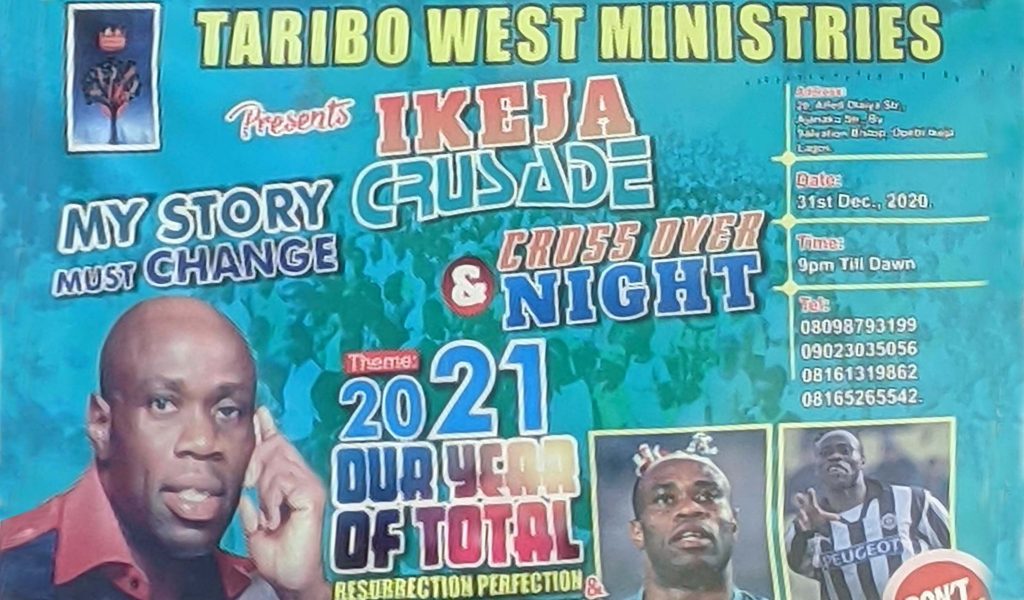

A team member (who does not watch Football or know much about the industry) asked if this image is real. Like our teammate, you also might not have followed Football much. Still, the name “Taribo West” will ring a bell.

This image in itself does not indicate Taribo West’s Net Worth or confirm that he is broke. It, however, definitely shows that unlike retired footballers who may end up as coaches, managers, pundits or businessmen; he ended up on a very different path. Interestingly, the flyer above shows that he still uses his influence as a former player to help get some traction in his ministry.

We often hear stories of former star footballers. Many of whom we expect to be doing much better than they currently are. Like Taribo West, some names might already pop up in your mind right now. Names of stars who truly lived the rich life and now just get by with whatever their hands find.

You might judge and wonder what happened and some of us might have even googled “Why do footballers and musicians go broke?” but this post contains lessons for everyone; famous or not. The earning window for each of us is not lifelong; and for footballers, it is even shorter. At most, they will actively earn between the ages of eighteen and thirty years. After that, they’re faced with the decisions they made while balling – pun intended.

Can These Footballers Go Broke?

Footballers earn a lot during the peak of their careers. For example, Messi’s net worth is estimated to be around £309m ($400m) as of 2020. While Ronaldo’s net worth is estimated at $450 million, that’s about ₦178Billion (₦178,814,475,000 to be exact).

These are the two MVPs in football right now. So it is absurd to even think that they can ever go broke. Granted, Taribo West did not make as much as they did during his time. However, what guarantees continuous prosperity for footballers is not popularity or even influence; it is detailed and calculated moves off the pitch with their finances too.

People assume that retiring from football (or retiring at all) calls for celebration and leads to a life of ease. However, that’s not always the case. They forget that the large sum they make while in the game is meant to last the rest of their lives. Also, footballers retire earlier than the average person, therefore have to be even more strategic in planning their finances for retirement.

The question now is, do footballers effectively plan for retirement by building a positive net worth?

Net worth is the value of the assets a person owns, minus the liabilities they owe.

Positive or Negative Net Worth?

Your net worth is what is left when your liabilities are deducted from assets. Assets provide monetary value, while liabilities are responsibilities or obligations that reduce your resources. Net worth can be negative or positive, depending on if your liabilities outweigh assets and vice versa.

For example, real estate and mutual funds investments are assets that can pay returns year upon year; while luxury cars acquired for personal use are liabilities. The value of a car depreciates once it is driven out of a dealer’s shop. Plus, it will require maintenance over time. Quick tip though: one way to make a car an asset is to use it for ride-hailing services. That way, it sort of earns what it spends. ?

The fact that some footballers will not earn a monthly salary after retirement means that they must ensure that their net worth is positive. Acquiring assets that continue to pay even after retirement is key.

Many footballers earn so much money. If their liabilities, however, pile up to be more than assets, it will result in a struggle-filled retirement.

Rasheed Yekini

Rasheed Yekini was the footballer who got Nigeria her first-ever goal in a World Cup. He, therefore, deserved to have spent the latter part of his life in a more befitting manner. He got a £100,000-a-month contract at Olympiakos in Greece at the peak of his career. So where did all that money go after his career?

And that’s the thing. With a career in football, the question should be where is all that money going DURING your career? Not after. To a large extent, this is what determines a financially fulfilling retirement.

According to this Guardian article, “he was one of the highest-profile Nigerian players to return to the local leagues”. He got back to Nigeria at the age of 39 and things seemed to just spiral down from there.

Rasheed Yekini is said to have been approached by the Nigerian Football Association (now known as The Nigeria Football Federation) in 2010 over an ambassadorial role but refused to come on board. This was considered by some to be his opportunity for a financial comeback, especially because he did not actively build a positive net worth before the end of his career,

So even though Rasheed Yekini was an exceptional striker on the pitch, people cannot say the same concerning his financial status off the pitch.

The thing about saving, investing and building a formidable financial portfolio is that it is no respecter of persons. It only regards principles. So when footballers and musicians go broke, it is often because they did not follow financial principles.

Celestine Babayaro

At the age of 16, Babayaro was already getting the attention that his on-pitch moves deserved. But in 2011 at the age of 33, some news outlets reported that he had become bankrupt.

It was and still is a very big deal to play as a defender or midfielder in the Premier League and Celestine Babayaro did that! For most of his career, he played for Chelsea from 1997 to 2005, and then later for Newcastle United, from 2005 to 2008. That’s not all! He represented Nigeria’s national football team for about 9 years. He was also a part of the Olympics, World Cup and African Cup of Nations squads. Big deal!

The referenced article above stated that he earned £ 25,000 a week at one stage. That’s about ₦13,418,040.42 today. So, where is Babayaro today and what does he do?

In this interview, he debunked being broke but said he currently engages himself in helping “the younger ones grow, giving them advice on how to become successful professionals.” Babayaro also admits to having retired from football too early. When asked about what is next for him career-wise, he did not share definitive answers and said anything could happen.

There’s a lesson here. Future plans should be as crystal clear as possible. So why do footballers and musicians go broke? Some leave their fate to guesswork and that is financially risky. Remember the tweet shared earlier about only retiring based on your net worth?

The decision to retire should be based on one’s positive net worth and not on feelings or emotions. Footballers (and anyone really) should ensure they’ve taken advantage of all opportunities in their careers before retirement.

Musicians Go Broke Too

Rihanna – the same Badgalriri – was left nearly bankrupt in 2009.

She sued her asset management firm, claiming gross mismanagement that led to her overspending and making uninformed financial moves. In a collaborative fund article, they state that her advisor responded with this question “Was it really necessary to tell her that if you spend money on things, you will end up with the things and not the money?”

Of course, many musicians purchase way more things than they should in order to keep up appearances and this contributes to why some go broke after a successful career. However, another reason why musicians make uninformed or poor financial decisions is that they do not employ the services of an Asset Management Firm at all or they employ one that does not truly care about them.

A time comes when a person begins to make so much money that it is almost impossible to handle it themselves. In this case, working with a reputable firm is the smart thing to do and failure to do so will end in tears. Yes, footballers and musicians go broke sometimes because they try to manage their wealth themselves!

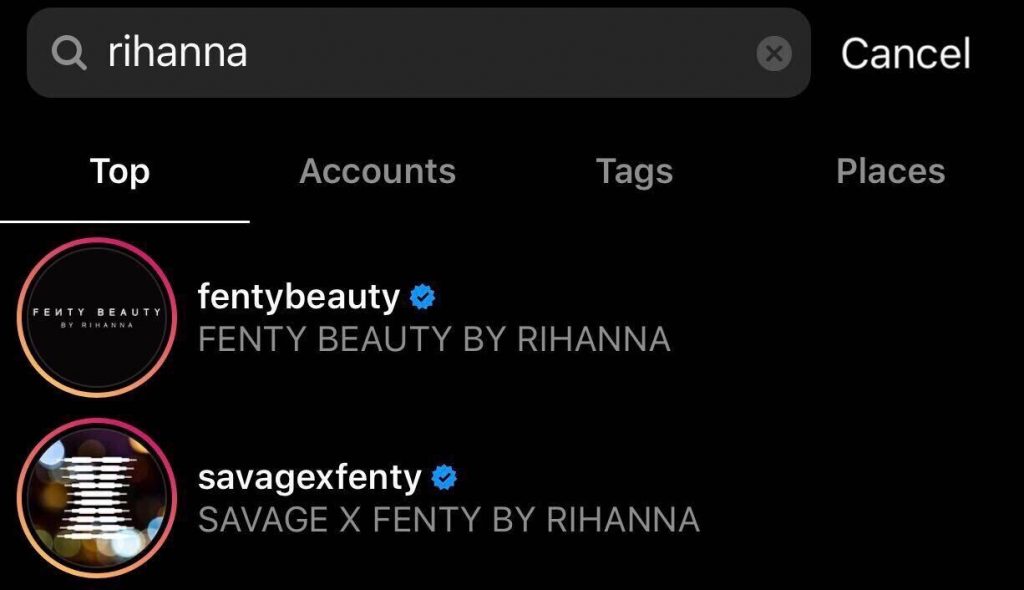

That said, obviously, Rihanna learnt her lesson and has rebuilt her wealth over the years. Last year, she was on the Forbes’ list of richest self-made women in America with a net worth of $600m as a result of her music and cosmetics line.

She has also become so much more strategic that if you search for Rihanna on Instagram, you will find her businesses before you find her.

There’s a lesson here too.

Musicians have so much influence and they can leverage that to build businesses that stand the test of time. Instead of putting all their eggs in one basket, they can diversify and start enterprises that continue to pay them long after they’ve left the stage.

The main thing about wealth is that it should provide people with options and control over their time.

50 Cent

For someone who sang:

? ?

I, I get money, money I got (Yeah, yeah)

Money, money I got, money, money I got (I run New York!)

? ?

50 cent also got some hard financial hits.

According to CNBC, “50 Cent declared bankruptcy days after he was found guilty of releasing a sex tape online in June 2015, for which he was ordered to pay $5M to the victim. The previous year, Jackson (50 Cent) had been ordered to pay $17M to headphone manufacturer Sleek Audio for copying their designs.”

Another reason musicians go broke? Thinking their actions cannot attract certain penalties.

50 Cent was accused of replicating headphone designs and was ordered to pay the headphone makers millions of dollars in 2014.

Granted, famous musicians can get away with a lot more than the average person, but it does not mean that they will get away with everything.

Hard Lessons on Why Footballers and Musicians Go Broke

Plan for retirement – always be asking “What am I doing with my money?”

Employ the services of a trusted Asset Management Consultant to help you. This is so that you can focus on your career, while they focus on what happens to you after.

If your money is spent on liabilities, you’d end up with liabilities that continue to take from you, not assets that have the potential to continuously pay you. You will be tempted to think that you’re wealthy because of flashy and expensive items. However, true wealth is the one that passes the test of time.

Leverage your influence to build partnerships and businesses. Don’t just be a footballer or a musician, be an entrepreneurial football player or musician.

In Conclusion

To be fair, famous people live under so much pressure. There’s societal pressure and there’s peer pressure and none of these is better than the other.

In addition, if everyday people struggle so much with these pressures and even fall victim to the Diderot Effect, how much more those who are famous? There will perhaps be a deeper need for them to upgrade every single thing to suit their status and in the process, bad money decisions will be made.

However, the fact that these pressures exist and that you find yourself surrounded by opportunities to make bad decisions doesn’t mean you have to. It is really sad that some footballers and musicians go broke due to bad decisions but you have a choice. You very likely can leverage the same status that pressures you to act crazy in your favour. Look at how Rihanna turned the tides and leveraged her status and influence to build a thriving business plus boost her net worth.

A blissful retirement doesn’t happen by chance, it is built by being intentional with your finances and making wise money decisions every day. You can start working on yours now with a Cowrywise account.

RELATED

Why Mutual Fund Investing is a Good Idea For Retirement