In 2024, families and businesses continued to face significant challenges, reflecting the trends seen in 2023.

Over the past two years, discussions have centered around rising food, energy, and overall cost of living. Furthermore, ongoing fluctuations in exchange rates are still negatively impacting the economy.

2024 Recap: Building the Blocks

Key Policies and Developments During the Year

- Return to orthodox monetary policy: interest rates increased, and the cost of capital was record-high

- Multiple tariff adjustments: consumers paid significantly higher prices

- Persistent FX losses experienced by Nigerian corporates

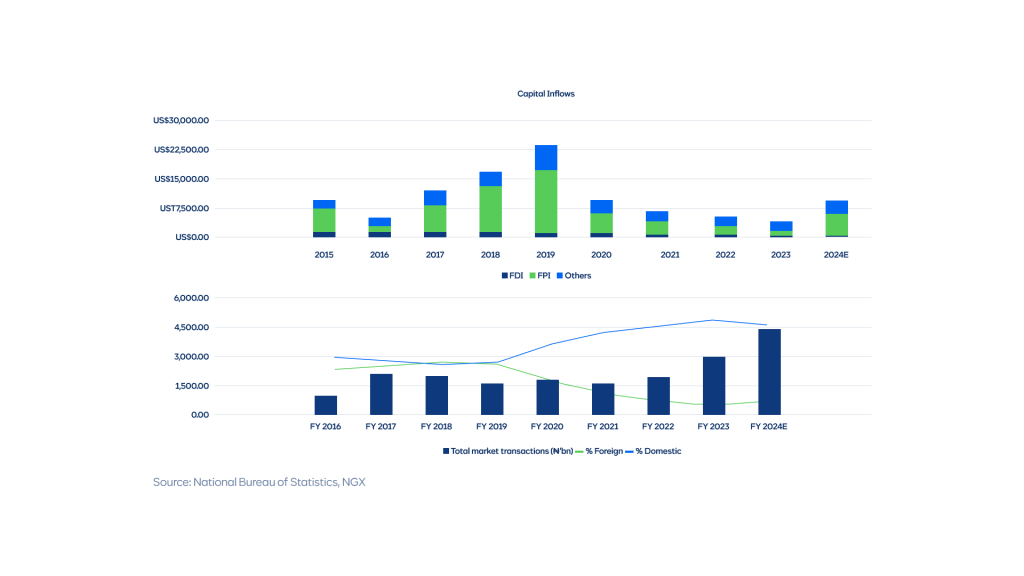

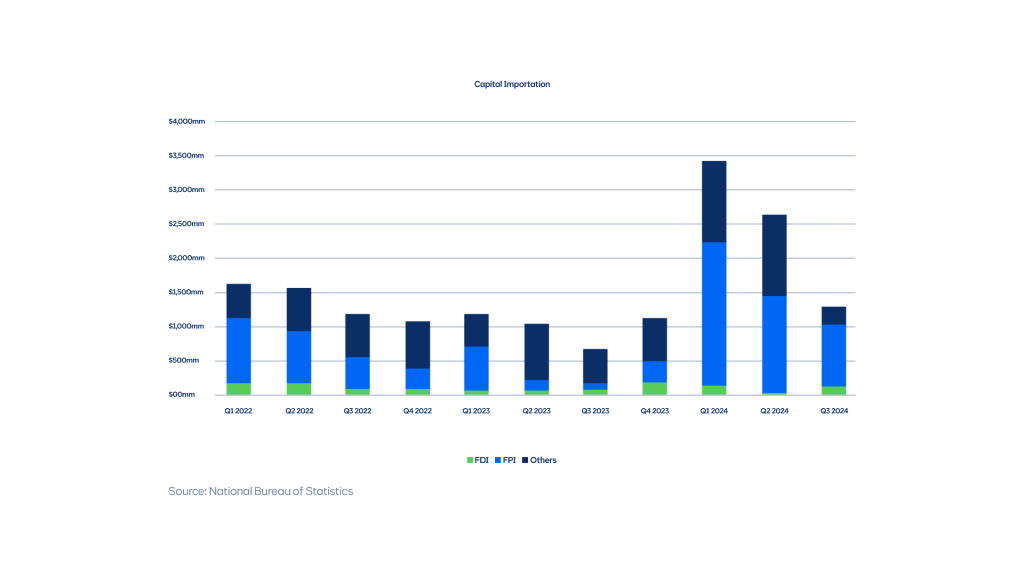

- Improved inflows by foreign investors into the economy, but inflows are not captive

- Tax reforms

- Minimum wage increase to ₦70,000

- Increased divestments of onshore assets by international oil companies and consequent increased presence of indigenous oil companies.

- Modest improvement in oil production

- The return of Donald Trump as the President of United States of Americ

The most challenging times seem to be behind us. With optimism for 2025, we anticipate a significantly improved economic landscape compared to the past two years, although some challenges are likely to persist. Amid these challenges, there are underlying opportunities for investors to capitalize on.

We discuss key economic and financial market trends and developments likely shaping 2025.

1.0. Global trends

Geopolitical conflicts remain a recurring theme and a major threat to global economic stability. For instance, the impact of the Russia-Ukraine conflict is still felt in the global crude oil and commodities markets (Russia is one of the top crude oil-producing nations in the world, and Russia and Ukraine are the top two producers of grains in the world). The sustained conflict between the two nations has major implications for energy and commodity prices (such as wheat, sorghum, barley, cereals, palm oil, sugar, etc.). This, therefore, is a threat to global inflationary pressures.

More recently, the conflict in the Middle East, particularly between Israel and Hamas, has implications for the global crude oil market on the basis that it could spread to other neighboring countries that are oil producing.

Meanwhile, the return of Donald Trump as the President of the United States of America heralds a different set of implications for the global economy. As we have seen before, a Donald Trump presidency will likely result in two scenarios: (i) increased crude oil production by U.S. producers and (ii) a potential rise in tensions between the U.S. and China, along with some neighboring countries.

Increased crude oil production by U.S. producers may lead to a decline in global crude oil prices. This impacts Nigeria in two ways: (i) a pass-through effect on energy prices, which is positive for domestic inflation. For context, crude oil is the most significant cost component in the production of petrol and diesel. Therefore, a lower crude oil price could translate into lower fuel prices and (ii) a potential loss of government revenue.

On a separate note, the weakening power of the Organisation of Petroleum Exporting Countries (OPEC) which leads to less compliance with sustained oil cuts by members, also adds to the pressure that would lower prices in the global crude oil market.

Overall, a decline in global crude oil prices and anticipated foreign exchange stability should help alleviate domestic inflationary pressures in the Nigerian economy.

Global trends

- A new dawn for innovation and tech startups (re: Elon Musk)

- Russia-Ukraine

- Middle-East Turmoil: (Syria, Israel-Hamas, Lebanon)

- Uncertain immigration laws

- Potential for heightened trade war with China and the battle for the soul of the global semiconductor industry

- Potential for increased oil production (among shale oil producers)

The Nigerian economy appears to be somewhat insulated from global events. The consequences of global macroeconomic trends are particularly significant when viewed through the lens of oil inflows and foreign investments.

2.0. Domestic Economy

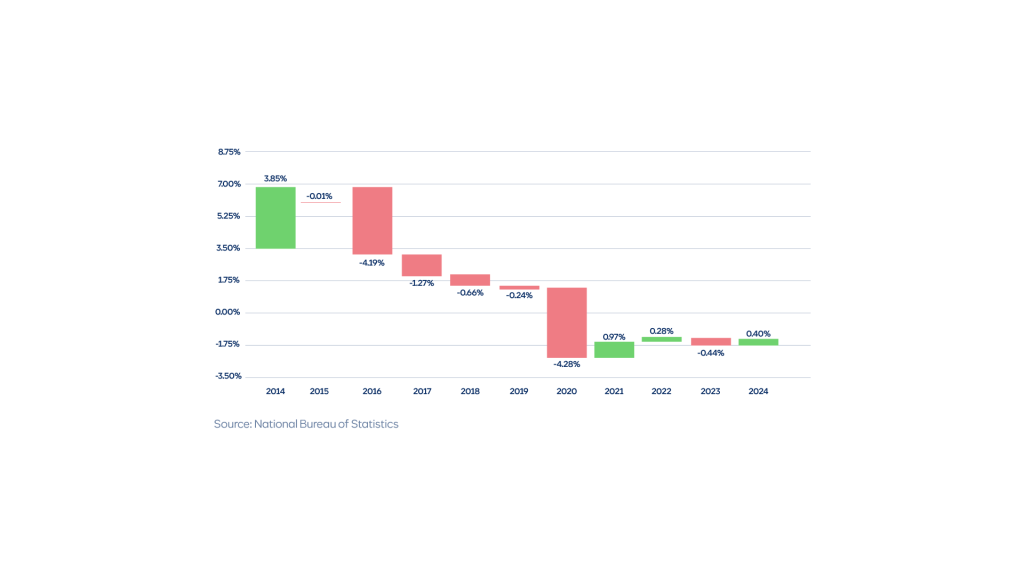

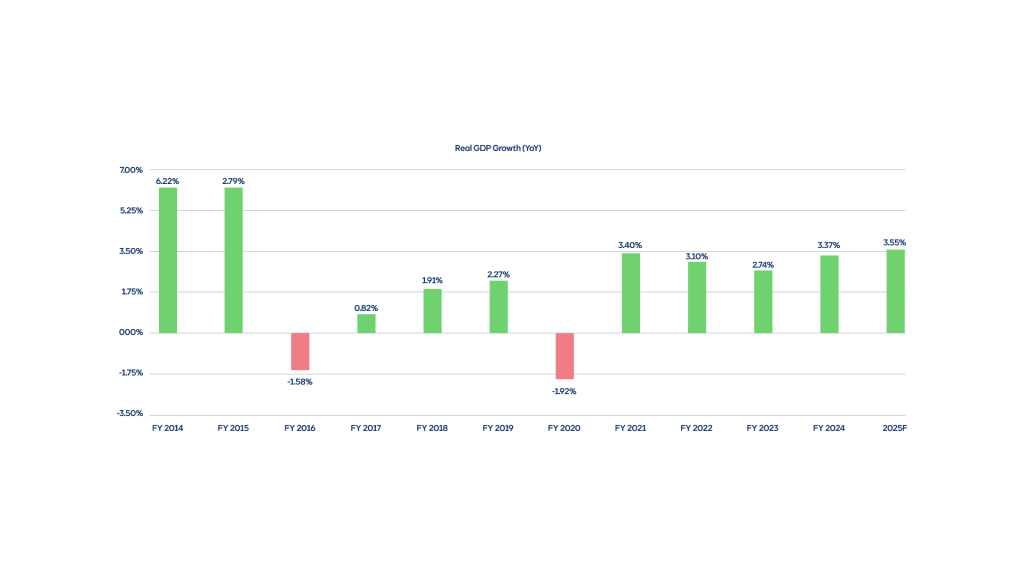

Economic activities improved by 3.2% as of 9M 2024, and it is expected to close the 2024 fiscal year at 3.4%—an improvement from the 2.7% growth recorded in the 2023 fiscal year. The modest rise in economic activity growth resulted from a combination of factors, including enhanced oil production, a resilient manufacturing sector, and relatively strong growth in the financial services and telecommunications sectors. Some of the key events that occurred during the 2024 fiscal year included improved policy implementation (particularly monetary policy), which contributed to increased stability in the foreign exchange market. Consequently, businesses could source FX to import raw materials.

The security infrastructure across key oil terminals was enhanced, leading to improved oil output. Additionally, there were early signs of increased investments in the domestic oil and gas industry, emphasized by recent acquisitions of oil assets by indigenous oil companies.

Nonetheless, the overall economic performance, although it showed some improvement, remained weak in 2024. More importantly, the growth per capita (a more relevant measure of Nigerians’ standard of living) over the past ten years is still in negative territory. Some challenges that have constrained economic prosperity during this period include the high cost of doing business, the unavailability of long-term capital, policy inconsistencies, and an unproductive labour force.

Drivers of the Weak Economy

- High cost of production (also includes foreign exchange issues, infrastructure gaps, etc.)

- Unavailability of long-term capital

- Policy inconsistencies

- Unproductive labour force

In 2025, the Nigerian economy will likely sustain its economic improvement, albeit modestly, driven primarily by further increases in oil production and, more importantly, foreign exchange stability. The ongoing reforms by the current administration (e.g., tax reforms, enhanced implementation of the Petroleum Industry Act, among others) are expected to result in improved economic growth in the near to medium term.

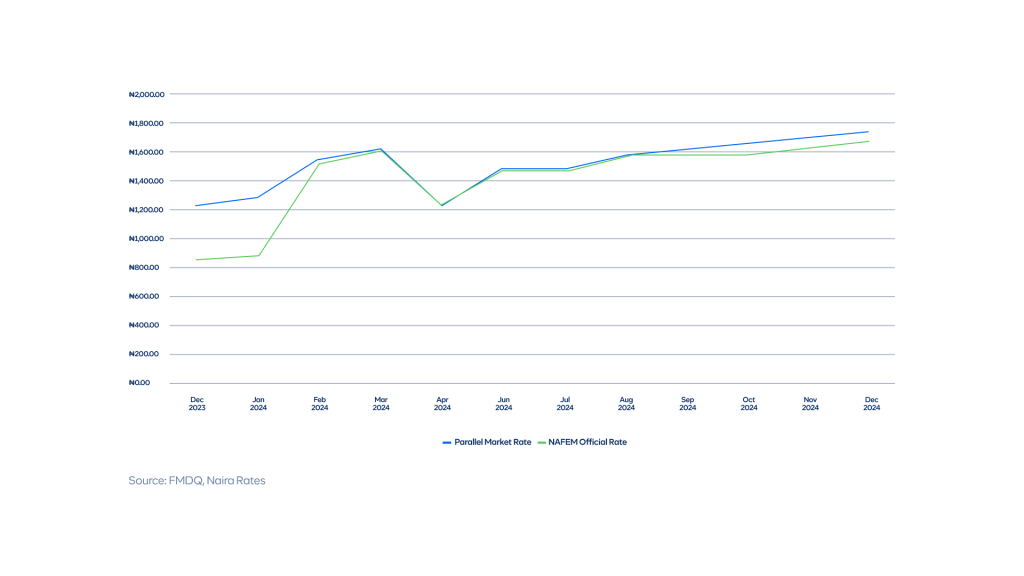

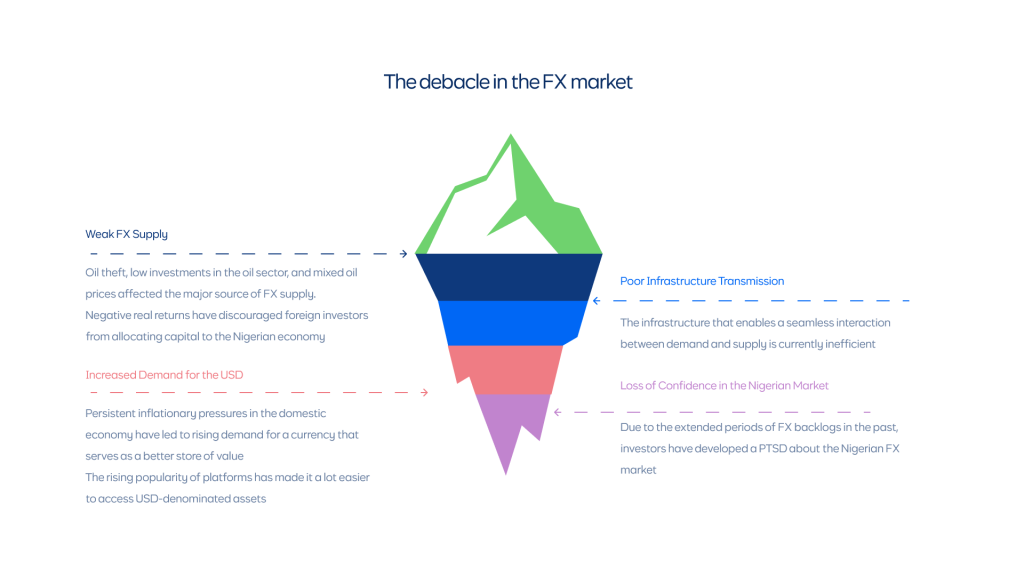

3.0. FX Stability at last

The FX issue has undoubtedly continued to be a significant problem for everyone in the economy. Businesses rely on foreign exchange to import raw materials to produce goods. If the exchange rate becomes scarce or unavailable, the impact on the prices of goods and services will be felt, effectively adding to inflationary pressures.

The Central Bank of Nigeria (CBN) implemented key reforms in 2024 to stabilize the foreign exchange market. The most recent policy was the Electronic Foreign Exchange Matching System (EFEMS), which recently went live. This development is expected to drive transparency. With increased transparency and trust in the FX market, supply is expected to improve, thus stabilizing the FX market.

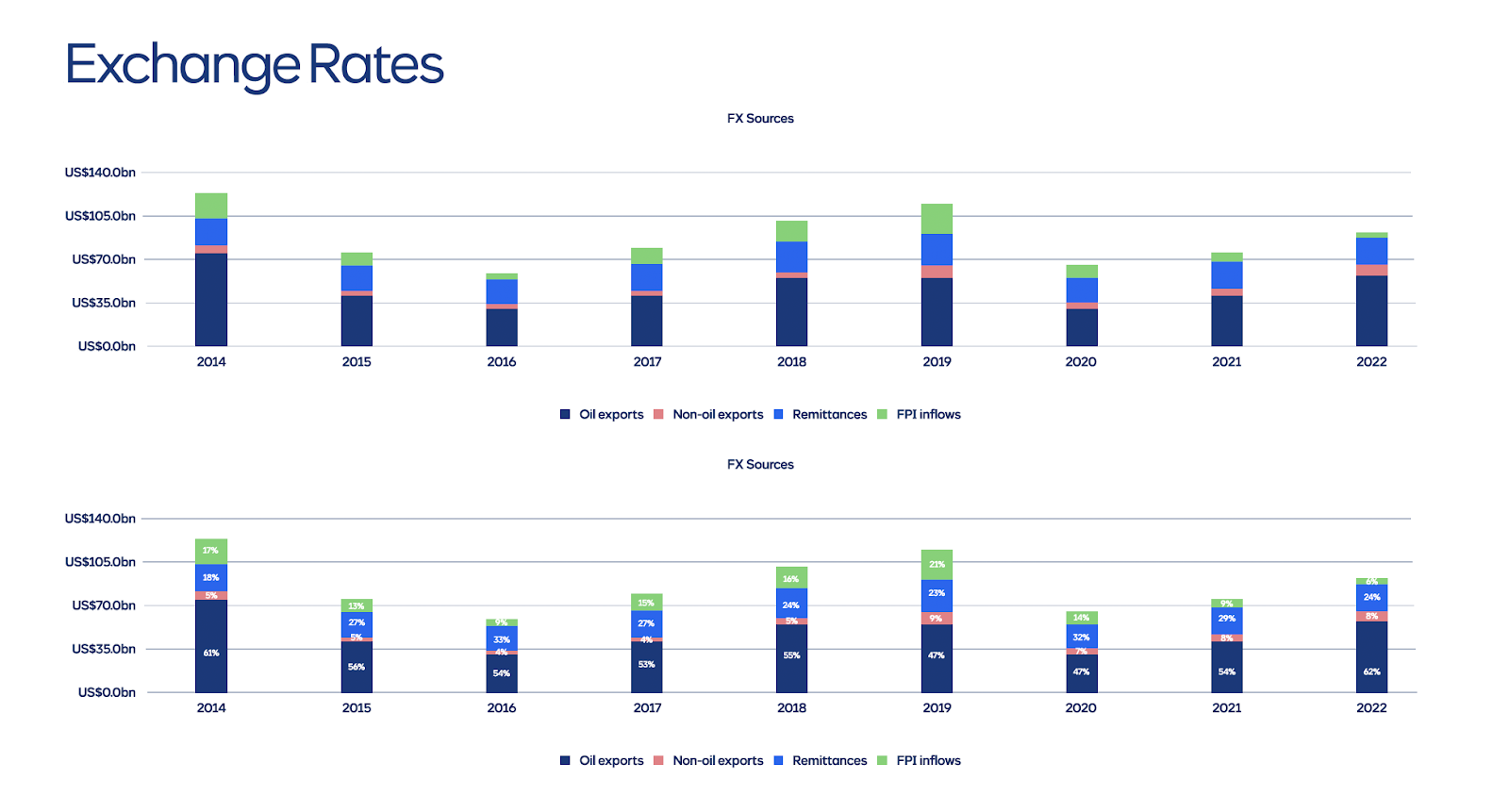

Fundamentally, the stability of the exchange rate is hinged on adequate supply. Meanwhile, the broad sources of FX supply in the foreign exchange market include:

- Oil exports

- Non-oil exports

- Foreign inflows (which can be foreign portfolio investment (FPI) or foreign direct investment (FDI)

- Diaspora remittances

- Other inflows (which can be loans or other foreign currency inflows)

There has been a notable improvement across most of these FX sources. For context, reports of improvements in oil production have been recorded. Meanwhile, the recent investments of indigenous oil production companies are expected to increase output in the near to medium term. Therefore, the supply of FX from oil inflows will likely improve in 2025.

Furthermore, foreign inflows significantly improved in 2024. Specifically, the increase in interest rates has attracted foreign investors to Nigeria. These inflows have also contributed to the enhanced economy FX supply. This trend is likely to continue into 2025.

On a balance, the exchange rate is expected to be stable for the most part of 2025, based on expected improvements in FX supply due to the factors described above.

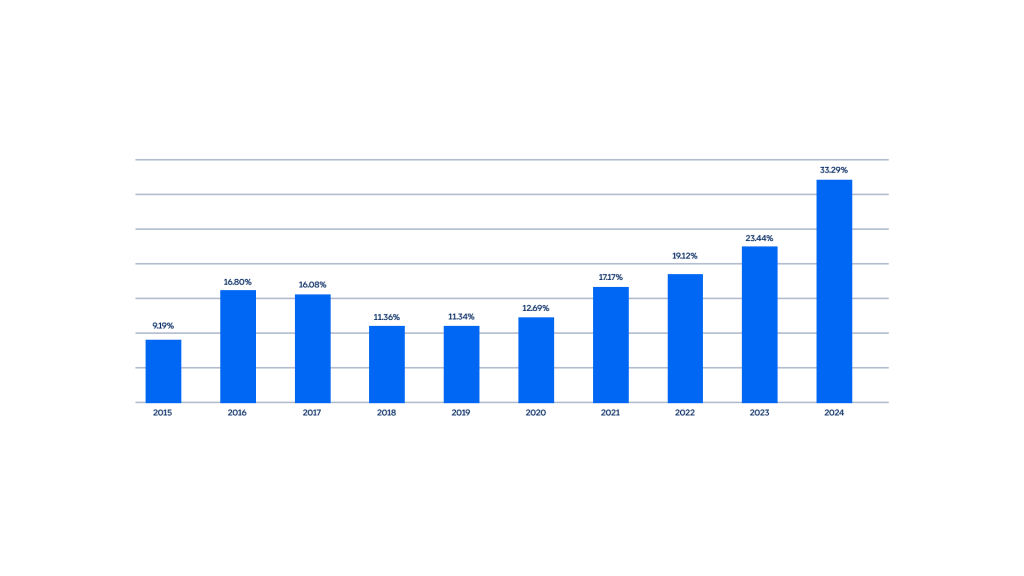

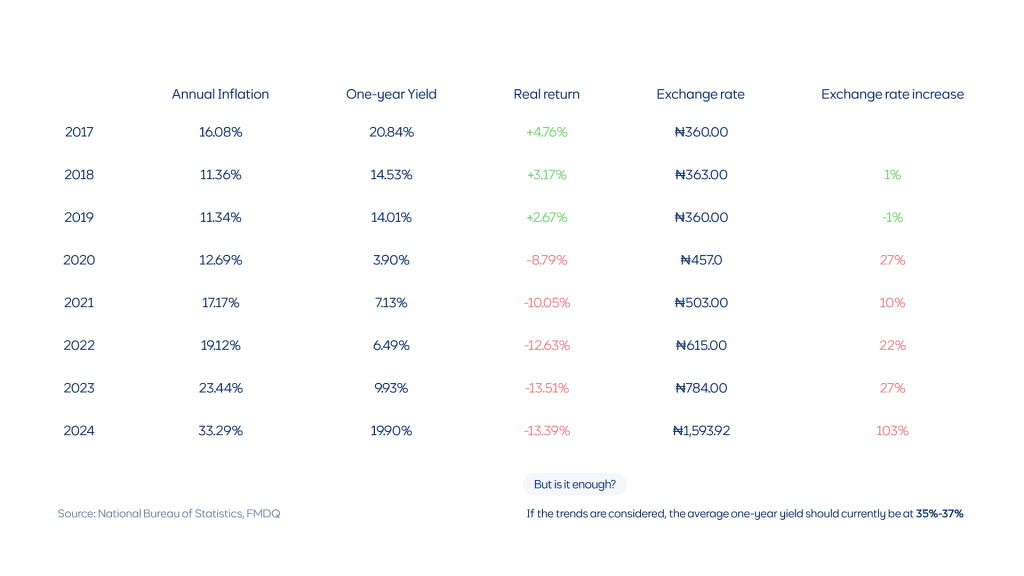

4.0. Inflationary Pressures: Is There Any Relief in Sight?

Headline inflation rose persistently, averaging 33% in 2024, up from a 23% annual average in 2023. Several factors accounted for the jump in price level in 2024, including the rise in energy prices, high transportation costs, and high prices of essential household goods. One variable that is common to these factors is the exchange rate. Given the marked rise in exchange rates, the pass-through effect is reflected across these factors.

The exchange rate is expected to remain stable in 2025, with the pressure points contributing to rising prices in the economy anticipated to moderate. Furthermore, the CBN is likely to maintain its monetary policy tightening approach, which is expected to curb the monetary drivers of inflationary pressures within the economy. Hence, the inflation trend is expected to be stable, although the level should remain high.

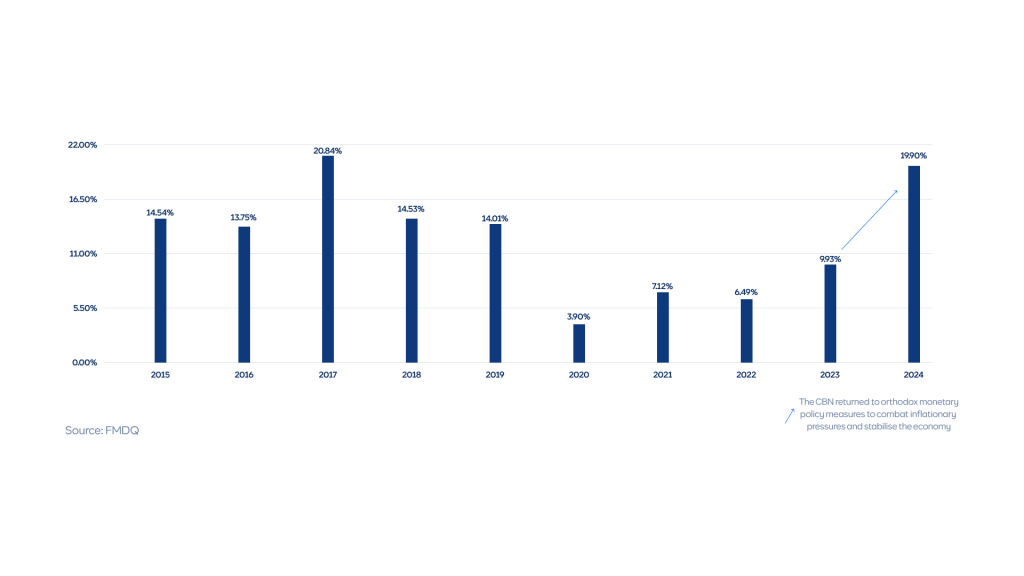

5.0. Interest Rate Hikes: Are We Likely to See a Soft-Pedalling?

Motivated by persistent inflationary economic pressures, the CBN’s approach remained restrictive. For context, the CBN raised interest rates six times in 2024. The Monetary Policy Rate (MPR) increased to 27.50% as of November 2024 from 18.75% at the start of the year. Nonetheless, inflationary pressures mounted, but the recent month-on-month trend has declined.

We believe interest rates will remain elevated, with additional rate hikes expected until at least the first half of 2025. This situation arises from significant underlying factors causing price increases due to too much money in the system without corresponding output/goods produced, and there is a high likelihood that these drivers will persist. The federal government projects a fiscal deficit of ₦13 trillion in 2025. This figure alone is substantial enough to destabilize macroeconomic stability. Meanwhile, historical trends indicate that the budgetary deficit consistently exceeds the budget. Therefore, to mitigate the potential impact of the fiscal deficit and maintain macroeconomic stability, the Central Bank of Nigeria is anticipated to keep interest rates elevated.

Additionally, we noted above that there is an increased likelihood that the economic disagreement between the U.S. and China will persist. In that event, the downside implication is inflationary pressures in the U.S. economy, which could compel the United States Federal Reserve to act, by reversing its current dovish stance. A rising interest rate in the United States makes the US Dollar more attractive. Therefore, we may see sustained higher interest rates in the Nigerian economy to encourage foreign inflows and prevent domestic demand for the USD (for FX stability).

6.0. The Investment Strategy in 2025

What Will Likely Change in 2025?

- Higher oil inflows, as a result of stable oil prices and improved oil production

- Sustained increase in interest rates is expected to keep foreign and domestic investors interested in Naira assets

- The launch of the Electronic Foreign Exchange Matching System (EFEMS) is expected to improve the transmission mechanism between FX supply and demand

Considering the macroeconomic outlook for 2025, especially in a stable, high-yield landscape, the fixed-income market should continue to be appealing. At the same time, easing inflation and better foreign exchange stability are anticipated to boost equity performance in 2025. Additional elements supporting equity gains include corporate activities such as capital raising, mergers and acquisitions, capacity expansions, divestments, and new listings.

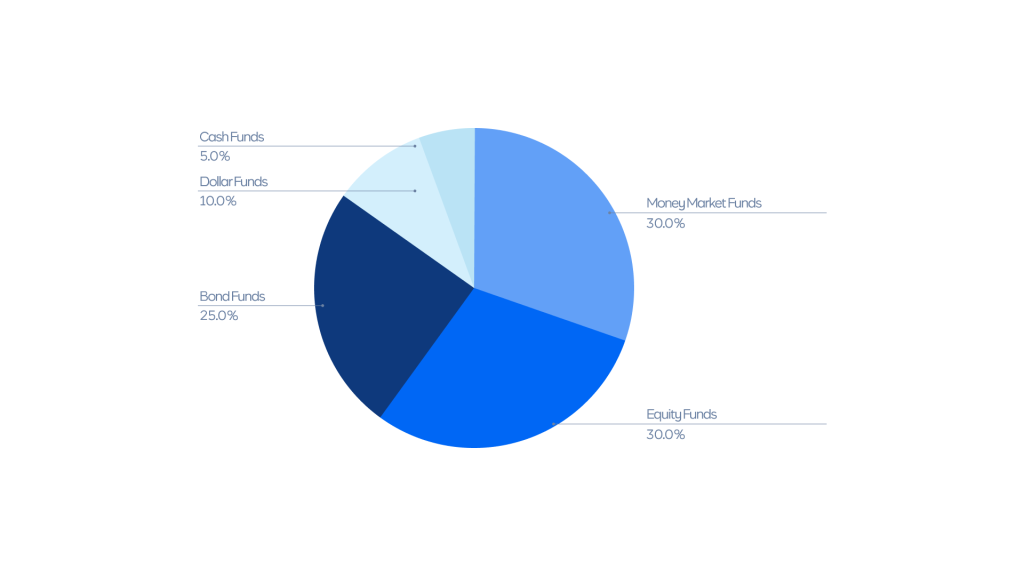

Therefore, we advise a diversified portfolio asset allocation in 2025 in the following form:

30% in money market funds

Rationale: yields are expected to remain elevated till at least the first half of 2025 before we hope to see any moderation. Therefore, short-term instruments such as Treasury Bills, Fixed Placements, etc., are expected to be attractive. To capture value across these instruments, a 30% allocation in money-market mutual funds.

30% in equity funds

Rationale: The equities market is projected to sustain its strong performance in 2025, driven by better macroeconomic conditions. Since 2020, it has recorded robust double-digit gains and positive returns for four consecutive years. Expected developments and catalysts in 2025 are likely to support this ongoing momentum.

25% in bond funds

Rationale: We advise increasing the allocation to bond funds in 2025 from the 20% allocation in the prior year. As 2025 progresses, we expect potential yield moderation, which will enhance the appeal of bond funds. Typically, bond funds perform better when interest rates are stable or declining.

10% in dollar funds

Rationale: We advise reducing the dollar fund allocation to 10% (down from 20% in 2024), based on expectations of stability (or potential decline) in the exchange rate in 2025.

5% in cash

Happy Investing in 2025!