We have made a new update to Money Duo called Pods.

Picture this: you are driving on the highway or scrolling through Twitter and you see our ad:

Call for Couples. We are looking for lovers/couples madly in love enough to save together.

Qualifications:

- Male or female

- Madly in love

- Have serious plans for the future

- Not afraid of big goals and dreams

- Looking to open a joint account with zero hassles

If you meet these criteria, then this ad is for you.

What would your first instinct be? Would you drive/scroll by or would you send it to your partner saying, “Hey babe, we definitely fit this spec” If you answered in the latter, keep reading. If not, keep reading anyway.

Let me introduce you to Cowrywise Money Duo 2.0: the private savings product for lovers like you.

What is Cowrywise looking for?

We are looking for couples and not just any couple. We are looking for couples who want to build wealth. Together. So if you are married, engaged, or in a serious relationship, looking to collectively meet your financial goals, you are just the couple we are looking for. If this sounds like you and your partner, great! We are excited to welcome you to the future of joint private savings.

Cowrywise Money Duo – Unlocking the power of two

In 2021, one of our creative designers, Nonso Okolo had an idea to create a feature centred on love money, and togetherness. He shared the idea with the Cowrywise team and in no time, work started in earnest. We were all excited to build a product that solidifies and doubles the financial position of couples.

From research to project definition, development, testing, and launch, the execution was in full swing. And just like that, we created Money Duo – a savings plan for couples to maximize the power of two people! Two heads are better than one. The same applies to two people combining their individual resources to meet one single-minded goal.

We were set to launch on February 13, 2021. But that day, an #EndSARS protest was held in Lagos. And in solidarity with the movement, the launch date was shifted to the 14th. Two years ago on Valentine’s Day, we launched the product that has since changed how couples save together: Money Duo.

What is Money Duo 2.0?

Money Duo 2.0 is completely different from the product we launched two years ago. But, regardless of the differences, the purpose has remained the same; to help couples build wealth together. And as an innovative fintech company, it’s in our DNA to take feedback from users, to ensure we are building a product that actually matters to them. In the past two years, we’ve had couples like you choose Money Duo as their preferred joint account of choice.

During this time, they’ve given us valuable feedback on what to improve; feedback that took us back to the drawing board. What we have now is a better, far more transparent product built to serve you and your partner on your best wealth-building journey yet. I’m sure you want to know what exactly is new on Money Duo 2.0. Stick with me. First, let me tell you why you actually need Money Duo.

Before there was Money Duo

Before Money Duo, there was one arduous process for couples to save together, which involved a series of hurdles they had to cross.

- Your presence was needed and you had to fill out exam-like forms: This is a typical case of ‘I’ve got 99 problems, saving shouldn’t be one of them’. Couples looking to save together had to walk into a bank to open a joint savings account. If you’ve been to a bank recently, you’d know that’s a big problem. You’d first have to fight your way through the gate to actually get into the bank, before joining a queue, and getting to the customer service personnel, only to be given a form to fill.

One of our Money Duo users had this to say,

“My husband and I wanted to open a joint account just after we got married. We walked into the bank, and we were given a 2-3 page form to fill out. We both looked at each other, smiled, said our thank yous, and walked out. We never went back. In fact, we still have the form at home somewhere”

This brings us to the second point.

- You had to present a utility bill and wedding certificate: The challenge with this requirement particularly was that by default, it automatically excluded couples who weren’t legally married from opening a joint account. So, if you were dating or engaged, you couldn’t save together simply because you weren’t legally a couple.

- You didn’t have options: At the time, no other institutions offered any alternatives. If you wanted to open a joint account, you had to go to a bank. If you weren’t legally married, you’d either have to wait till you were married, or save separately. Not very customer-friendly choices. But, now you have a choice.

The purpose of innovation and technology is ultimately to make life easier. And the great thing about Money Duo is that it solves all these frustrations with one simple, thoughtful, and ingenious digital solution that ensures that any couple can save together for the future they are building.

More than a joint savings account.

Here’s why you should use Money Duo

The quick answer? Money Duo was built with you and your partner in mind.

The long answer:

- You can set up a joint savings plan in minutes: No need to fill out forms or join bank queues. You can have your private joint savings account right there on your Cowrywise app.

- Your funds are private: Even though your joint account is accessible to only both parties, your partner can only withdraw their contributions. Not yours.

- We have interest rates you’ll fall in love with: Just in case you’re not aware, you can earn more interest with Cowrywise. So while you and your partner build financial intimacy by saving together, you also earn cool interest along the way.

- Accountability: shared money goals are only valuable if the goals are met. With periodic and automatic debits set on your Money Duo plan, couples can stay disciplined, on track, and accountable to each other, ensuring they meet the money goals they set together.

The future of joint savings just got more transparent, couple-friendly, and intimate.

This is Money Duo 2.0

What’s new?

- Save the way you like: When we launched Money Duo two years ago, couples had to save the same amount. But over time, we’ve come to understand that couples don’t always have similar income streams. So we’ve realigned the product with current economic realities. With Money Duo 2.0, you can now decide to save N100,000 monthly while your partner saves N300,000. Everybody wins!

- You can now save for short-term goals: Before now, saving with Money Duo required that couples save for at least a year. While that is strategic for some couples, we understand that some couples may want to save toward short-term goals. With Money Duo 2.0, you can save for a shorter period and your funds are open for withdrawals anytime you need them.

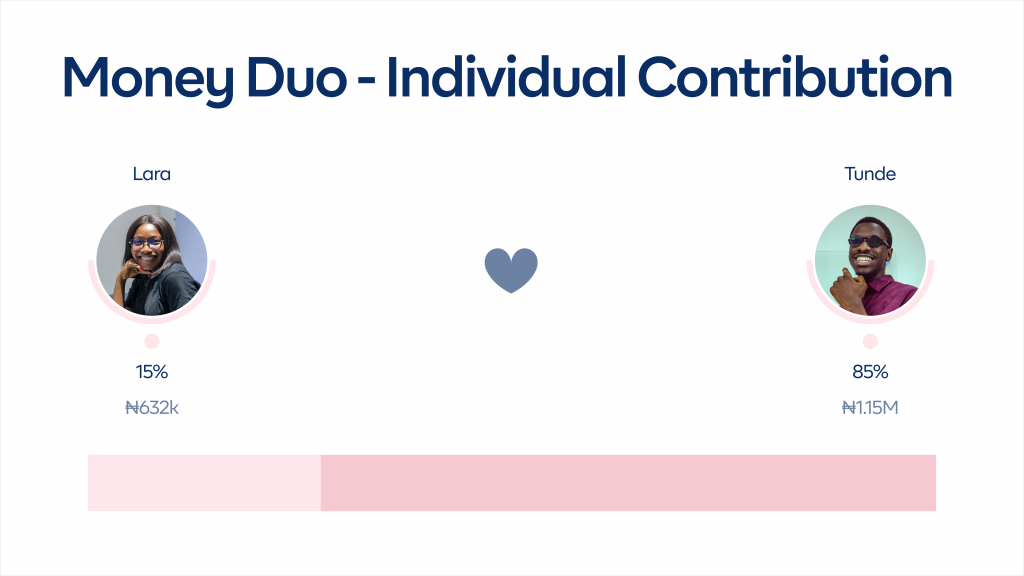

- Far more transparency: We’ve made Money Duo even more transparent, ensuring you now have even more visibility over the state of your finances. Couples now have a view of their individual contributions to the plan. You can easily tell how much of the funds is yours and your partner’s respectively.

How does Money Duo work in 3 steps?

- Step 1: Sign up on Cowrywise. You both have to be Cowrywise users to use Money Duo. You can sign up on Cowrywise here.

- Step 2: Send your partner a Duo invite. Open your Cowrywise app and send a Duo invite to your partner.

- Step 3: Ask your partner to accept your invite. Once your partner accepts your Duo invite, you both can start saving together.

Back to our call for couples

By now, I’m sure you get the gist. Now that you know what Money Duo is about, and you got to the end of this article, you must be ready to build wealth with your partner. Are you part of those we are looking for?

ALSO READ

How Pods is revolutionizing the concept of joint savings in an age of individualism

I am still waiting for Cowrywise to be inclusive to Muslims so that we get profit instead of interest.

We currently get nothing if we don’t want interest.

Exactly!

Me too,I support this!

Precious Fortune blessed by this

Thank you keep it up

Fully Supported. Cowrywise needs to embrace full financial inclusion to go places. Excluding a major block of interested investors cum customers limits widespread acceptability of Cowrywise Service. Financial Inclusion is key for a Multi-Religious Society like ours. Moreover, the issue of avoiding interest and opting for profit is not exclusive to Muslims alone, it is also a goal for ethical investors irrespective of religious affiliation. Trust Cowrywise will do something concrete about this customer base request/requirement before another fintech competitor does.

Cowrywise is just so lovable ?

Nice and cool

I’m waiting for cowrywise to open my app

I love Cowrywise app so much. It has helped me meet most of my goals financially.

I recommend this app for everyone!!?