Though it might not feel like it now, Nigeria has witnessed a significant transformation in its economic landscape between 2000 and now. New sectors like the budding fintech industry have sprung up. Seemingly transient sectors, like telecommunications and banking & finance, have moved from being almost non-existent to contributing significantly to economic growth.

This economic transformation has birthed a new generation of High Net Worth Individuals (HNIs). These individuals are not following traditional paths to wealth but are pioneering innovative approaches to prosperity. As the economy evolves, Nigeria’s next HNIs are emerging as key players in driving growth, innovation, and socio-economic development.

This report seeks to delve into the unique characteristics, aspirations, and driving forces behind Nigeria’s next generation of HNIs. From the rise of tech-savvy entrepreneurs to the influence of global connectivity and

changing socio-economic dynamics, we aim to uncover the factors shaping the trajectory of this dynamic group.

Keep reading for the full report or hit download to get a copy.

Who is an HNI?

A High Net Worth Individual (HNI) is typically defined as someone with a relatively high level of wealth. While there isn’t a universal threshold for HNI status, it often refers to individuals with assets above a certain amount. According to the SEC, an HNI is an individual whose aggregate net worth of investment assets exceeds 100 million Naira. However, on a global scale, the benchmark for an HNI is someone with assets worth over $1 million. From an earnings perspective, to be in the top 1% of Nigerians, you need a monthly earning of ₦4.02 million. Surprisingly, a monthly earning of ₦870,032 puts you in the top 10% of Nigerian earners.

Fig.1: 2024 income distribution in Nigeria

Source: Dataphyte income inequality (adjusted for inflation)

Irrespective of how you choose to define them, Nigeria’s HNIs play a significant role in shaping the country’s economic landscape. More often than not, they are captains of industries, employers of labour, drivers of innovation and influential figures across various sectors.

The current landscape of HNIs in Nigeria

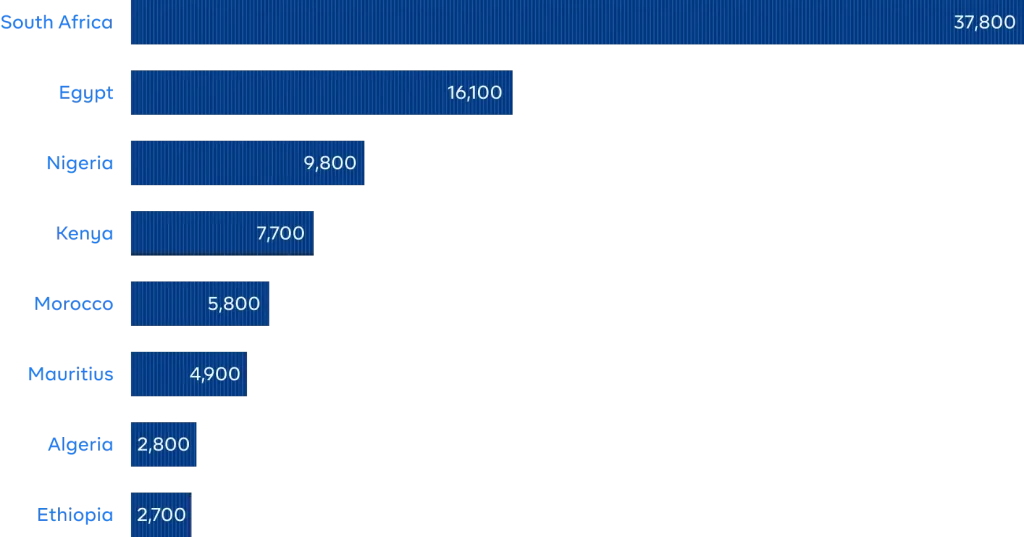

According to Statista, Nigeria has the third highest number of HNIs in Africa with a total of 9,800 people worth over $1 million. Nigerian HNIs come from diverse backgrounds and industries, including finance, real estate, telecommunications, technology, entertainment and infrastructure.

Fig.2: Number of HNIs in some African countries

Source: Statista

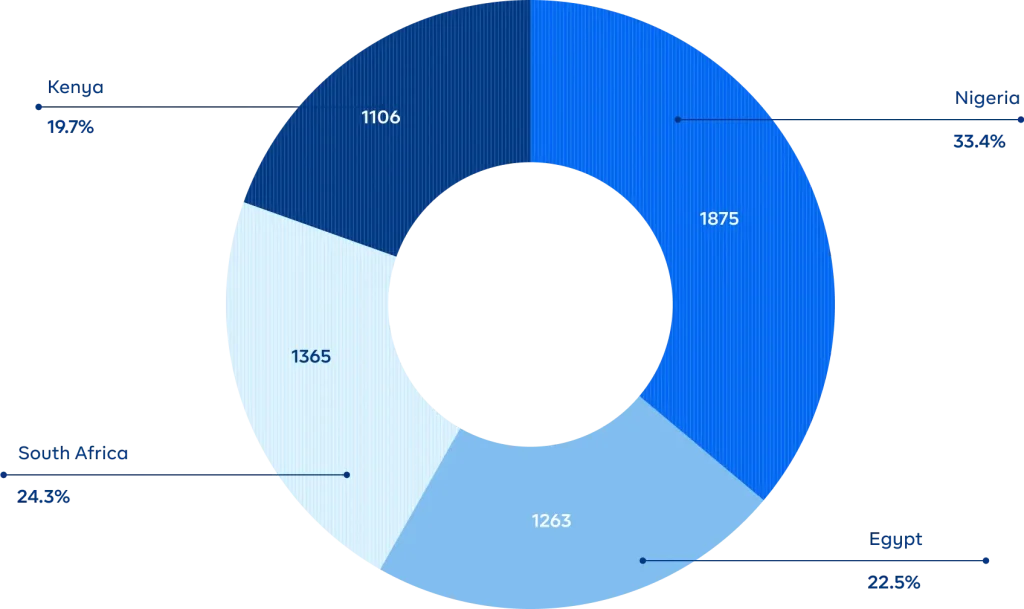

In recent times, however, there has been a surge in the number of tech-savvy entrepreneurs among Nigerian HNIs. These individuals have leveraged digital platforms such as e-commerce, fintech, and other technology-driven ventures to build successful businesses and create wealth. Over the last decade, fintech firms have been attracting funding from investors across the globe. Between 2019 and 2023, Nigerian fintech firms attracted over $1.5 billion in funding.

Fig.3: Fintech funding in major African countries in $billions

Who are the next generation of HNIs?

As you must have guessed, Nigeria’s next generation of HNIs are not octogenarians. Many of these individuals are young professionals or entrepreneurs who have achieved or are in the process of building success for themselves within and outside Nigeria. As anyone who has done business in Nigeria already knows, resilience and resourcefulness are minimum requirements for successful entrepreneurship and these men and women are in the process of developing themselves for the next phase of their lives. The strong emphasis on education in Nigerian culture also means that a significant proportion of Nigeria’s next generation of HNIs have obtained higher education degrees from prestigious higher institutions of learning, both within Nigeria and abroad. Even with the “Japa” wave going strong, a large portion of Nigeria’s educated youths still remain within the country.

When it comes to booming businesses, this generation of educated and hardworking problem solvers who are very tech-savvy are very much open to leveraging digital tools and platforms to drive their businesses and investments. This could explain the dominance of Nigerian founders in the African fintech ecosystem.

However, not all of Nigeria’s next generation of HNIs are likely to be tech founders. Some are likely to be characterized by diverse career trajectories, including entrepreneurship, corporate leadership, finance, technology, and professional services.

Other sectors like logistics & transportation, healthcare & pharmaceuticals, and entertainment are also experiencing significant growth. The budding entertainment industry in particular is experiencing exponential growth and global recognition. Nigeria is fast becoming a hub for music, film, television, and digital content production. These industries are attracting investments and global partnerships on a large scale, contributing to wealth creation, cultural export, and economic growth.

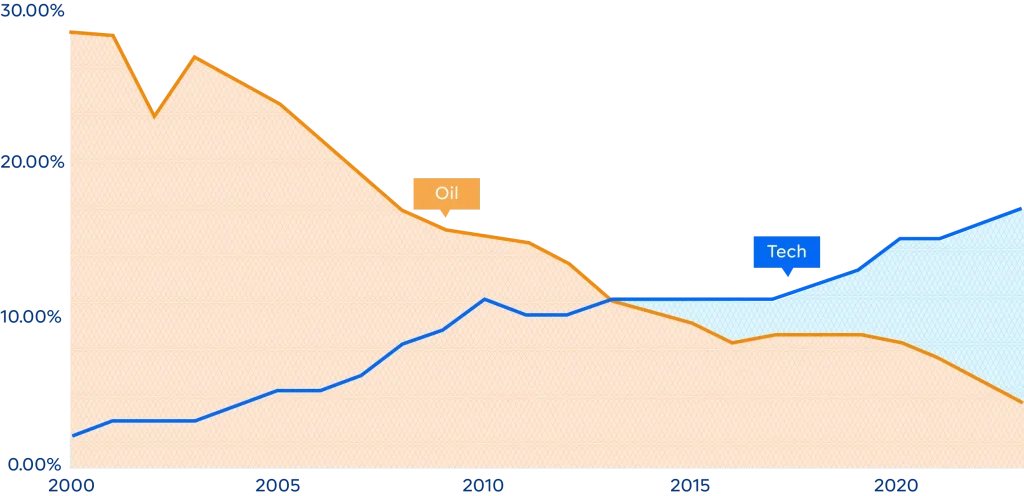

Tech is the new oil

The ICT sector has grown significantly over the past few years and is now a major contributor to the economy. Specifically, the sector has grown from accounting for only 2% of GDP in 2000 to 17.3% in 2023. This is even more than the infamous oil & gas industry which accounted for 5.8% of GDP in 2023.

This has been driven by Nigeria’s youthful demography which is characterized by a large proportion of tech-savvy young people with a never-ending appetite for tech-centric products, tech entrepreneurship, fintech innovation and e-commerce expansion.

Figure 4: ICT and Oil contribution to GDP

Source: CBN, NBS

This growth of Nigeria’s ICT sector is likely to continue in the coming years. This growth will be driven by ongoing technological advancements and the increasing integration of digital technologies into the economy.

Agricultural sector to remain relevant

With a large population to feed, the Agricultural sector is likely to remain a critical component of Nigeria’s economy, offering immense opportunities for investment, innovation, and wealth creation, especially for the next generation of HNIs. As Nigeria continues to grapple with the challenge of food security and sustainable agricultural development,

the agricultural sector stands as a key driver of economic growth, job creation, and poverty alleviation. These guys recognize the importance of value chain integration in the agricultural sector, from production to processing, distribution, and marketing. Investing in integrated agribusinesses that control multiple stages of the value chain allows HNIs to capture value, mitigate risks, and create synergies across different agricultural activities.

Despite the security challenges, we continue to see success stories in the agricultural sector with companies like Reel Fruit and Tomato Jos already showing proof of concept. Going forward, the agricultural sector is likely to remain relevant to Nigeria’s next generation of HNIs as a source of investment opportunities, entrepreneurship, and social impact.

Every country needs a manufacturing sector

The still nascent manufacturing industry is a sector that the next generation of HNIs might find attractive. As the largest economy in Africa, Nigeria has a diverse manufacturing base that spans various industries. This includes food and beverages, textiles and apparel, chemicals, pharmaceuticals, and automotive manufacturing. This sector presents

significant opportunities for investment, entrepreneurship, and wealth creation.

The currency weakness witnessed and the government’s focus on import substitution means that manufacturers can help reduce reliance on imports and strengthen Nigeria’s industrial base. Next-generation HNIs can invest and invest in import substitution industries, such as food processing, consumer goods manufacturing, and industrial machinery production, to meet domestic demand and reduce import dependency.

Nigeria’s manufacturing sector also offers opportunities for export-oriented industries to tap into regional and global markets. By investing in integrated manufacturing value chains, from raw material sourcing to production, distribution, and marketing, businesses can control quality, reduce costs, and optimize supply chain efficiency, resulting in higher profitability and sustainable growth.

In the automotive industry, we have companies like Nord and IVM who are already paving the way for future players. This trend is likely to continue in the automotive sector and other arms of the manufacturing industry.

The journey is not without challenges

As Nigeria’s economy continues to evolve and expand, driven by the ambitions and aspirations of entrepreneurs, several challenges pose obstacles to the HNI’s aspirations for wealth creation, entrepreneurship, and economic empowerment. These challenges underscore the critical need for proactive measures to ensure the sustainable growth and prosperity of the country. Some of them are listed below.

Infrastructure deficit: Nigeria’s infrastructure deficit, including inadequate transportation networks, unreliable power supply, and limited access to broadband internet hampers economic growth and investment opportunities for HNIs. Particularly, the lack of infrastructure increases operational costs, hinders business expansion, and reduces the competitiveness of Nigerian industries.

Security concerns: Persistent security challenges, threaten the safety and stability of Nigeria’s investment environment. HNIs face risks to their personal safety, and business operations, in regions affected by instability. This instability undermines confidence and hampers economic development.

Access to finance: Limited access to affordable financing options, including bank credit, venture capital, and private equity, constrains the growth and expansion of HNI businesses in Nigeria. The high cost of borrowing, stringent collateral requirements, and lack of tailored financial products for SMEs impede entrepreneurial ventures and inhibit job creation and economic growth.

Skills shortages and talent gap: Nigeria’s education system faces challenges in producing a skilled workforce that meets the demands of the modern economy. HNIs encounter difficulties in recruiting and retaining qualified professionals with specialized skills, particularly in STEM fields, which undermines innovation, productivity, and

competitiveness in key sectors. The lack of financial education is also a barrier to entrepreneurship as many business owners are not familiar with the inner workings of the capital market or even the brochure of services available at a deposit money bank.

Market volatility and economic instability: Nigeria’s economy is susceptible to external shocks, commodity price fluctuations, and currency volatility, which poses risks to HNI investment portfolios and wealth preservation strategies. Secondly, Economic instability, including inflationary pressures, exchange rate depreciation, and fiscal deficits, erodes purchasing power and reduces investor confidence in the Nigerian market.

Social inequality and poverty: Nigeria’s high income inequality, and social disparities present challenges for HNIs seeking sustainable economic development. Addressing poverty, unemployment, and social exclusion requires efforts from the government, businesses, and civil society to promote inclusive growth and equitable opportunities for Nigerians.

Government policy could be a key

Though the road ahead looks promising, unlocking the full potential of various sectors and industries hinges greatly on government policy. Government policy is key to unlocking the full potential of various sectors and industries, including manufacturing, agriculture and technology. The government could for example provide investment incentives to encourage the allocation of capital towards strategic sectors that contribute to economic growth and development. By the same token, regulatory reforms can also reduce bureaucratic red tape, and improve the ease of doing business.

Secondly, government policies that facilitate public-private partnerships (PPPs) can leverage private sector expertise and capital to address infrastructural gaps. Next-generation HNIs may participate in PPP projects that offer attractive returns. They can also contribute to the socio-economic development of communities and regions. Steps also need to be taken to ensure the development and sustainability of the capital market. This is to make fundraising a seamless process for entrepreneurs.

Why Cowrywise?

At Cowrywise, we are in the business of digitizing wealth-building for Africans. We are building a savings and investment culture among the growing population of underserved Africans. This is to help them in their journey to HNI status.

We offer a host of well-diversified mutual funds to protect you from market volatility and economic instability. Recognizing the digital-native nature of the next generation of entrepreneurs, we prioritize digital channels for wealth management.

We also offer personalized financial planning services tailored to your unique needs, goals, and preferences to help build wealth that your future self would be proud of.

Understanding the importance of financial education, we invest in providing high-quality thought leadership content and research reports on relevant topics.

We are reachable on social media platforms where we maintain transparent communication with our clients. We also provide regular updates and insights into investment strategies and market trends.

Don’t have a Cowrywise account yet? you can start building wealth that lasts here.

Well done, Kayode. This piece is very comprehensive and aptly captures the challenges against the country’s economic prosperity. I know all hands must be on deck to address these challenges, particularly through PPP, however, the government needs to work purposefully to create the enabling environment for businesses to thrive from ideation to market entry and beyond. This I believe they can do by increasing transparency in government’s dealing to boost citizens as well as investors’ confidence and by introducing policies that deal frontally with specific challenge facing critical sectors of the economy.

This is a very insightful report. Thank you.

Thank you cowrywise for bringing in existence such a platform to help African build wealth.

And for the insightful articles on money always. Thank you.

??

Our Mission: …democratising wealth! ??