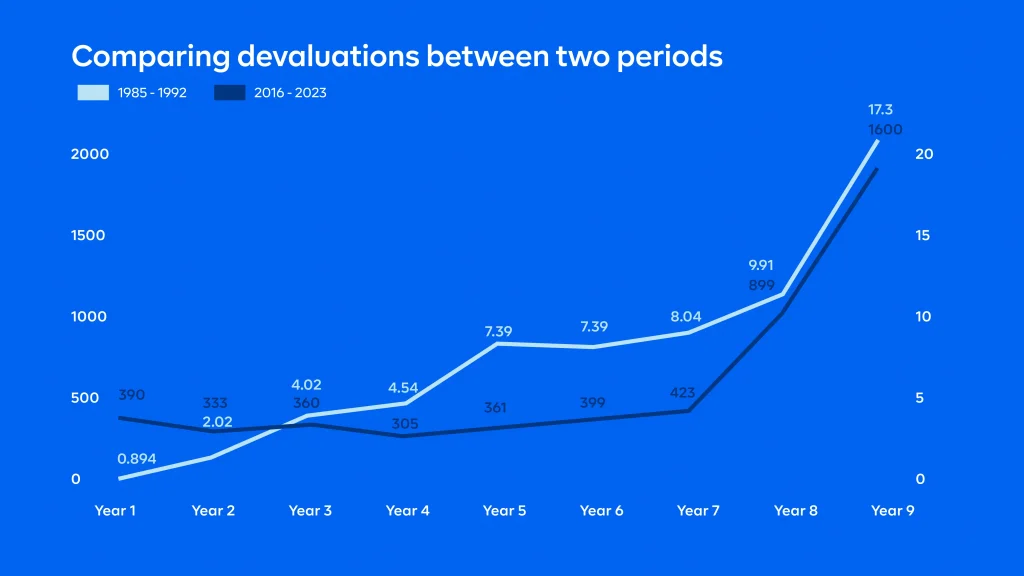

The Nigerian Naira is currently undergoing persisting devaluations and despite what one might be tempted to think, the Nigerian FX crisis didn’t start today. As a matter of fact, the naira has experienced periods of devaluation to varying degrees in the past. Between 2001 and now there have been periods of at least 7 sharp currency devaluations. The period of sharpest devaluation occurred during the Ibrahim Badamasi Babangida era (1985-1993). Within this period, the currency devalued by a factor of 19.4x, from 0.89/$ to 17.3/$.

Source: Wikipedia, CBN

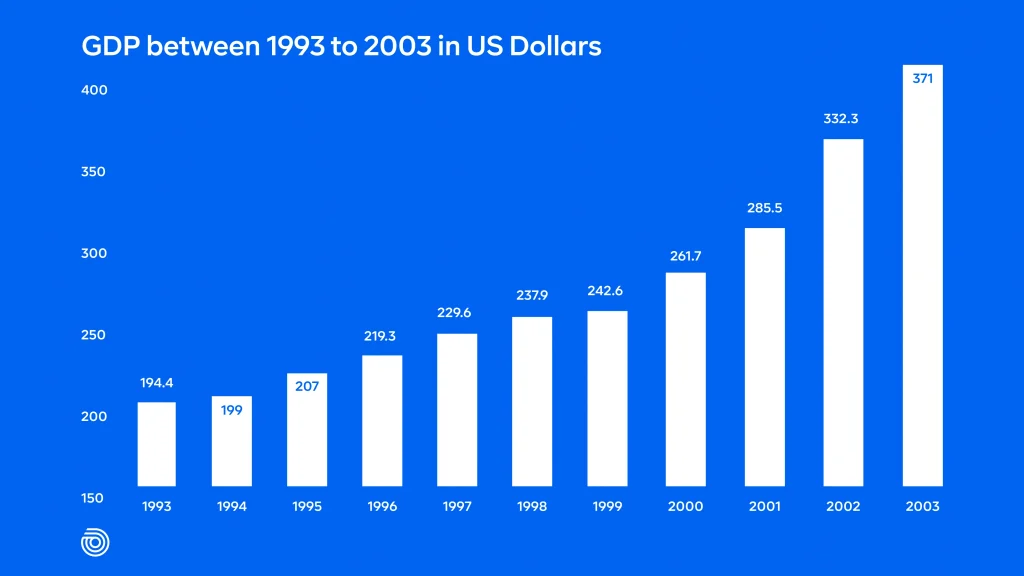

Interestingly, periods of currency weakness have been followed by periods of economic recovery and resilience. After the 1993 era, for example, the economy grew from $194.4 billion to $371 billion in the next decade. Unemployment and inflation also improved within the same time frame. While the current challenges facing the Nigerian currency may seem daunting, there are several reasons to remain optimistic about the future.

Source: Wikipedia, CBN

Firstly, Nigeria’s economy is inherently robust, with diverse sectors such as agriculture, telecommunications, and fintech showing significant growth potential. These sectors have the capacity to drive economic expansion and contribute to foreign exchange earnings, which can help stabilize the currency over time.

Additionally, recent efforts by the Central Bank of Nigeria (CBN) to implement reforms aimed at enhancing the country’s foreign exchange management framework are beginning to yield positive results. The adoption of a flexible exchange rate system and measures to improve liquidity in the foreign exchange market is likely to help ease some of the pressures on the Naira in the long term.

What should you be doing

Despite the positive outlook in the long term, you need to survive in the meantime. Below are some steps you can take to help you survive the current cost of living crisis.

Budgeting and Planning

Having a budget is one way to protect your finances in an inflationary environment, This is because budgeting helps you track your expenses and income and Identify areas where you can cut back or reduce spending. You can also prioritize the purchase of essential items and cut back on non-essential expenses until the financial situation improves.

Buying in bulk

With the price of essential items likely to be higher the next time you buy them buying items in bulk protects you from having to spend more money for the same item and helps you save more in the long run. You will also be able to budget better, as most items are cheaper when purchased in bulk. If you find such purchases to be strenuous for your pocket, find someone with whom you can split the costs.

Invest

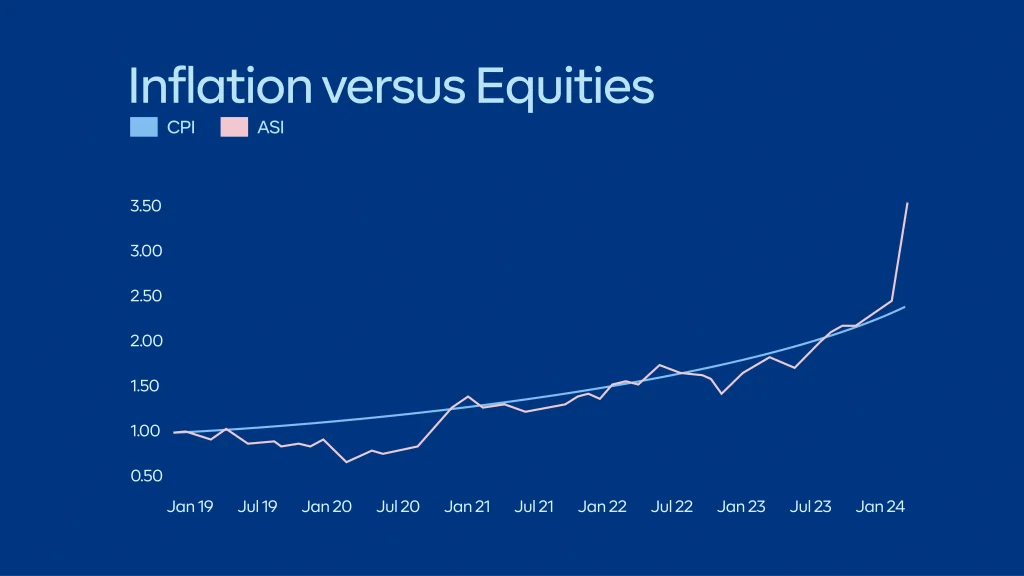

Even though times are hard, saving and investing is one surefire way to protect yourself from unforeseen future events. Failure to plan for unforeseen circumstances could result in undue financial strain when faced with unexpected expenses. Though it might not look like it, there are still ways to make money in this economic landscape. Investing in an inflationary environment might mean increasing your weight in equities as the equities market remains the safest bet against inflation (see chart below). Also, with the volatile exchange rate you might want to consider buying a dollar mutual fund. Don’t leave large amounts of money in the bank for long. Invest and watch your money grow.

Source: NGXASI, NBS

Try diversifying your income.

Even in times of low inflation, there were better ways to structure your finances than putting all your eggs in one basket. This approach can help protect you against the impact of financial challenges because if one source of income is affected, you still have others to fall back on. If you have a job, start thinking of a side hustle.

Stay Positive: Remember that financial crises are temporary, and staying positive and flexible can help you adapt to changing circumstances.