Cowrywise is launching a financial education app for kids called Cowrywise Kids and is partnering with Yellow Cowries to close the financial literacy gap even further.

This is the full story!

Over the past year, Cowrywise has partnered with several high-profile brands to fulfil its mission to democratise access to investment opportunities. We launched a case study with the Lagos Business School earlier in the year, titled “Cracking and Segmenting the Next Million Customers”, a multimedia exposé for business leaders to learn, adopt and execute strategies employed by the Cowrywise leadership team to grow the business into the powerhouse it is today.

We’ve also partnered with the Lagos State Government for Sustainable Development Goals (SDG) to bring financial literacy closer to women in hard-to-reach communities. So far, we have educated 1,525 women across different communities, from Ikorodu to Okokomaiko to Shomolu.

In September, we partnered with Meristem to move the market forward. We launched Stocks by Cowrywise, an investment product to empower more individuals to invest in the Nigerian Capital Market, further reducing the barrier to entry into the Nigerian Stock Exchange. This goes on to show that the right partnerships can disrupt any market, especially when an unstoppable force like Cowrywise meets an unshakable industry player such as Meristem.

Now, Cowrywise is teaming up with Yellow Cowries to tackle yet another fundamental problem with a financial education app for kids – financial literacy.

Understanding the depth of the financial literacy gap

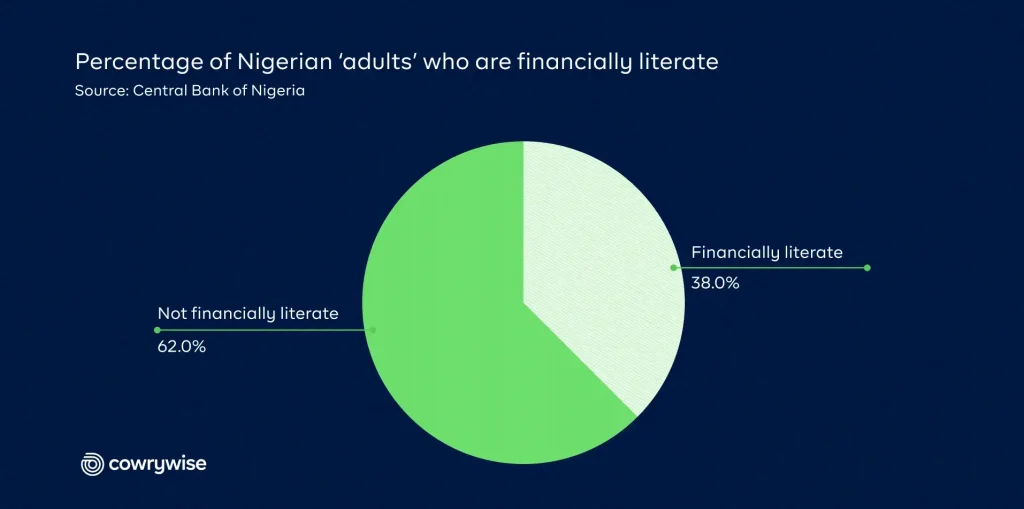

According to Enhancing Financial Inclusion and Access (EFInA)’s 2023 A2F survey, “Nigeria is a country gradually sliding deeper into financial fragility”. With 26% of Nigerians excluded from financial services (down from 32% in 2020), and 62% categorised as financially illiterate, it paints a clear picture of the financial state of affairs of a large number of Nigerians, and its snowball effect on the economy as a whole. “When more people understand money—how to save it, grow it, invest it, or borrow it responsibly—they contribute more effectively to the economy. Financial literacy is not just an individual benefit—it’s a national advantage. It drives wealth creation, reduces inequality, and promotes economic stability”.

Additionally, there is a strong correlation between financial literacy and financial stability, and several studies capture this hypothesis. A study by the Lagos Business School indicates that financial literacy is a strong determinant of financial inclusion and that financial literacy has a significant positive effect on the demand for formal savings products. Another source claims that financial literacy enables informed decisions, helps manage debt, and provides tools for long-term planning. This is a national emergency, as the opportunity cost of low financial literacy and its impact on mass economic participation is great.

This begs the question. With the obvious and clear-cut advantages highlighted above, why is the financial literacy rate in the country so low?

The literacy rate in general is improving, but financial literacy is lagging.

Statista puts the literacy rate in Nigeria at 63.16% as of 2021 – a 1.14% increase from 2018, and a 3.79% increase from 2016 for individuals between 15 years of age and above (with the South-West region taking the largest piece of the literacy pie). Other sources peg the numbers within a similar range. This indicates that the two metrics aren’t moving at a parallel pace.

Our recent survey on the launch of stocks, for example, showed a similar trend, with 59.9% of the respondents admitting to not having enough confidence in their financial knowledge to participate in the stock market. The trend is not unexpected, given the correlating penetration levels in other financial-based factors such as financial health scores, access to formal banking services, etc.

More investments and actionable frameworks are required to execute the needed policies

While there has been increased clamour for literacy in general, the same can’t be said of financial literacy. Cowrywise, for example, is known for its positioning as a champion of financial education. With thousands of financial literacy resources availablee on its website and its continued investment in the Cowrywise Ambassadors Community, Cowrywise has been a major driver of financial literacy since its inception.

The CBN also released a framework for a National Financial Literacy Drive in 2015 – a blueprint for implementing financial literacy for the attainment of financial system stability and as a key component for the implementation of the National Financial Inclusion Strategy.

NIBSS also rolled out a Financial Literacy School Club Empowerment Initiative in commemoration of the 2024 Global Money Week in partnership with the Central Bank of Nigeria (CBN), to sponsor 200 students from the Lagos State Education District 1.

While the investments in driving financial literacy by private and public players are laudable, they are simply not enough. We need more partnerships between the private and public sectors to aggressively close the financial literacy gap even further.

Financial literacy is a critical piece missing from school curricula

Over the past couple of years, there have been drastic changes and reforms in the education sector to empower students to compete on the global stage. There has been an increase in STEM (Science, Technology, Engineering and Mathematics) in Nigerian schools, driven by the government’s recognition of its role in national development and economic growth. In its latest reform, Nigeria has officially added Mandarin (the standard Chinese language) to its senior secondary school curriculum in a nationwide policy decision.

As far back as 2017, the Central Bank of Nigeria (CBN) announced it was working to include Financial Education in school curricula, as part of its effort to promote Financial Literacy in Nigeria, after identifying the lack of consumer sophistication as one of the contributory factors to the financial crises of 2008-2009 that affected the Nigerian Capital Market.

“Subsequently, Nigerian financial literacy framework was developed in conjunction with stakeholders, which recognizes school children and youths as a major target for Financial Education. We also recognize the infusion of Financial Education in the national school curriculum as a primary channel to reaching out to this large group”.

Director, Consumer Protection Department, CBN, Umma Dutse, 2017

An October 2024 report by the Punch revealed that the Central Bank of Nigeria was poised to collaborate with the Nigerian Educational Research and Development Council to integrate financial literacy into the school curriculum for junior and primary schools across the country.

But, from all indications, the financial literacy train has been unable to leave the station for various reasons.

We wrote a similar report on the impact of this gap on students of tertiary institutions. See the full report here.

Is there hope on the horizon?

As of the time of writing this report, neither the 2017 framework nor the aforementioned partnership has yet been adopted. This is a huge miss for one major reason. On one hand, there is a positive correlation between open discussion of finances in a household and higher financial stability. According to the Journal of Economics, Finance and Management Studies, on Financial Literacy and Financial Behaviour in Households, ‘financial literacy is a crucial foundation for healthy family financial management. Higher literacy levels correlate positively with better financial practices (e.g., saving, investing, debt management).

Supporting studies also suggest that incorporating financial education into curricula and providing accessible financial resources lays the groundwork for early financial literacy and responsible financial behaviour, empowering individuals to make informed financial decisions later in life.

On the other hand, kids and young adults who grow up in households where money isn’t discussed are likely to struggle later in life. Take Adedoyin, for example.

Let’s take a look at Adedoyin

Adedoyin works as a social media manager in an advertising agency on the mainland. When she’s not creating content or engaging on Twitter, she’s babysitting Idoreyin, her nephew. At 27, she considers herself a late bloomer, as she just bought her first car and just recently made her first million on a side gig.

She recently came across the Stocks Campaign and invested in several mutual funds, as well as purchased some shares. Although the user experience of the app was great and the educational content was helpful, she wished she knew more about investing.

“Deep down, I wish I had more exposure to financial literacy as a child; I would most likely be better off financially. And I made myself a promise – that Idoreyin will get access to financial education early, so that history will not repeat itself”.

Now, as a Cowrywise customer, Adedoyin will have access to Cowrywise Kids to help her nephew take the right step forward in his financial literacy journey.

Looking ahead

If you have gotten this far, this scenario is quite relatable. You most likely remember a friend, where in their household, the opposite was the case. They were clearly ‘rich’ and talked about money more openly, which sometimes tended to make you feel out of place whenever you visited. The domino effect of this socio-cultural phenomenon has already started to fall, building a society where money isn’t discussed at home, financial education isn’t taught in schools, and the financial literacy rate stands at 38%.

This is why the partnership with Yellow Cowries is extremely crucial.

About Yellow Cowries

Yellow Cowries is a financial health and well-being organisation with a mission to educate and motivate students, young adults, women, and entrepreneurs regarding their financial choices. Formed in 2018, Yellow Cowries employs its cutting-edge gamification and unique tools to bridge these identified financial literacy gaps.

So far, Yellow Cowries has trained over 20,000 students across secondary schools in Lagos and Akwa Ibom state in partnerships with the state governments and NGOs. They currently manage financial literacy clubs in 128 schools in Alimosho, Agege, Lagos Island, Yaba, Ikeja, Okota, and other areas within 4 key districts in Lagos. Financial literacy circles are also running in the University of Lagos, Lagos State University, and the University of Ibadan.

Their Plan-Save-Invest (PSI) curriculum model ensures that learning takes place in a structured and easy-to-understand format. It incorporates diverse methods and approaches, including the establishment of Financial Literacy Clubs and Circles in secondary schools and tertiary institutions, the use of budgeting tools, and the biannual Financial Literacy Brainee Competition.

But their crown jewel is the PSI Card game, and it is one of the core assets of the partnership. The card game existed as a physical game and on the Play Store, managed by the Yellow Cowries team. Cowrywise has reimagined and digitised the card game, building the entire UX and UI from the ground up, making it even more user-friendly and interactive, and injecting it into a larger ‘ed-tech’ ecosystem – Cowrywise Kids.

Introducing Cowrywise Kids

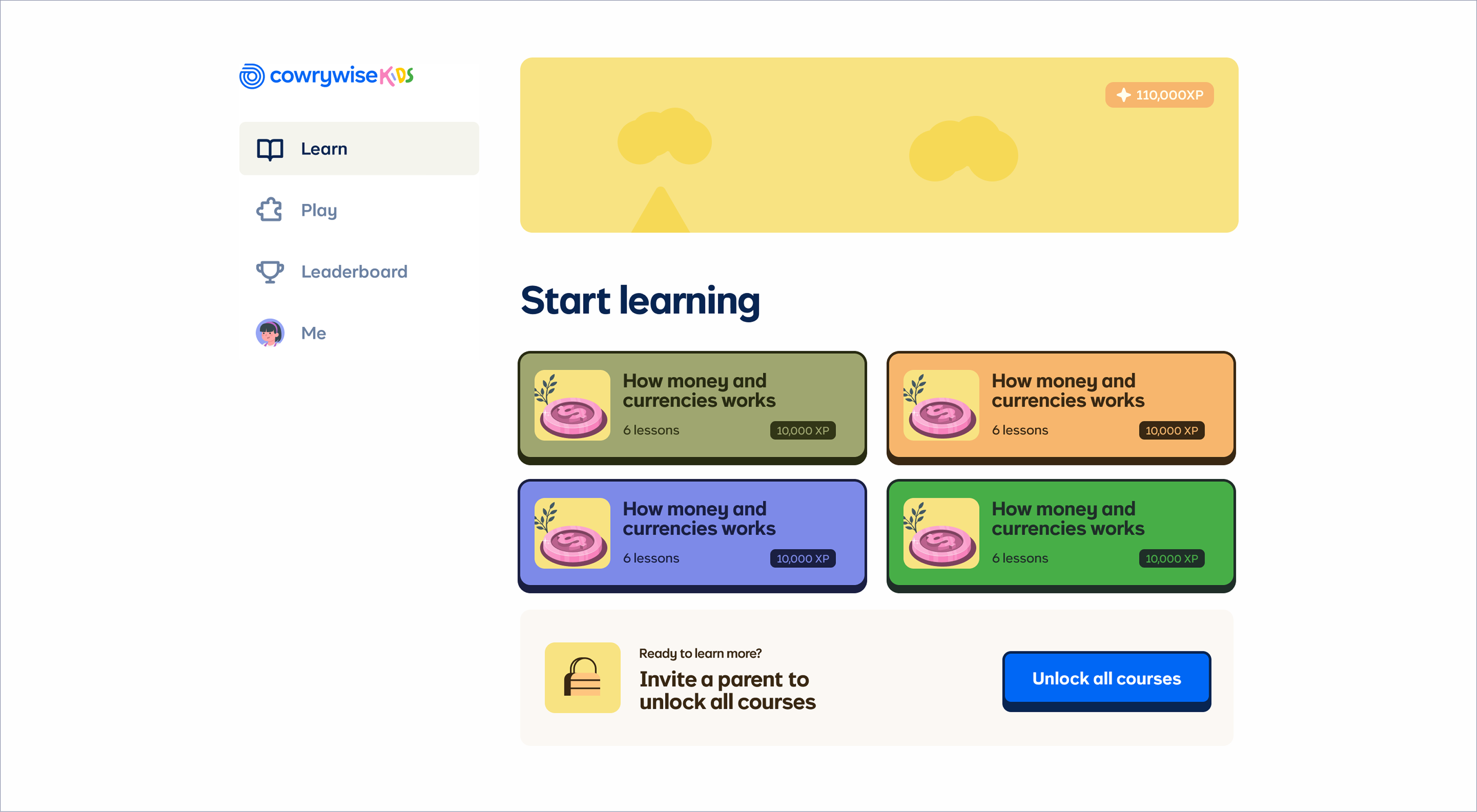

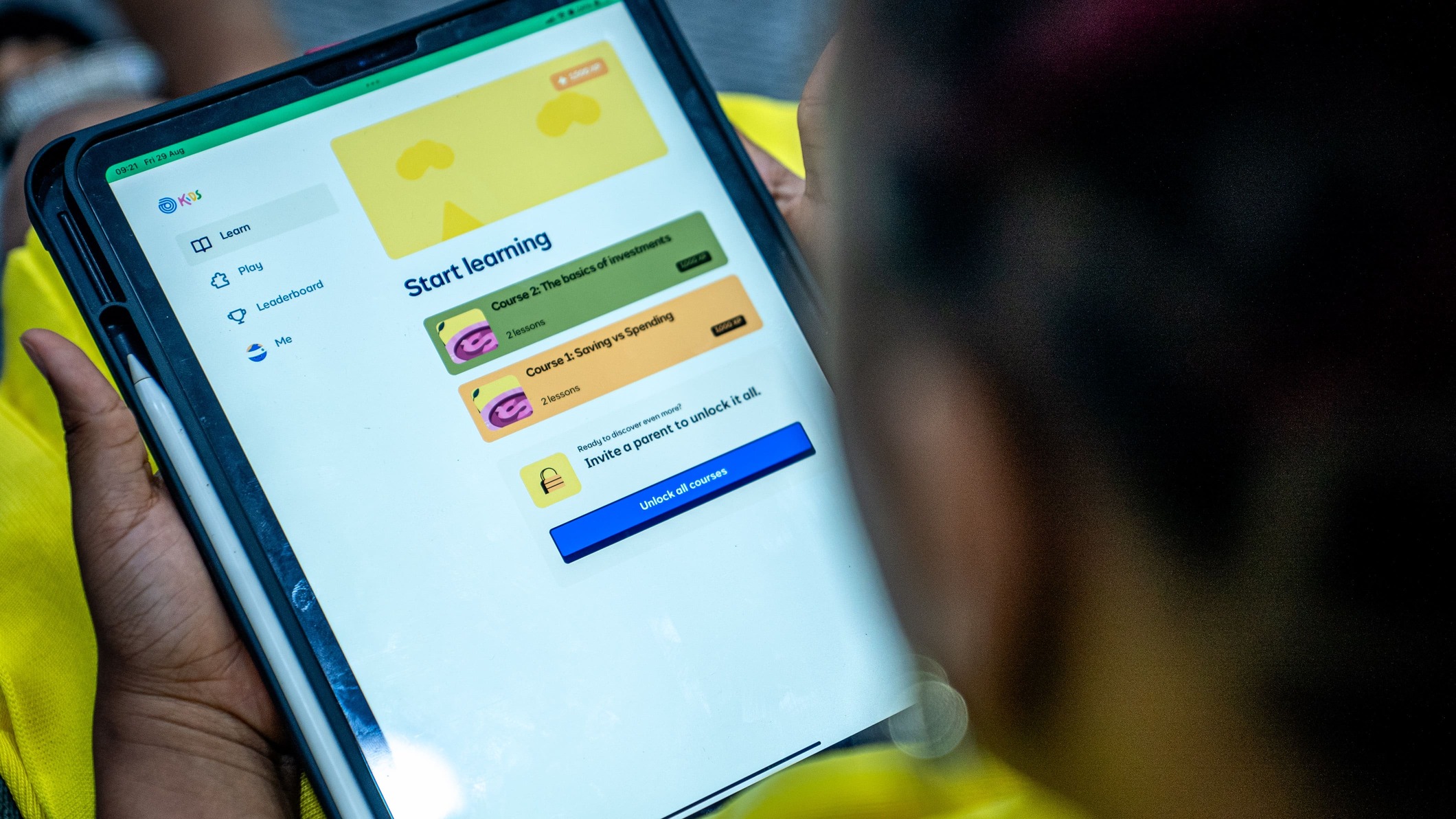

Cowrywise is launching Cowrywise Kids and is partnering with Yellow Cowries to provide access to their PSI card game to a larger audience. Cowrywise Kids is a financial education app for kids, structured in a self-paced learning platform and digital ecosystem built to teach children between 5 and 17 about money, saving, and good financial habits. The Cowrywise Kids ecosystem features two core components: courses and games.

Courses

Each course comprises simple, bite-sized lessons, quizzes, and questionnaires, organised into categories to cater to different age groups. Every lesson is tailor-made to teach children at their current level of understanding. Children can progress as they finish lessons and courses. They can gain XP (experience points) and climb up the leaderboard as they progress through the platform.

Whether it’s after school or during their free time, every lesson they learn helps them grow into confident, money-smart adults.

Games

Yellow Cowries PSI Card Game: It is the core finance game that children won’t find anywhere else! The Yellow Cowries PSI (Plan, Save, Invest) game is a digitised single and multi-player card game designed to teach kids and young adults personal finance.

It’s like a game of ‘Whot’, except in this case, the goal is to spell out specific keywords by swapping or trading cards and answering finance-related questions to assemble the correct order of cards. The engagement necessitates familiarity with money concepts, encouraging children to learn to win.

There are two game modes – children can play competitively against each other and against the computer. Multi-player gameplay is an important part of the dynamic, to encourage participation in children and build a unique blend of cognitive and non-cognitive skills.

Beyond gaining XPs, competitive games nurture vital soft skills such as teamwork, leadership, communication, and emotional regulation—qualities that are essential for success in future.

Here’s how it works

At the start of the game, each player receives a random deck of cards. Every card has three attributes: a letter, a point value, and a word tag. These attributes determine how useful the card is for the most important action of the game: making a word. Players earn points whenever they use their cards to build one of three target words: PLAN, SAVE, or INVEST.

If a player doesn’t have the right letters to form a word, they can take a secondary action: trading a card. This allows them to keep making progress each turn. But trades come with two challenges:

- The opponent must see value in the card being offered and agree to the trade.

- The player offering the trade must correctly answer a financial literacy question to complete the exchange.

If a trade fails or is rejected, players still have one fallback option: swap one of their cards with a random card from the pile. This is a bet that could either move them closer to forming a word or set them back.

The game ends once the draw pile is empty. At that point, each player totals the points from the cards used to make their words. The player with the highest total score wins.

For example, if one player forms INVEST with cards worth 28 points, but their opponent forms PLAN with cards worth 37 points, the second player takes the lead—even though both made a word.

This is why the primary action, making a word, requires careful planning, smart trading, and a bit of risk-taking.

Now, go and play.

Why a gamified finance experience?

The real question is…why not? Kids love games, and what better way to teach them a ‘boring’ subject like finance than to ‘marry’ it with something they love. This is a statement of fact, and there is data to prove it. According to multiple sources;

- 67% of children found gamified courses more motivating than traditional course-delivery methods.

- Businesses with gamified loyalty programs such as virtual badges, points, or exclusive perks witness a 22% increase in customer retention.

- 89% increase in children’s performance via challenge-based, gamified learning compared to lecture-based education.

- Gamification boosts memory and recall by 40%, with children retaining as much as 90% of what they’ve learned.

- 68% of children feel more motivated and engaged when using gamified learning.

- Gamification improved children’s understanding of the curriculum by 75.5% and 89% wanted gamification for other subjects.

The verdict?

The data is a strong indicator that gamification is a critical driver for engagement, memorability, and learning. This is a key strategy and driver for the partnership and is a critical success factor for the adoption of the product and the long-term impact of closing the financial literacy gap.

Other key features on Cowrywise Kids

- Account Creation states: Visitors to kids.cowrywise.com can create an account or profile depending on their status as either parent or child.

- Parental Access: Parents can create profiles for kids that need supervision, and will get notifications and emails capturing their child’s activity and progress.

- Invite parents or fellow children: Depending on the resource/need, visitors can either invite fellow children to play or a parent to unlock additional games and features.

- Profiles: Create a profile for each child to maintain a personalised experience for them

- Avatars: We have provided numerous avatars that parents and children can pick from to match their personality

- XPs: Gain Experience Points (XPs) for the completion of lessons and games on the platform. The more XPs you have, the higher you’ll be on the leaderboard.

- Leaderboards: Serve as a visual representation of your position on the platform

- Nest: Parents with kids between 5 – 17 years, and who have a Nest account (the Cowrywise investment account for kids), will get a prompt to automatically complete the profile creation flow by linking it with their kid’s Nest account.

- Quick Install: Install the app on your device with one tap, so you don’t have to worry about logging in later on.

Here’s how you can join Cowrywise Kids

For Parents

- Go to kids.cowrywise.com

- Tap “Continue as a parent”

- Type in your Cowrywise email

- Enter the code sent to you

- If you have more than one kid, you can create a profile for each of them.

For Children

- Go to kids.cowrywise.com

- Tap “Continue as a child”

- Pick the username we suggest or make your own

- Choose a password

Closing the literacy and wealth gap within one ecosystem

With the addition of Cowrywise Kids, the Cowrywise wealth management ecosystem has come full circle. Cowrywise has created a dynamic and personalised all-in-one investment app to help Nigerians invest based on their lifestyle choices and personal preferences. We now have investment products that fit every stage of life, their lifestyle, and their pocket, enhancing product stickiness and utility.

By building the app at the intersection of lifestyle, accessibility, and income, Nigerians can truly embrace the journey to building lasting wealth.

Parting words

The road to closing the financial literacy gap is still long. Closing the gap will require significant investments and input from both the private and public sectors. Luckily, innovation is our ally. With increasing levels of mobile penetration and access to the internet, it has never been more possible to take financial education to the people who need it the most.

At Cowrywise, our mission is to democratise access to investment opportunities by solidifying meaningful partnerships. With stakeholders such as Yellow Cowries, it is possible to drive real and lasting change for the next generation. As a brand, our mission is sacred, and we consider it a public service to connect Nigerians with the financially stable versions of themselves they want to be in the future.

If you are a parent, create an account for your kids on kids.cowrywise.com. For non-parents, recommend the platform to your nephews, nieces, your neighbour’s kids or even a teacher or school. Nigeria needs more financially literate people, not just for personal gain, but also for the collective good.

Be part of that drive – change someone’s life for the better.