Evaluating a mutual fund’s performance can be a tad difficult. Although it’s advisable to look at past performance, this does not mean it will follow the same pattern as there’s no evidence that good-performing funds will continue to perform well.

So how do you know if your fund is doing great or underperforming? Continue reading.

How to Evaluate Mutual Fund Performance

1. Scale the fund’s performance against the benchmark

One of the first things to do while assessing a mutual fund is to analyze its performance against a benchmark.

Every fund has a benchmark that is used to track and evaluate its performance.

Investors should be aware of this, and you can use this as your first analysis parameter.

A successful mutual fund consistently outperforms its benchmark in the long run.

The extra return is referred to as the fund’s “alpha” when it exceeds the benchmark.

2. Compare similar funds

You can also evaluate a fund’s performance by how well it performs in comparison to its peers in the same category.

Mutual funds aspire to have the highest rating in their industry. Therefore, a comparable peer performance can help to learn the value a fund has garnered in a given timeframe.

3. Compare expense ratios

Expense ratios are the annual maintenance fee charged by mutual funds to cover their costs.

It covers the fund’s yearly running expenses, such as management fees, allocation costs, advertising expenditures, etc.

Expense ratios seem minimal, but you should know how much of it is going out of your investment.

4. Portfolio quality

The ability of the stocks in the portfolio to provide higher returns on capital over a certain period is a reflection of their quality.

Consider the mutual fund’s position in the industry, the returns, and the performance history.

5. Assess your goals

Your goals and the composition of your portfolio are closely related.

For example, it would not be ideal to invest in mutual funds today to finance a goal you plan to achieve in the next year.

Mutual funds are long-term investments that are known to deliver profits over 5+ years.

A qualified professional can assist you in allocating your portfolio among investment options that are appropriate for your objectives.

6. Risk return indicators

This is one of the most popular ways of evaluation because these indicators help understand if the fund you have chosen can compensate for the risk you are undertaking.

There are four widely used risk return indicators:

- Alpha

- Beta

- Standard Deviation

- Sharpe Ratio

Alpha

Alpha is the excess of the mutual fund’s risk-adjusted performance over the performance of a chosen benchmark index. If the fund has a positive alpha, it means the fund manager has delivered more returns to the investors. A negative alpha, on the other hand, implies a scheme is not able to even benchmark returns.

Beta

Beta is used to compare a mutual fund’s volatility with a market’s general fluctuations. Using the stock market as an example, the market is said to have a beta of 1. But if a fund has a beta of > 1, it shows that the fund is more volatile than the market. But a beta of < 1 indicates that the fund is less volatile than the market.

For example, a fund with a beta of 1.3 has 30% more volatility than the market.

Standard Deviation

The standard deviation determines how much all of a fund’s returns differ from the historically predicted returns. It is a popular metric for evaluating a fund’s volatility. A fund with a higher standard deviation may tend to be riskier compared to one with a lower standard deviation.

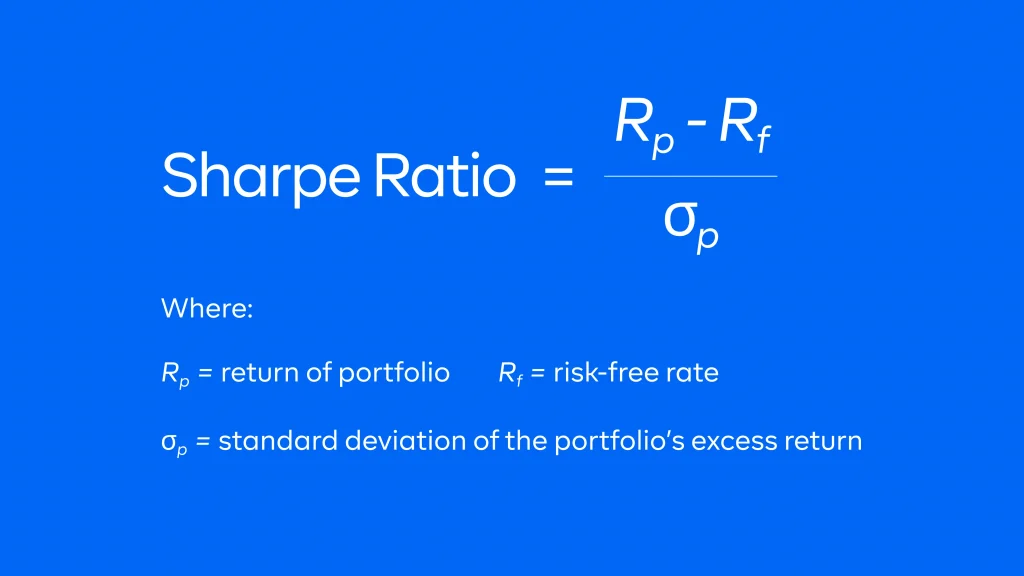

Sharpe Ratio

The Sharpe ratio compares the return of an investment with its risk. It indicates the additional return you are receiving for each unit of risk you take on by purchasing a mutual fund unit.

Generally, Sharpe ratios above 1 are considered good. You should opt for a mutual fund with a higher Sharpe’s ratio which means a higher risk-adjusted return.

How often should you evaluate your mutual fund’s performance?

Depending on the duration of the investment, you should examine your fund every six months to a year.

A shorter time frame for evaluating the funds does not provide an accurate picture of the success of your investments, especially because frequently looking at your portfolio could cause you to make irrational choices.

However, some factors may warrant you to evaluate your portfolio before it is necessary, especially if there have been recent changes.

Some of the changes include:

1. Change in fund manager

If the manager of the fund changes, you should get to know the new manager and talk to your advisor about the potential effects on the fund. Every fund manager has their approach to managing money, which may impact how well that fund performs.

2. Fund closure

There may be times when a fund closes for various reasons and pays investors back their money. In this situation, the mutual fund will notify you in advance, and you may need to adjust your portfolio.

3. Scheme merger

Imagine that after investing in scheme A, a large-cap equities fund, the mutual fund company decided to combine it with scheme B, a multi-cap fund. As a result, you must withdraw from the large-cap fund you originally allocated to and invest in a different large-cap fund.

Why Evaluate Your Investment Performance

- A good investor doesn’t just make investments; they also monitor and assess their portfolio.

- Periodically reviewing your portfolio can let you know if you’re making or losing money.

- Evaluating your mutual funds also helps you know when you need to rebalance your holdings because your asset allocation or fund manager has changed.

Bottom Line

Evaluating your portfolio performance is necessary, especially as a staunch investor. Although most investors may be satisfied with a portfolio’s overall returns, a more complete analysis should be carried out to ascertain the success of each asset.

Watch out for fund performances that swing excessively. Rebalance your portfolio to align with your goals and get thorough feedback from a qualified professional. And remember—past performance does not predict future outcomes.

Ready to start investing? View our collection of mutual funds.

RELATED

When Can You Sell a Mutual Fund?