The Nigerian Exchange (NGX) recently indicated the possibility of extending trading hours from the current window of 9:30 AM – 2:30 PM to a longer session: 9:00 AM – 5:00 PM. Understandably, this has elicited a range of reactions from market participants.

At Cowrywise, we believe this could be a welcome development if implemented in a phased and collaborative manner. Below, we outline our views.

Why We Think This Policy Could Be Positive

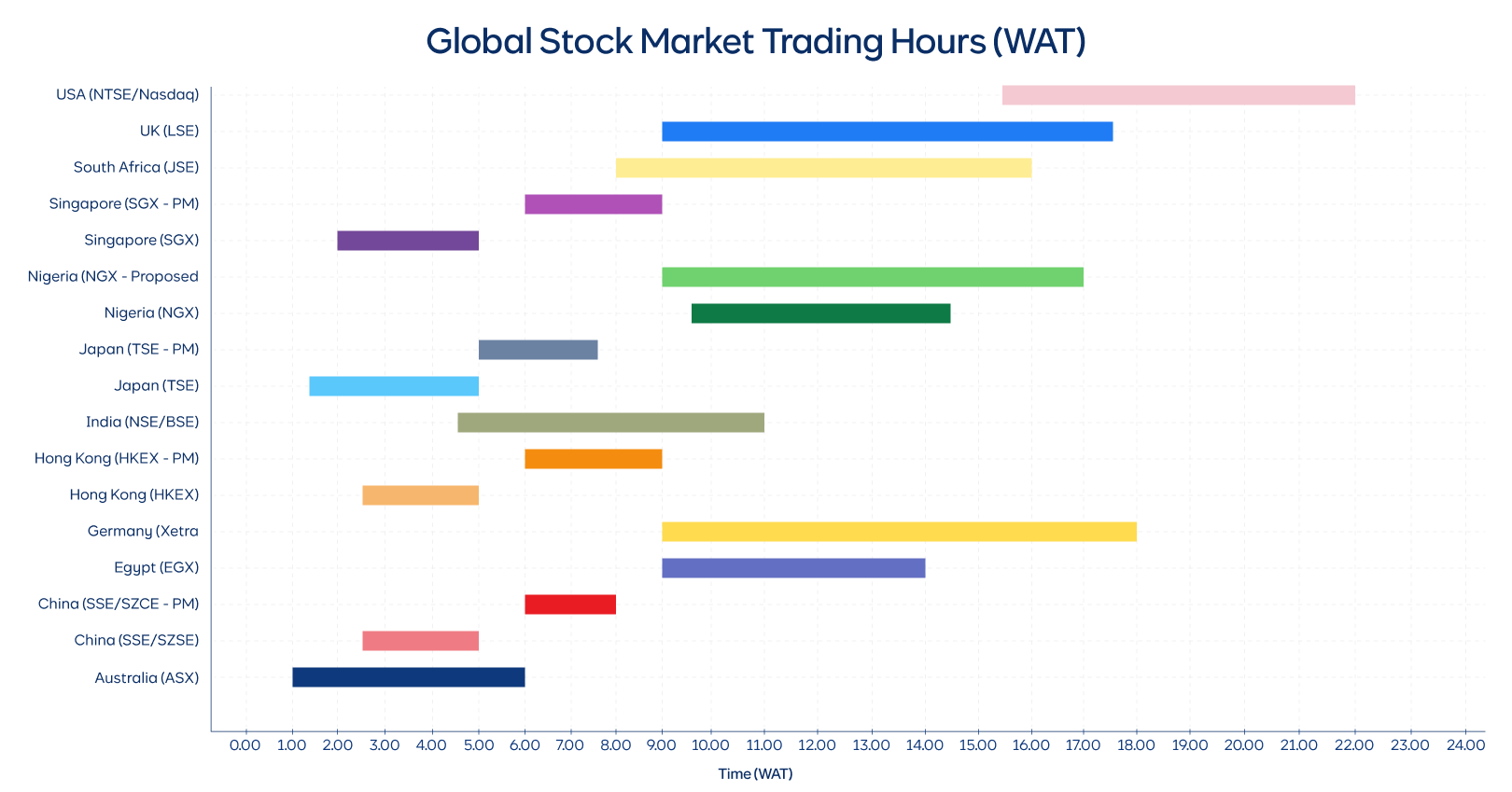

1. Global Overlap & Investor Alignment

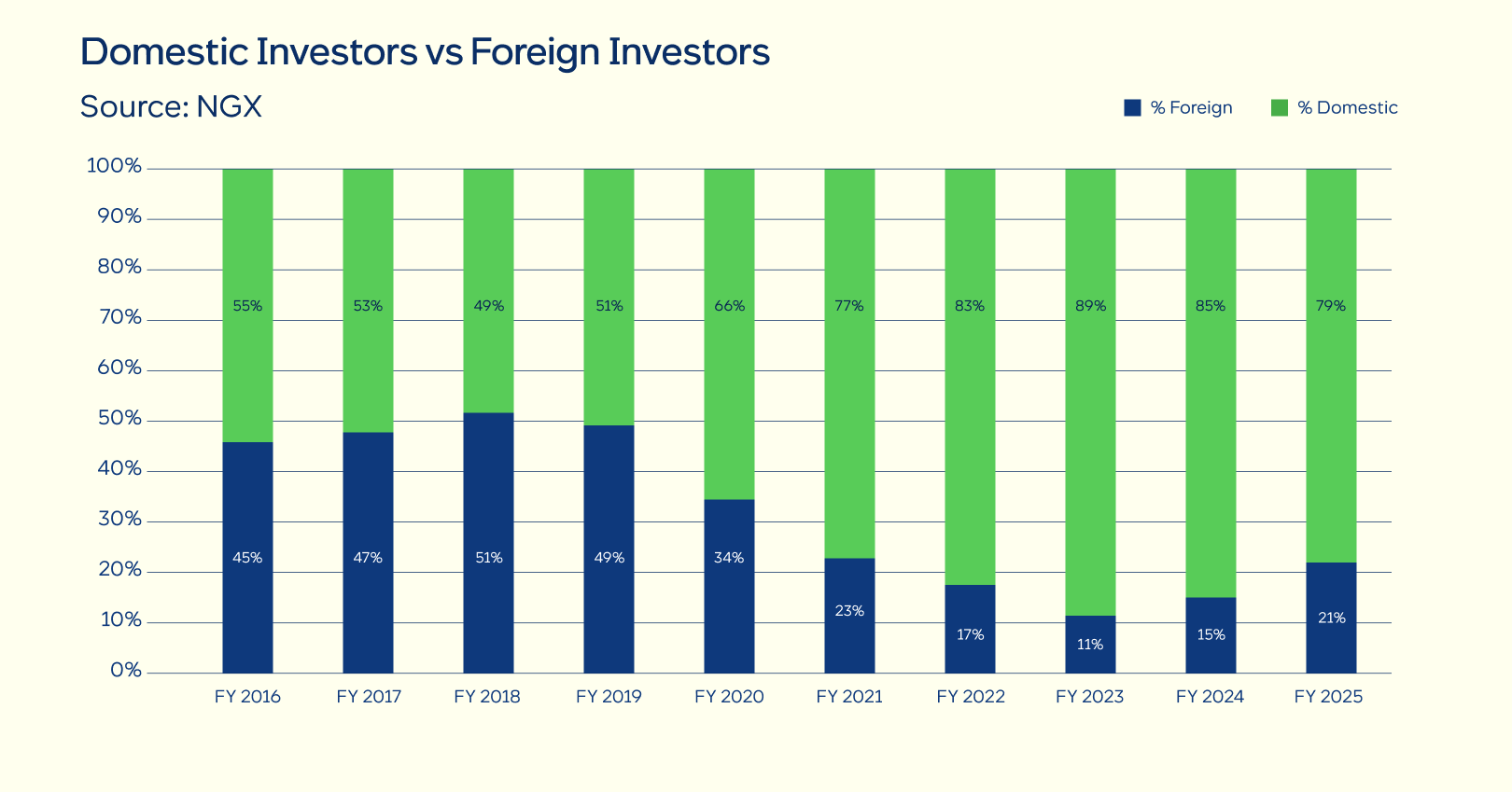

Extending the close to 5:00 PM synchronises Nigeria with the full trading day in London and catches the first 90 minutes of New York’s session (which opens at 3:30 PM Nigerian time). This would allow Nigerian equity prices to react more promptly to global market-moving news and make it easier for foreign investors, who typically work UK/US hours, to engage in our market.

We welcome and acknowledge this as part of broader efforts to enhance foreign investor participation in Nigerian equities.

2. Potential to Double Market Activity

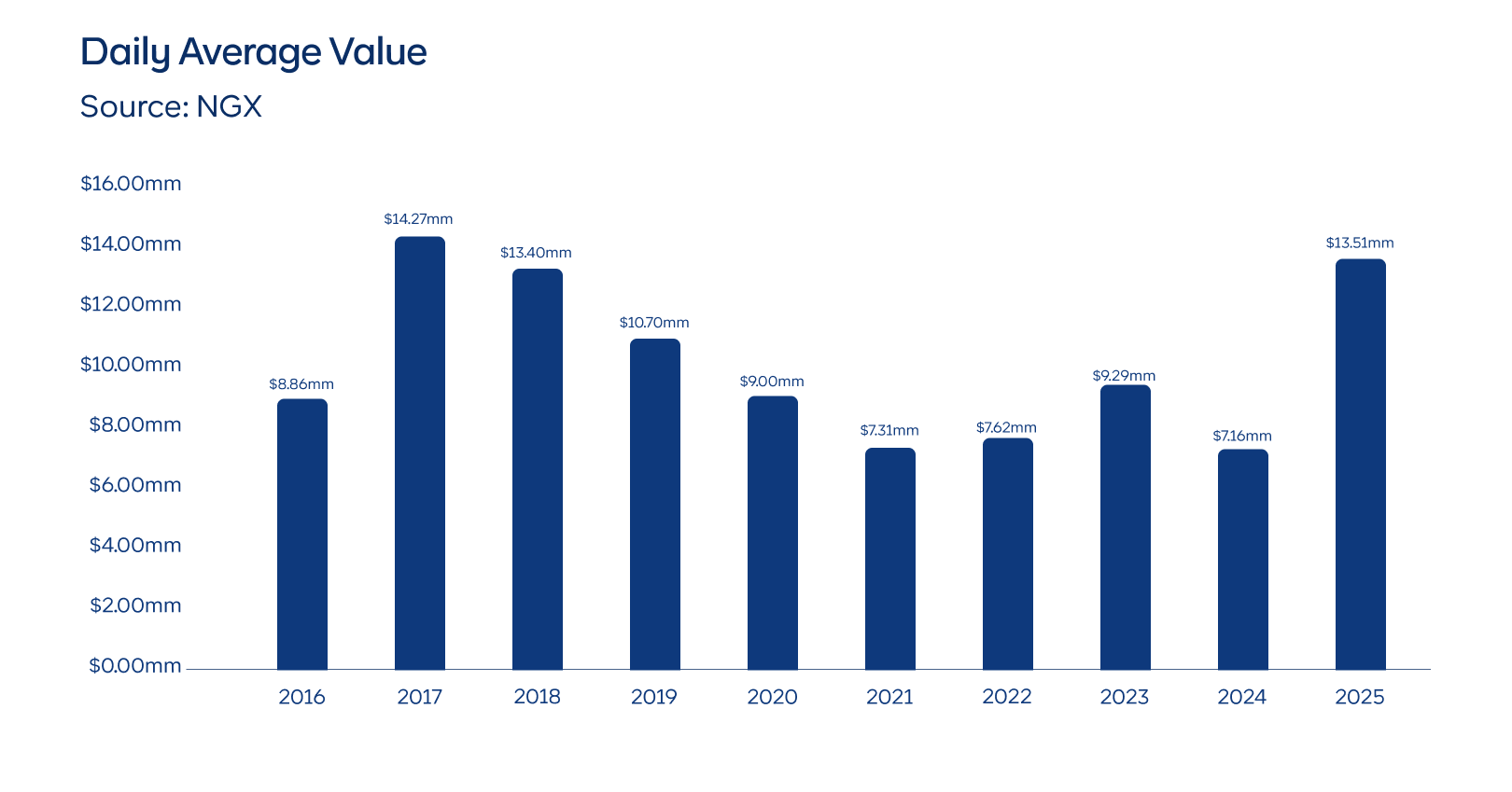

Currently, the daily average trading value is ₦20 billion ($14 million), with foreign investors contributing just 20% (about $3 million). For perspective, in 2014, average daily trading value stood at $33 million, of which foreign investors accounted for $16 million.

If improved infrastructure and policies like extended trading hours help bring back even half of that foreign participation, the Nigerian market could see an additional $13 million (₦19.5 billion) in daily trades – effectively doubling current activity. This would turbocharge the current positive momentum in the market.

3. Improved Liquidity and Price Discovery

Longer trading hours support deeper liquidity and better intraday price discovery, especially around overlapping periods with global markets. Evidence from other exchanges shows that when trading windows expand, volumes rise and price formation becomes more efficient.

4. Sign of a Modern, Global Market

The NGX is already migrating to T+2 settlement by November 28, 2025. Adding extended trading hours aligns with this modernisation drive and sends a strong signal that the Nigerian market is becoming more globally competitive. For context, the Johannesburg Stock Exchange is already exploring 24-hour trading.

Why Some Stakeholders Are Worried

Operational Costs and Readiness

Brokers, custodians, registrars, market-makers, and even the Exchange itself may face increased costs from longer staffing, power, IT, surveillance, and compliance hours. Without operational readiness or the right incentives, some participants may simply “go dark” after 2:30 PM, thereby diluting the objective of the policy.

Our Suggestions

To mitigate these risks:

- The NGX should engage widely with market stakeholders through open consultations.

- A phased rollout may help, starting with select participants or extended hours only on certain days.

- Encourage tech adoption, flexible staffing models, and fee reviews to support longer sessions without overburdening intermediaries.

In conclusion, our view is that the policy represents a step in the right direction, one that could reshape Nigeria’s capital market trajectory. But it must be done in a way that reflects the operational realities of participants and is aligned with broader reforms in market infrastructure.

If executed well, we believe this could be a defining moment for the Nigerian equities market, setting the stage for more liquidity, better price discovery, and renewed global investor confidence.