Market slice is a monthly summary of mutual funds on Cowrywise and money news. This jargon-free report is shared on the 3rd of every month.

Hello there ??

This the first market slice report, and I am excited to share it with you. It can be a burden understanding the various moving parts of the investment world, but that is about to change. Every month, the team will scrape through the complex news and I’ll help summarize that into a simple format for you.

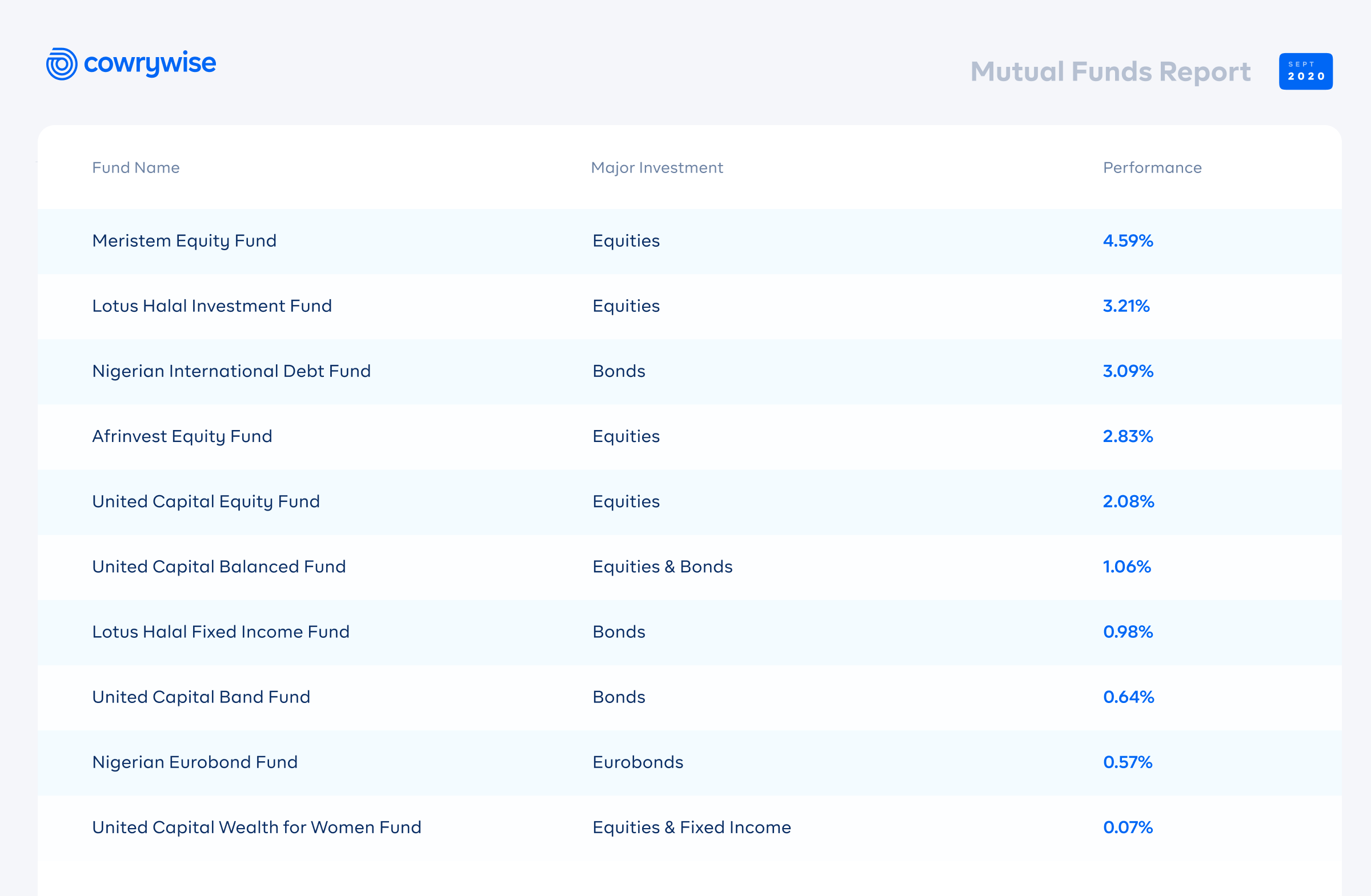

How Mutual Funds Performed in September 2020

The image below showcases the performances of funds. You should share it with your friends. The paragraph after it explains how they are ranked.

? There are three major types of mutual funds:

- Low-risk funds

- Medium-risk funds

- High-risk funds

For a plain English guide on types of funds, please check here. This report, however, focuses on medium and high-risk funds. The performances of these two funds are usually based on price changes. I’ll use an example to explain this. Assume you own 10 units of a mutual fund. If the selling price of each unit was ₦100 on September 1 and ₦105 on September 30, you have gained 5%. That is because ₦5 is 5% of ₦100, and each unit now costs ₦5 extra.

Using the same approach, we examined the sell prices for the units of these funds as of September 1, 2020, and compared them with periods around September 30, 2020. Then, we did some math to show how much the units of each fund gained or lost. If you still do not get this, please drop a comment and I’ll explain. Keep going for some important market news.

? Equities: Dancing to the Bulls

When the stock market performs well–gains money–it is described as a bull and when it loses money, a bear. There’s a story behind this. Now, funds that invest majorly in equities (stocks) are known as equity funds. When the stock market does well, these mutual funds tend to also do well.

The terms “bear” and “bull” are thought to derive from the way in which each animal attacks its opponents. That is, a bull will thrust its horns up into the air, while a bear will swipe down. These actions were then related metaphorically to the movement of a market. If the trend was up, it was considered a bull market. If the trend was down, it was a bear market.- Investopedia

In September 2020, a report described the Nigerian stock market as a contrarian. Globally, stock markets were having a bear party. But the story was different for Nigeria, Kenya and Japan. The Nigerian stock market had a good dance of bulls in September. So much that an equity fund earned as much as 4% in one month.

Bank Interest Rates: Down Again ?

The CBN reduced the MPR (Monetary Policy Rate) in September. Don’t leave me, I’ll explain what that means. Simply, it is the rate at which the Central Bank lends money to your regular banks. Ideally, the higher it is the harder it is for banks to lend out money. The lower it is…(can you complete that?). Great, I knew you were one smart person. So, a reduction is expected to push banks to lend businesses money at cheaper rates.

However, that is not big news. The news is in how this affects returns on a savings account, with your bank. Before that decision, the CBN had also placed the minimum interest rate at 10% of the MPR. In essence, now that the MPR has gone from 12.5% to 11.5%, the minimum interest rate on a savings account is 1.15% per annum (10% of 11.5% is 1.15%).

The Point?

You can trust your bank to be generous and pay better than the minimum (as you would trust snow to fall in Nigeria), or you could check out some mutual funds here.

? Data snap of the month

Over the past 10 years, the cost of furnishing a house has grown by 13.8% on a yearly basis (138% in total). In clear terms, a chair that cost ₦50,000 (10 years ago) might now cost ₦116,000 today. Read our guide on managing household expenses here.

Your favourite advisor,

Ope ?

Thank you ?, Adviser.

You’re welcome, Farouq.