Bonds are securities where an investor lends money to the government or a corporate body in exchange for interest. However, unlike regular bank loans, bonds don’t involve collateral (except secured bonds), and the repayment terms vary.

Let’s explore what a Bond is in full detail and how it might reward your investment portfolio.

What Are Bonds?

A Bond is a fixed-income instrument. It’s a loan from an investor to a borrower. Bonds are pretty common among government and corporate companies to raise money.

They are often used to fund new projects or ongoing expenses, and in turn, the borrower (government or corporate body) will pay back the investments with an agreed interest rate over a certain period.

Depending on the agreement, maturity dates can range from 1 to 20 years, and the principal is returned at the end.

How do investment bonds work

If a company or government has a project to finance, wants to build infrastructure, or pay off debts, they directly issue bonds to investors.

The borrower sets out the term of the loan, interest payment and maturity date. The interest payment is also known as a coupon, and the interest rate that determines the payment is called the coupon rate.

Bonds are a legal contract between the lender and the borrower. If they default on payment, the lender can seize or sell their assets until they get their principal back.

What is an example of a Bond?

Suppose the government decides to borrow N1 billion to finance the construction of a new highway but can’t be funded by a bank. The government may choose to raise the money by selling 1 billion naira worth of bonds to investors.

Each of them can have a face value of N1,000,000 meaning the government is selling a total of 1,000 bonds – under the agreement, for instance, that the government promises to pay the lenders (investors) 5% interest per year for five years, with interest paid twice a year.

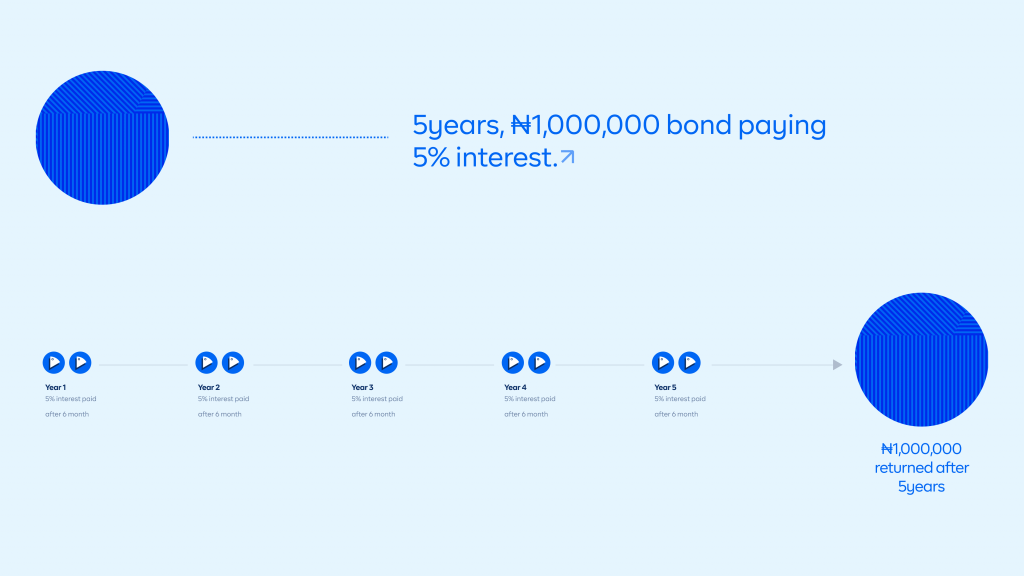

For example, you might buy a 5-year, N1,000,000 bond paying 5% interest. The government, in exchange, will promise to pay you interest on that N1,000,000 every six months and then return your N1,000,000 after five years.

Types of Bonds

1. Bond Fund

Bond funds are also called Bond ETFs. This is when different bonds are packaged into one type of fund. They may contain hundreds or thousands of different kinds of funds like corporate funds, junk funds etc. and can be purchased conveniently in one bond holding. They are low risk but usually have higher management fees.

2. Corporate Funds

Companies issue them if they are looking to expand. Companies prefer bonds to loans because they offer lower interests rate and more favourable conditions. Companies are, however, susceptible to bankruptcy, so the yields are fairly higher.

3. Government Bonds

This is where money is loaned to a government for an interest rate. They are issued by local, state or federal governments and have lower yields because they are more financially stable and less prone to risks.

4. Municipal Bonds

These are issued when a city or a town wants to raise money for public projects like hospitals, roads, parks etc., the interest earned from municipal bonds is tax-free. There are two types – General obligation bonds, which are used to fund projects that don’t generate income, and Revenue bonds which could be paid back by collecting toll fees on a newly constructed highway.

5. Junk Bonds

They are a type of high-yield corporate bond that is rated below investment grade. While they offer higher yields, junk bonds are named junk because of their higher default risk compared to the other types. As a result, they are usually not the best for low-risk investors.

Tips for Investing in Bonds

Before investing in bonds, you should:

Understand Risk Tolerance

As with every kind of investment, you should know your risk level. Are you the type of person that’s comfortable losing money as much as they earn? Avoid investing solely in yield because Bonds with a lower credit rating mainly offer a higher yield to compensate for higher levels of risk.

Know the bond’s rating

Credit agencies offer different ratings to different bonds; this can help the investors weigh the bond issuer’s financial strength. The agencies often use different grading systems to compare risk – AAA is the highest rating, and there are others like AA+ up to D+. A low rating means more risk of the bond defaulting but remember the agencies may not always be accurate, so do your extensive research.

Keep Track of Maturity Dates

When investing in bonds, be mindful of the maturity date. Although the maturity date is when your investments will be repaid to you, know how long your investments will be tied up in a bond before deciding.

Benefits of Investing in Bonds

Capital preservation and income generation are good reasons to consider when investing in bonds.

As an investor, they might be an excellent way to preserve your money while also generating interest.

They are seen as a less risky alternative to stocks and a great way to diversify a portfolio because they are more predictable; it does not mean they are not prone to risks.

One of the biggest and most common risks is when the issuer does not pay back the principal at the agreed time, this is known as default risk.

The higher risk also depends on how financially stable the issuer is. Government bonds tend to be more stable than companies because a company can easily declare bankruptcy.

How to Invest in Bonds

Bonds are not publicly traded, so it might be not easy to know when you’re not paying a fair price as an investor. You can purchase individual bonds from a broker through brokerage accounts, you can also purchase government bonds from an online broker, or directly from an issuing government.

Bottom Line

Bonds are generally seen as a better option in that there’s a way to get back your principal when there’s a default, unlike other stock options. They are less volatile than stocks and are best for low-risk investors. However, expert investors diversify portfolios with stocks and bonds as they grow.

Before investing, it’s advisable to compare ratings. When considering a particular bond, be sure to research about it and the borrower and know its risks before deciding to invest.

RELATED

Very Educative

Glad you learned something, Simon.

Do you have these options on cowrywise app?

Yes, some of our mutual funds have bonds in their mix. Check out the available mutual funds here: https://cowrywise.com/mutual-funds and tap “Learn More” to see their individual fund composition.