We have made updates to how Emergency Plans work. Click here to see the update.

In this article, we are going to look at the impact of the recent Stash update regarding emergencies through two use cases and highlight the best way to maximize Emergency Savings Funds for your emergency needs.

⚠️ It’s important we reiterate that we don’t operate the same way as your bank or payment provider and we can’t serve the purpose of making quick withdrawals. Ultimately, because you are building wealth, and you have a long-term mindset, your investment account shouldn’t be used to fund emergencies unless as a last resort.

The Emergency Savings Fund is an investment plan built for emergencies you can plan for, that aren’t extremely critical, and that you can afford to wait 24 hours for. You are most likely wondering what kind of emergency can be planned for. To get the full context, keep reading.

Emergencies and Withdrawals: Use cases

Emergency Savings Fund has certain advantages. It puts your mind at ease, builds financial discipline, and reduces financial burdens. To understand the product, why it was built and the best way to maximize it, we need to look at emergencies from two perspectives.

The first use case – Using Stash for emergencies

We’ve noticed a number of our customers use Stash to hold monies they need to access quickly. Stash isn’t a bank account or a substitute for one. It’s a funding channel to top up your plans and receive payouts from investments and/or matured savings.

It’s also not a payment account. Stash is not the ideal product for making payments, keeping funds for emergencies, or making quick withdrawals. And with the 24-hour processing period, it’s not advisable to keep emergency funds in Stash.

That isn’t what Stash was built for. As such, we advise that you keep such funds in your regular bank account.

The second use case – Saving in an Emergency Plan

The context of an emergency means different things to different people. An emergency could be anything from paying high-priority medical bills to purchasing household supplies, groceries, or feeding. It could even be sorting out quick financial obligations.

An emergency to one person, may not be an emergency to another. But, an emergency is still an emergency regardless. The second use case forms the basis of this article.

Flashback: Why we built Emergency Savings Fund

In 2018, we launched Emergency Savings Funds, designed to help you face unpleasant financial surprises. As such, it was important we defined the context of emergencies we were building for; and the definition of emergencies still holds true now as it did then.

A quote from our 2018 article states that “one can define an Emergency Savings Fund as the big brother you run to when there is a serious financial issue beyond your immediate control. It is a stash of funds that should be built over time, and not one that is tampered with within short intervals”.

To achieve product-market fit, it was important we established and validated the ideal use case. What kind of emergencies can be ‘planned’ for, within the context of what we do as an investment company, as well as the socio-cultural context of emergencies?

“Emergency funds come in handy when faced with job loss, health emergencies, natural disasters, etc. You should work towards gathering up an amount that can cater to your living expenses for six months in case you run into an emergency that blocks your income flow for six months”.

From our research, the most prominent financial emergencies include medical emergencies, job loss, or disasters. For example, according to Reuters, around 20% of Nigerians lost their jobs during Covid-19 in 2020. On a yearly basis, there are numerous flooding disasters that affect major towns, and cities. And life-threatening medical emergencies are commonplace. But, there’s one thing these emergencies have in common.

Emergencies of this nature have the potential to greatly disrupt your finances. This means monies in an Emergency Savings Fund are ideally a lifeline when all other streams of income have been exhausted due to an emergency.

In short, your Emergency Savings Fund is actually the fund you need when other emergency monies run out, which means you are in a position to plan accordingly.

For individuals building wealth (remember all funds are invested, including Emergency Funds), it is important your investments aren’t tampered with, except when absolutely necessary.

Emergency Savings Funds are also an investment

Remember, monies in Emergency Savings Funds are not to be tampered with within short intervals, especially since they are being invested; we have explained this in a previous article.

For example, if you lose a job, you most likely have some savings in a regular bank account that can keep you afloat, pending when you get another one. Based on the context of the Emergency Savings Fund and the way it was built, you have the leeway to make a withdrawal from your Emergency Saving Fund when your current cash flow is depleted (remember, the idea is to not tamper with any of your investments unless you have to). The same scenarios apply to medical emergencies or disasters.

Let’s dig deeper, and take a look at another case study. Most car owners have some form of insurance coverage (either third-party or comprehensive) to ensure their cars can be replaced or repaired in case of accidents.

But, many car owners reserve insurance claims for extremely serious issues like theft, or wreckages known as ‘write-offs’. For other incidents like scratches, dents, run-ins with danfos, etc, the majority of car owners typically cover the cost out of pocket, instead of making a claim.

The principle for Emergency Savings Funds works the same way.

Your investments in Emergency Savings Fund should be your last resort when all else fails.

We hope, you never experience an emergency of an extreme nature, but life happens, and it’s important to plan ahead. And if you do have an emergency, you should hopefully have saved up enough funds which will serve as a viable lifeline if life happens. The generally accepted amount one should target annually, based on suggestions from top advisors globally, is six months of living expenses.

For example, if your monthly living expense is N200,000, your emergency fund should be at least N200,000 x 6 = N1,200,000. You can build this over 2 years by saving N50,000 monthly, which can generate returns during that timeframe.

But, how has Emergency Savings Fund performed so far?

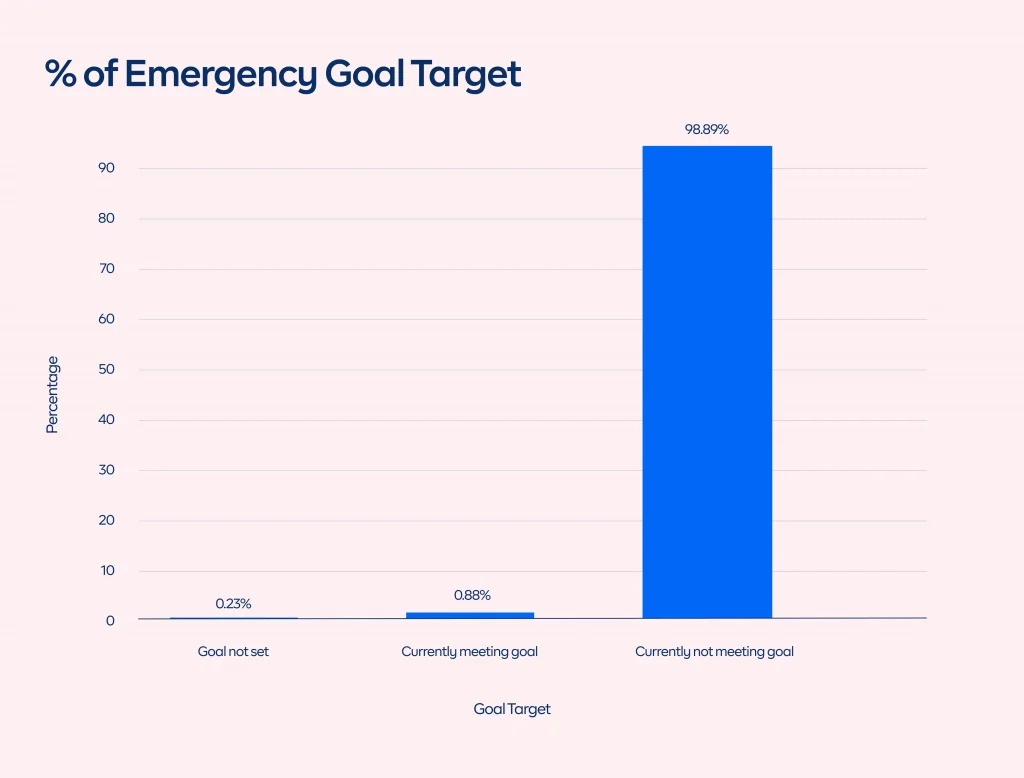

Emergency Savings Funds x Product Adoption

To date, we have had thousands of users fund their Emergency Savings Plans every day. But only 0.88% of users are meeting their emergency goal target, which means they have successfully kept aside up to 6x of their monthly living expenses. On the other hand, 98.89% of customers are currently not meeting their savings targets. What is the most likely reason for this? The likely culprit is that customers aren’t funding their Emergency Plans frequently based on the 6x guideline or are making incessant withdrawals that prevent them from meeting their goals.

It’s important to meet your savings goals. And as an investor, you should view your Emergency Savings Fund as an investment, as it currently offers up to 10% p.a in annual returns. Having invested 6x of your monthly expenses gives you enough funds to manage your existing lifestyle, or cover the costs of your emergency in case of any eventualities.

Help section

How will the 24-hour processing period affect me if I have an emergency?

Instant withdrawals will no longer be available, and we advise that you keep funds needed to meet your daily needs, obligations, or emergencies that need to be attended to quickly in your bank account for easy access instead. We believe strongly that your daily cash needs and emergencies should not be funded by your investment account. Emergency Savings Fund was built to accommodate emergencies that aren’t extremely urgent (and you can afford to wait 24 hours for) and when other income sources are unavailable.

I have an emergency today. Why should I be concerned about my investment in Emergency Savings Fund?

Withdrawing for an emergency is a temporary bump in your financial journey, and having a long-term horizon will help you get back on track. As an investor, even if you have an emergency to attend to, it’s important to keep your long-term investment goals in view.

Why should it take 24 hours to process funds, and how does that help me in the event of an emergency?

As we mentioned earlier, monies from emergency funds are invested through the custodial structure and will go through the stipulated processing channels. Also to note, emergency funds should serve as a last resort, in the event all other income streams are blocked, depleted, or unavailable.

Emergency Savings Funds are open plans, which means you can make withdrawals anytime, unlike locked savings plans. This gives you the means to plan ahead to withdraw from your investments ahead of time, taking the 24-hour processing period into consideration, for emergencies that can afford to wait. Remember, the Emergency Savings Fund is the big brother you run to when other emergency monies have run out.

What good are returns in the event of an emergency?

The returns over time add up to your initial capital and investment. The more you invest, the more you maximize the power of compounding, which means you’ll potentially have more funds accumulated based on your capital and interest rate. In the face of an emergency, you can withdraw your capital and your cumulative returns to meet your needs.

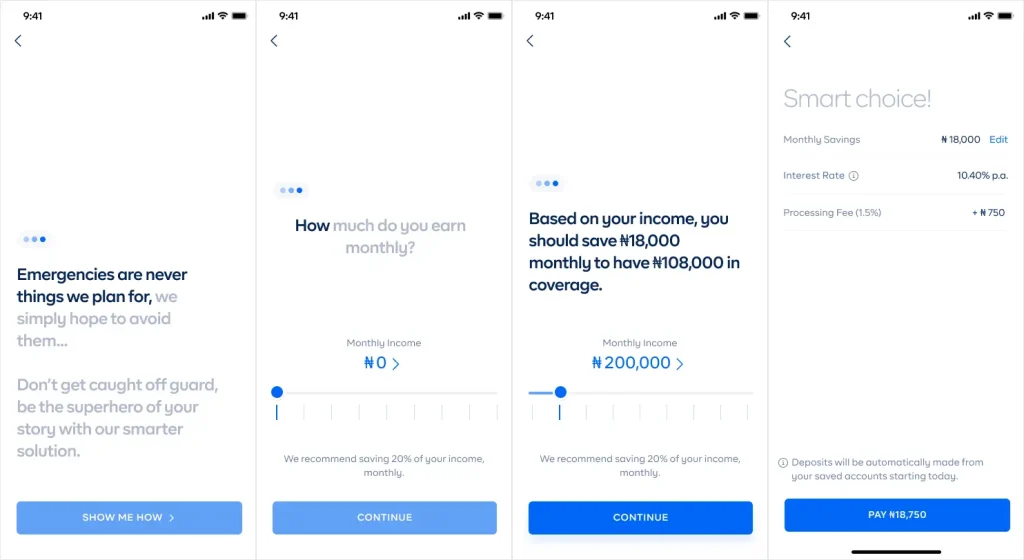

Update – Recommendations on Emergency Plans

We have made several changes and optimizations to help you plan and stay ahead of life. In the updated version, we have included a recommendation screen to reduce the mental load required when deciding how much to save in an Emergency Plan.

Typically, you should save at least 6 months’ worth of your monthly expenses in your Emergency Plan to give you optimal coverage for emergencies, or 20% of your monthly income. The recommendation screen helps you automatically calculate exactly how much to save based on the 20% recommendation, so you can start saving as quickly as possible. This recommendation is not cast in stone, and you make make necessary changes depending on your financial situation.

Final words

As always, our goal remains the same; to help the young generation of Nigerians build wealth by cultivating and making better financial decisions.

Keep planning. Invest wisely. Grow your wealth.