardless of your design and beautiful features, people forget. The downsides to this are also pretty evident and consist of:

- Lower active users

- Lower discovery of features

- Slower growth loops

Background: A Clear Content Strategy

In designing our content strategy, we were clear about our intent. That is to sound like an elder sibling and in turn, create things that people will share. For a start, we focused heavily on emails, social media and in-app messages (IAMs). In a later article, we’ll share how IAMs helped us boost our Playstore performance.

Push Notifications vs. Email Marketing

Our experiments exposed to the following lessons:

- Emails are great for distributing our financial education content.

- Push notifications and feature positioning (in-app) are better for product nudge campaigns.

Another thing to note here, however, is that driving product nudge campaigns heavily through emails can impact your open rates, as they tend to get boring. We recommend exploring IAMs and deep-linked push notifications more.

Our Journey with Push Notifications

We didn’t discover the potency of push notifications until we fully explored Firebase Cloud Messaging (FCM). Jump to this section to read on how to set up push notifications for your apps today.

Our first active push notification went out on May 21, 2019. It nudged users to update their apps. However, our big one was on May 24, 2019.

Two things happened that day. We enjoyed massive user-generated content (UGC) and also saw a spike in one-time deposits.

How to Design your Push Notification Campaign

Based on that experience, we took note of 4 parameters to consider in the design of push notification campaigns:

- Timing

- Targeting and tone

- Frequency

- Success metric (beyond the buzz)

Witty notifications are bound to spur UGC. However, how do you position for that and also go beyond the buzz to measure concrete contributors to your north star metric? In our case, our metric is assets under management (AUM).

Let’s use the push notification on May 24th as a case study. The message was scheduled to go out at 5:07 PM on a Friday. At that time, it’s expected for people to be relaxed and looking to make various purchases for the weekend flex.

Hence, a call to save money you are about to spend was bound to feel timely. We saw cases of people who were window shopping on e-commerce stores receiving the notifications. It was a subtle trigger that drove one-time deposits for users and signup trickles. This had a clear impact on our AUM.

Based on our explainer, you can see that we let the timing determine our tone and guide the audience we focused on. Though we had no metric in mind as we were just excited to try things out, we learnt what metric performances to look out for. Till date, this guides our approach.

How to Craft Compelling Notifications

Before you dive into this, if you are a content/product marketer you should get a copy of “The Art of Plain Talk”. You will write clearly and shorter with the guides in the book.

That said, there are character limits that come with push notifications. You are allowed to write as much as 240 characters, but remember that we exist in an impatient world. Also, people can also see a few of those characters before tapping to read more.

We have just two simple rules:

- Work with a body limit of 45 characters. To help, use this character counter.

- Say exactly what you want. This isn’t the time for stories. For example, “Did you know that you can get free transfers with your username?” might not work. Rather, “Get free transfers with your username today” will probably do a better job.

- Use at least an emoji when you can. The moon face Ope uses is intentional.

P.S: Yes we too are also triggered by Ope’s messages! Just because we’re all a part of the team that shares these messages doesn’t mean they lose the ability to trigger us too. So, we are with you on disciplining Ope.

What can we do better?

We are working in-house to improve targeting and timing. Imagine walking into a store, and you get a notification that says: “Don’t spend too much in there”? It’s actually possible with a few tweaks.

Asides from that, we also understand that different tones apply to different segments of our audience. Same with time zones. We are looking to harmonize all of these and create more detailed campaigns with key conversion metrics. However, we cannot promise a guide for this when all is set up.

In summary, these are points you should also consider in creating your push notifications structure:

- Geo-based targeting

- Time zone segmentation

- Cluster targeting

How to Set Up Push Notifications for your App

On setting up your push notifications, there are a number of platforms to consider. To mention a few, you have:

- Firebase Cloud Messaging

- Intercom

- Customer.io

- OneSignal

In this guide, we focused on the Firebase Cloud Messaging approach. Do let us know if you try it out. We’ll be glad to advise on the challenges you might encounter.

Setting up your app to receive push notifications with Firebase Cloud Messaging

Firebase Cloud Messaging is a free, cross-platform messaging solution that lets you reliably send messages at no cost. You can send push notifications to your users without having to worry about server code using the Notifications Composer from the Firebase console or via server-side logic on your backend using the FCM REST API.

Key Messaging Capabilities

ー Send notification and data messages: Notification messages are handled by the Firebase SDK. It will automatically process the message and display it as a notification in the device’s system tray. You can use data messages to send custom data elements to the client application. However, you would need to handle how your app interacts with and displays this data.

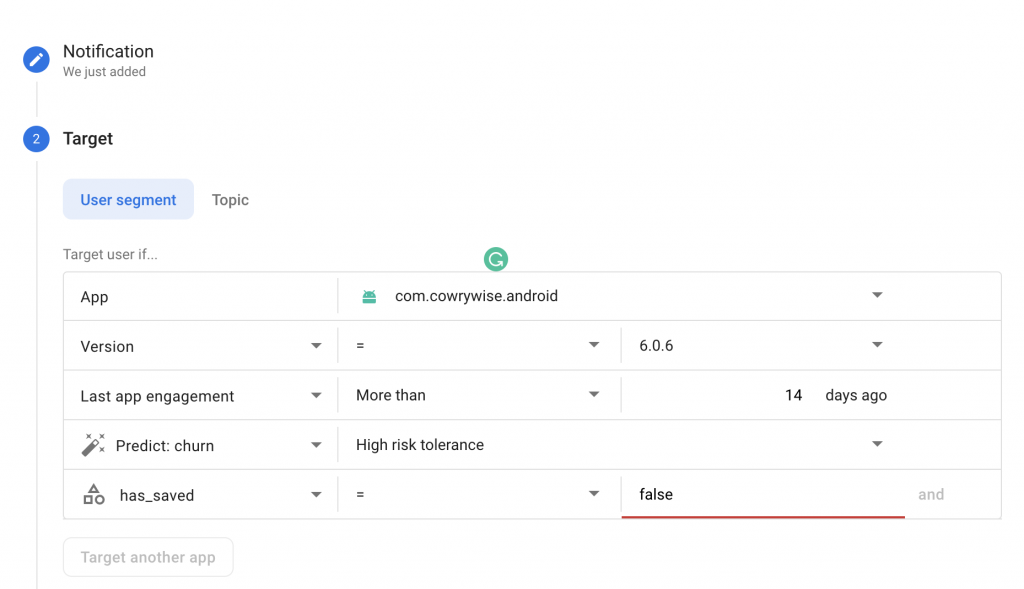

ー User Targeting: FCM lets you send notifications to users based on certain properties e.g Location, App version, App type, etc You can also set your own custom properties and send messages based on that. If you’ve set up Firebase Predictions, you can also target users based on how likely they are to engage with your app over a period of time. For example, if Predictions warns that someone is likely to disengage from or uninstall your app, then you could use FCM to re-engage them and/or remind them about a feature.

ー Analytics: With FCM, you can view how many messages were sent, opened and how many users converted. Even if you didn’t set any explicit conversion goals, you can still gauge whether users are acting on your notifications, by comparing the number of messages delivered, to the number of messages opened.

Firebase has a pretty detailed documentation on how to set up push notifications here. Once you have that set up, you can begin sending push notifications. If you have your own backend that you wish to integrate with Firebase, FCM has an API which has a lot of configuration options. FCM can also be integrated with many popular messaging platforms e.g Intercom, Customer.io , etc and you can use it to build your own notification service.

Monitoring/Tracking your Push notifications

Google Analytics for Firebase provides free, unlimited reporting on up to 500 distinct events. The SDK automatically captures certain key events and user properties, and you can define your own custom events to measure the things that uniquely matter to your business.

When you set up events, you can see exactly what steps your users took after receiving a push notification. You can create funnels, monitor drop off and see how many of your users convert after a push notification.

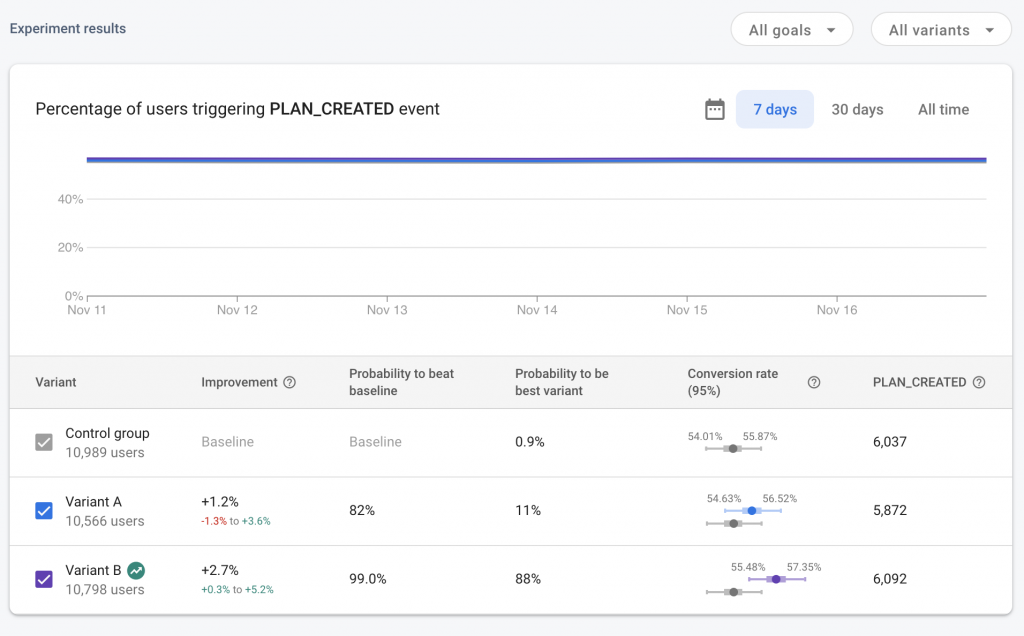

This is also useful during A/B testing Where you can have multiple variants of a push notification and see which one converts users best.

All your App’s events are visible on Google Analytics and you can do a lot more with the data there. Yes, It’s free.

Deep Linking push notifications

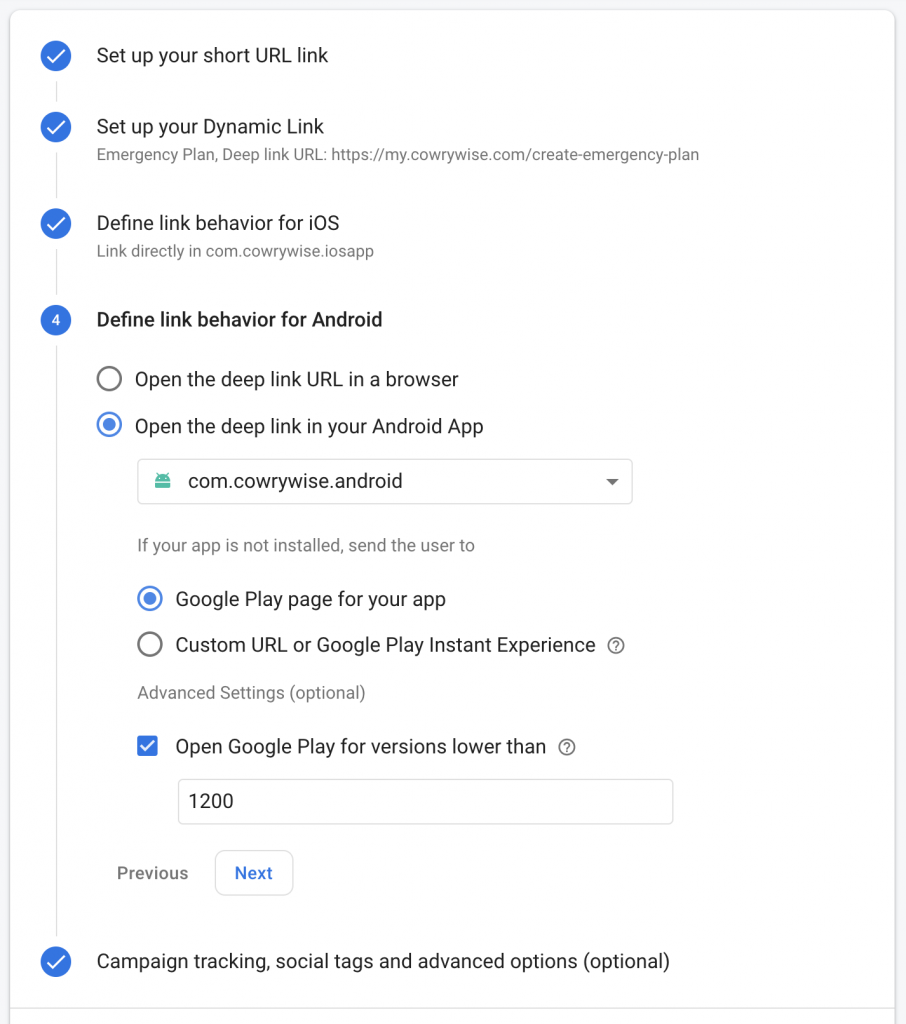

Once a push notification is opened, the user expects to be sent to a page in the app. This is where deep linking comes in. A deep link is a link that takes you directly to a specific destination within an app. In order to monitor and track these deep link events efficiently, we use Firebase Dynamic Links. This is optional, but Dynamic links come with a couple of benefits. For example, if your deep link should direct users to a new feature that is absent in outdated apps, You can set up a dynamic link that redirects users to the PlayStore/App Store to update their app. Once their app is updated the app opens the page that the dynamic link is expected to take them. Dynamic links also double as URL shorteners. You can add a custom domain and get URLs like cwry.se/app.

That was a long read. We believe you enjoyed it. Get to know more about our growth optimization efforts here. Also, do not forget to follow us on twitter.