With as little as NGN1000, through mutual funds, Cowrywise is making it possible for everyone to invest in Nigeria’s most profitable firms.

Eendragt Maakt Magt, that was what the first mutual fund, established in 1774, was called. This name, a Dutch one, translates to “Unity Creates Strength”, and it emphasizes the unique ability of mutual funds to aid the everyday person with accessing premium investment options. However, in Nigeria and most part of Africa, we have not been able to harness this strength due to the lack of inclusivity of mutual funds. The impact of this exclusivity is in two folds:

- More than 400,000 Nigerians have investments in mutual funds.

- The entire mutual fund industry in Nigeria is worth just N1.52 trillion (as of July 2022)

As a team driven by the commitment to democratize access to premium investment products by leveraging technology, we have spent quality time in the past four months working with top asset management firms in Nigeria on a solution that will help tackle the following problems:

- Accessibility

- Manual investment

- Risk assessment

- Limited transparency

- Complex money language

Ultimately, we have built a platform that allows us to give access to investing in mutual funds to everyday Nigerians, thereby providing a credible pipeline to improve retail participation in the Nigerian capital market. Our mission here is to provide access to over 10 million Nigerians by 2025 to build wealth through legitimate and professionally managed investment vehicles and grow the industry’s AUM multiple folds.

We are making Cowrywise the singular source of truth for all mutual funds in Nigeria.

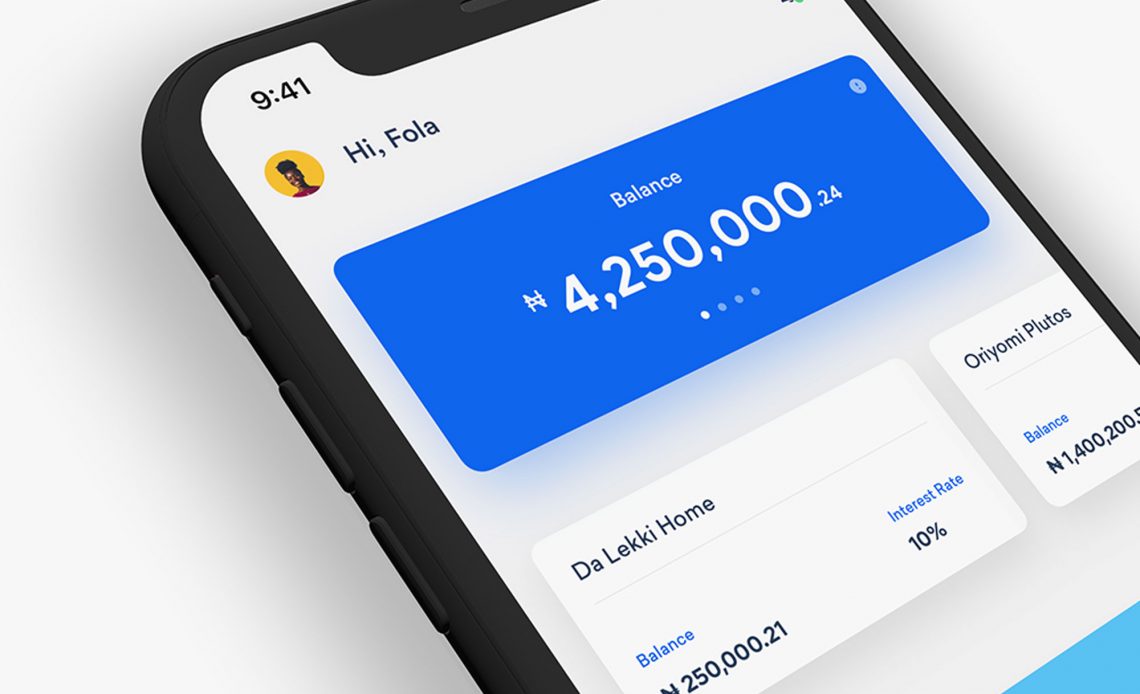

To have access, all you need to do is download or update the Cowrywise app on Play Store or App Store

How do mutual funds work?

Ordinarily, picking assets to invest in is an extreme sport. More often than not, you’ll get your two hands, not just your fingers, burnt. Combining this with the fact that they are not cheap, one can understand why many people stay away from investing in the stock market despite its high-earning potential.

Saving the day, mutual funds make it possible for people with little or no understanding of investment, to pool together their funds for investment in professionally selected assets at a very minimal cost. That way, you get to kill three birds, yes three, with one stone — the complex selection process of assets, high purchase prices, and neck-breaking management fees.

The challenges

Despite the evident benefits of mutual funds, participation, in Nigeria, has not just been low but limited to certain cadres of the society. In context, there are more than 400,000 mutual fund subscribers in Nigeria and the entire value of Nigeria’s mutual funds, hovering just over $2 billion, is equivalent to the value of assets under management for WealthSimple, a Canadian startup. It is safe to say that we have a long way to go.

A BusinessDay article focused on the mutual funds industry by highlighting its opaque nature. This and other challenges, like entry costs, have served as key impediments to (effective) participation.

Our all-new process, which is in line with our promise to democratize access to premium investment options, will be taking these challenges head-on, thereby making it possible for the everyday person in Nigeria to invest in multiple mutual funds right from the comfort of their phones, with as low as NGN1000.

How are we changing the game?

We have partnered with top investment houses like Meristem and Afrinvest to help Nigerians have access to multiple mutual funds all in one app. The mutual funds invest in companies like Dangote Cement, GTBank, Nestle, Total Nigeria and high-quality fixed-income securities. Interestingly, anyone will be able to access these funds transparently with as low as NGN1000.

We are also introducing a Systematic Investment Plan. This plan allows Nigerians to automate investment of fixed amounts into mutual funds over a period of time. This has been proven to be a good strategy for beating the downsides of investing.

Given that there are various types of mutual funds, we have developed a risk assessment algorithm that enables us to recommend a suitable mutual fund that suits your risk profile. Based on the results, we’ll suggest the best-fit funds and allow you to compare them properly before you make a choice. That way, you are not making an isolated or blind choice.

With these unique tweaks to the process of investing in mutual funds, we are on a mission to onboard 10 million new investors by 2025. You still haven’t invested in mutual funds? You have no more excuses, start with us today.

Download the Cowrywise app from Google Play Store or the iOS App Store and start saving and investing, or visit the Cowrywise website.

How has your experience with Cowrywise been so far? Share your story with us here. We want to celebrate you!!!

I’m trying it is not going

I downloaded the app I wanted to register is bringing login which are not register I’ve try my possible best is not going

The app is working very well I have started investing and saving plan thanks cowrywise ,but my problem now is that I don’t know if I can withdraw with my normal bank account

That’s my fear too

what a smart app but am just unable to save 100 nairas on It but still the best.

I don’t actually understand how it’s works

Hey. I don’t knew how to withdraw in to my bank account directly and what i understand majority of us here we have lack of orientation on cowrywise and your have saved me 5000 naira directly from my bank account . Thanks

Yes you can… Just put your main bank account, you’d see it in the settings or so. Let you can withdraw but it will take 24hrs to enter your account