Adeola Jones (not real name), works as a manager at a bank branch of one of the top banks in the country. With steady pay, a competitive salary, an official car, and perks that come with the job, Adeola is fairly comfortable -financially. But, things were not always like this.

Adeola’s story is a true ‘grace to grass’ story. He vividly remembers how his family’s fortune took a turn for the worse in the 80s when his father lost his job while he was in secondary school. He recalls how his parents had to cut down his provision supply while he was in boarding school. From 3 packs of cornflakes to one, 4 packets of Oxford Cabin Biscuit to 2, it was a nightmare. They even replaced the popular ‘Baba Sala’ Milk and Milo (the big 900g tin) with 360g. His dad had to sell some of his property and cars to keep the family afloat and cover his school fees through school. Sadly, his father passed away just a year before he gained admission to the University of Lagos when he was 18, leaving them with a small amount of money in the bank at the time, which was a nightmare to claim.

Many Nigerian households today have a similar story.

Now, married with three beautiful children, Adeola has toiled day and night and made extraordinary sacrifices to provide for his children. His one mantra, (as with most parents of his generation), is to provide his children with the best things in life – things he missed out on. But, there’s still one thing that troubles him. Adeola worries that even with the combined financial contribution of himself and his wife, the current state of the economy, their dwindling disposable income, and the rising cost of daily necessities, will rob him of the chance to leave something substantial behind for his children to support them by the time they are ready to leave the nest.

This is why we built Nest; to give parents one major advantage – time!

Inheritances and trust funds have been known to be the reserve of the 1%. But it doesn’t have to be

According to Yahoo Finance, less than a third of all households in America inherit any money, and between 70% and 80% of households receive no inheritance at all. You can expect the trend to be much dire here at home. 4 out of 10 Nigerians experience monetary deprivation, but more than 6 out of 10 (65% of Nigerians) are multidimensionally poor, meaning that they experience poverty on multiple dimensions – access to clean water, fuel, sanitation etc. The other 35% who aren’t in this group, have to tackle FX fluctuations, rising costs of basic needs, and dwindling disposable income, leaving little to no wiggle room to set aside an inheritance in the conventional sense.

While official statistics on the number or amount of funds bequeathed to children and wards via inheritances or trust funds in Nigeria are unavailable, the common school of thought is that such transfers of wealth are the reserve of only the wealthy, and are virtually impossible for the average Nigerian. And rightly so. You first have to possess some form of wealth, before you can transfer it. Now that the barrier to access for investments is at an all-time low, wealth is now within reach of the average Nigerian.

By extension, Nest by Cowrywise levels the playing field, giving every parent a fighting chance, and arming them with a financial investment tool, to help them systematically build wealth to transfer to their children – the financial foundation they never had.

Introducing Nest by Cowrywise

Remember Adeola’s fears – that he won’t be able to put money aside for his kids. Nest solves that problem.

Nest is an investment account for kids, to help parents invest periodically over several years, and take advantage of compound interest so that the investment grows over time. The concept is simple – tiny drops make a mighty ocean. The tiny drops here being those periodic deposits, (₦500,000 here, ₦2,000,000 there), and the mighty ocean – the funds you have now amassed, will continue to grow with your child. Nest accounts are locked from the day the account is created, and are only accessible to be transferred to the child (who the account was created for) when he/she turns 18.

A lot of parents today have had to work hard since they became adults, without much financial support from their parents. Like Adeola, it is understandable. As a parent, you have the chance today to end that cycle, and provide a solid financial foundation for your kid(s) when they turn 18 – think about it like a seed investment. This way, they can comfortably start their adult life on their feet. They could use the funds to get their first apartment, fund a business idea, pursue their higher education, learn a skill or fund a passion project, thereby reducing financial pressure on their parents.

Features of a Nest Account

Nest by Cowrywise has innovative features to help parents invest in their child’s future with ease.

- Co-management: Parents can invite their spouse or partner to co-invest in their child’s Nest Account – this way, you can double your efforts to fund your child’s endeavours, and increase the amount of money you can invest periodically. Dad and mum can co-manage their child’s account, with 100% transparency.

- Automation: Parents can automate their investments in their child’s Nest Account, so they never miss a deposit. Automation is extremely flexible, and parents can set the Nest Account to be credited from their bank accounts or debit cards on specific days of the week or dates.

- Account Transfer: Once a Nest Account is created, it is inaccessible until the child who the account was created for, turns 18. At this point, the funds become transferrable to the child’s account.

- Additional Security Features: In addition to the legacy security features that come with using Cowrywise (2FA, Security Questions, PIN), funds can only be transferred to the child once it has been approved by both parents, as co-managers of the account.

How to Create a Nest Account

Nest is currently available to Cowrywise customers only. To access Nest:

- Sign up/Log in on Cowrywise

- Tap the Nest Card on the home screen

- Input your child’s details (Name, date of birth)

- Proceed to enter your first investment amount

- Click on Create Account

You’ve just created a Nest Account. Congratulations! 👶

Time value of money – Why you should start investing for your children today

The time value of money is a fundamental financial concept that is two-sided. On one hand, it states that money available now is worth more than the same amount in the future. Simply put, the value of cash in hand today, is expected to diminish in value in the future, if the money doesn’t have any earning potential.

For example, with ₦100,000 in January 2024, you could purchase a long list of items in a supermarket. As of the time of writing this article, with the same ₦100,000, you can most likely purchase only 50% of the same items on the list (or less). ₦100,000 in January 2024 was more valuable than ₦100,000 in April 2025.

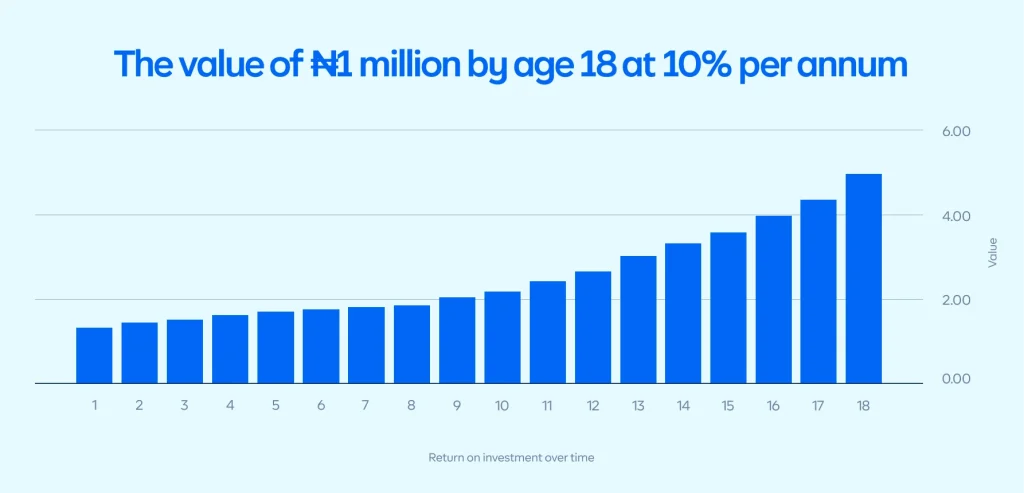

On the other hand, money you have now can be invested for financial return in the future, due to its potential to earn interest or grow through investment. We wrote an article about this here – where we broke down the relationship between the value of investment and time. For parents today, time is the greatest advantage for maximizing their children’s investment. For example, creating a Nest Account for a newly born child gives the investment 18 years to grow. At 10% per annum, ₦1 million could grow to about ₦5 million – on just reinvesting and compounding alone. With steady and periodic investments over time, the potential for returns could be much higher.

The bottom line? Start investing as soon as you can. Keeping cash till the ‘opportune’ or ‘best’ time will simply see your money devalue over time. Start with what you have, and invest in diversified, low-risk investment instruments that generate returns – This is one of the things Cowrywise is known for.

If you are a parent reading this, create a Nest Account today. Give your kids the wings they’ll need to fly out of your nest once they turn 18, and a financial headstart to navigate future money needs.

With Nest, you have nothing but time on your side.

‘The greatest gift Nest gives a parent is time’

If you can dream it, you can invest for it

We all dream. It’s natural to dream of bigger opportunities and a better life. As a parent, you dream of a brighter future for your children, filled with endless possibilities, opportunities to succeed, and the financial freedom to chase their dreams – things some parents never had. The structure of society, and availability of basic needs and amenities, have the capability to dahs all hope. But, there’s a popular adage that says, “When there is life, there is hope”. As long as you can read this message, your dreams and hopes are achievable. And with the right attitude, financial planning and patience, investing can make some of these dreams a reality.

Whatever you can dream of, you can invest for it!