We recently partnered with MoMo PSB to give more customers access to investment opportunities. Now you can invest everywhere you go. Literally. Here’s why!

In 2022, we wrote an article about embedded finance. Embedded finance is using financial tools and services by a non-financial provider. Simply put, it’s a way to position or integrate a financial product into a non-financial customer experience, journey, or platform. This allows the platform’s customers to use a value-added offering within the native customer journey. The next time you get a prompt to purchase an insurance policy while buying a car, or you get a notification to sign up on a BNPL (Buy Now, Pay Later) credit platform while attempting to purchase an item – a process called point-of-sale financing, you have embedded finance to thank.

In the article, we rightly predicted that embedded finance would become mainstream and that Cowrywise would be one of the local tech companies at the forefront of this disruption. Over the past couple of months, we have embedded investment products within various partner ecosystems such as the GTBank App, and the MyMTN app, and quite recently, we integrated our services with MoMo.

What does the partnership mean for Nigerians?

MoMo customers can now invest directly using funds in their MoMo wallets through the MoMo super-app.

Invest everywhere you go!

Embedding Cowrywise’s investment services within the MoMo ecosystem accomplishes two things. First, it deepens trust within the investment ecosystem. According to the 2023 EFInaA report, 196,000 people (about 6% of those using microfinance banks) experienced losing money/money missing from their account e.g. card/PIN fraud while using their microfinance account in the past 12 months. Generally, people have either lost money to bad investments or know someone who has. Consumers are typically suspicious of saving or investing on a new platform. Trust is a big deal!

And the partnership strengthens the basis of trust. Customers who invest with Cowrywise on MoMo can bank on the collective equity and credibility that MoMo and Cowrywise have built over the years. Customers are also covered with a ‘double dose’ of protection. MoMo, a legacy brand, is licensed by the Central Bank of Nigeria as a Payment Service Provider (PSB), and Cowrywise, a wealth-tech business, known for being disruptive, and its emphasis on the security of its customer’s funds, is licensed by the Securities and Exchange Commission (SEC).

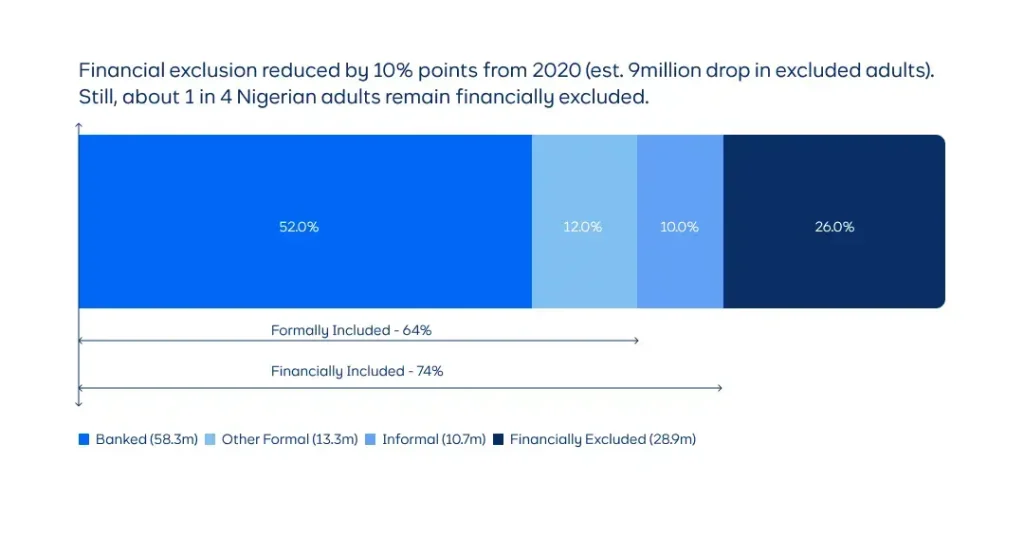

Secondly, and, more importantly, the partnership aims to deepen financial inclusion. The same report shows that 26% of Nigerians are financially excluded, down from 32% in 2020. Progress! However, another 24% do not have regular income to open a bank account, while 46% completely trust payment service providers and mobile money operators respectively – statistical evidence that validates the problem the partnership seeks to solve. With Cowrywise’s investment expertise as a licensed Fund Manager and MoMo’s vast customer network, improved access (via the App, or agent network), increased trust in PSBs and agents, uptake in mobile phone usage (93%), and the low barrier to entry, (customers can starting investing with as little as N1,000), Cowrywise and MoMo are perfectly positioned to deepening financial inclusion and access even further.

Early indications hint at an impressive adoption trajectory for the Cowrywise Mini-app on MoMo – and the potential to unlock much greater value.

The next time you think Y’ello, think about how you can invest and build wealth everywhere you go! It’s no more a metaphor, but a statement rooted in fact.

About MoMo PSB

In a rural village in Eastern Nigeria, Adaeze closes her shop for the day and picks up her purse, which contains the day’s sale proceeds. She proceeds to a mobile money agent and gives him the money. In exchange, the agent transfers the equivalent funds to her mobile wallet. For her, this is safer than keeping cash underneath her mattress where her money is prone to theft or loss.

Tunde lives in Surulere, an urban part of Lagos, where he works as a wholesaler for a bottling company. His sister lives in the opposite part of town and is dependent on him for her needs. She doesn’t have a bank account or a smartphone; so, he sends her a monthly allowance to her mobile wallet. A few minutes later, she walks to a man in a mobile money kiosk to withdraw cash from her wallet. She heads off, with her cash in hand, and walks off to a store to make a purchase.

This is the world of mobile money banking.

MoMo PSB helps Nigerians and Africans (about 50 million people) use their mobile phones to manage their money, turning it into a powerful financial tool. Whether you are an individual or a business, MoMo customers can make purchases, pay bills, send, receive, and affordably save money, closing the financial inclusion gap and ensuring that banking and financial services are within everyone’s grasp.

Now, you can add investing to the list.

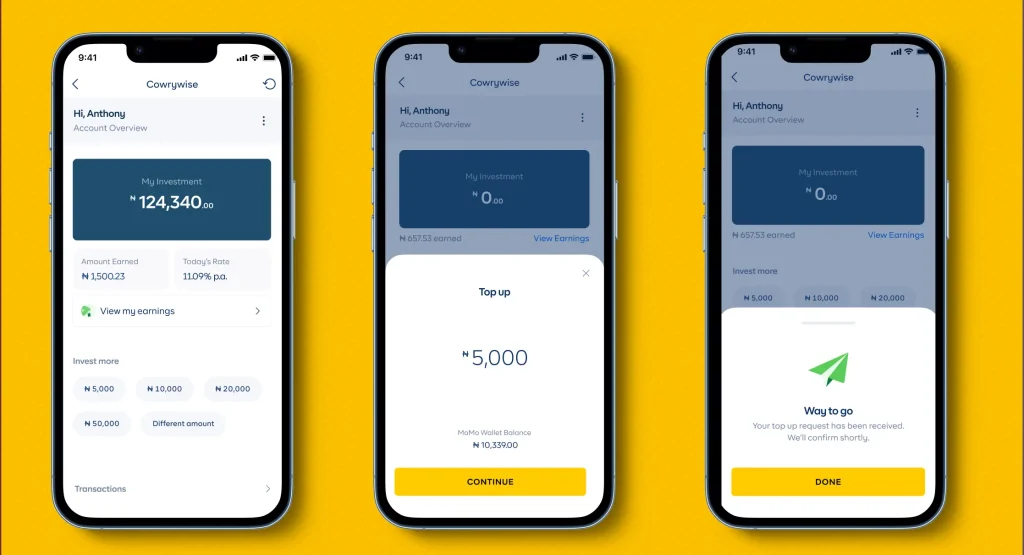

How to invest with Cowrywise on MoMo

You can access the Cowrywise mini-app through the MoMo app.

To invest on the MoMo app

- Launch the MoMo app

- Click on Cowrywise

- Add your NIN

- Invest directly from your MoMo wallet

Note: You have to have an MTN line to access this feature.

What’s next in the effort to get investment opportunities into more hands?

Plans are underway as we continue to expand and take advantage of partnerships of this nature to fulfill our mission. In 2018, we launched with one goal – to make investing as easy as sending a tweet, by democratizing access to investment opportunities.

This is what democratization looks like.

In the future, we will continue to bridge the gap between consumers who have access to investment opportunities and those who don’t. We will continue to reduce the barrier to entry even further and work hand-in-hand with relevant stakeholders to increase financial inclusion in Nigeria.

This is the time to do wealth differently!

New to investing? Invest in your first mutual fund here