Market slice is a monthly summary of mutual funds on Cowrywise and key money news. This jargon-free report is shared on the 3rd of every month. Share lessons on Mutual Funds in the year 2020 using the hashtag: #MarketSlice

? What a year!

First, I owe you an apology. This month’s market slice came with a little delay, but only because we optimized it for you with all the new data the new year brought.

Now, if you were to describe 2020, what words would you use? For me, 2020 was a year of oxymorons. An oxymoron occurs when contradictory terms seem to be in conjunction.

In a year where everything seemed downwards, the Nigerian stock market was a contrarian. It kept soaring even till our last Market Slice for 2020. In the same year, cryptocurrencies went on a growth rampage! This, of course, led to a lot of “Had I known” moments. [We have no position on crypto. Investing in it should be a personal choice after sufficient research.]

Summarizing 2020, it was a great investment year but not a year of great investors. What majorly happened was the market doing what it knows how to do best; taking everyone by surprise! It doesn’t mean the same will happen this year, but the rule remains simple: Stay Consistent. Speaking of great investors, it takes a lot to be one. This is why we advise investing with mutual funds, as this allows a professional to manage your funds for the best possible performance.

What is in this Market Slice?

- A throwback: 10 years of mutual funds in Nigeria

- How mutual funds in 2020 performed

- Top money market funds

- Top fixed-income funds

- Top mixed funds

- Top equity funds

- Top ethical (halal) funds

10 years of mutual funds in Nigeria (2011-2020)

Within the past 10 years, the total value of mutual funds in Nigeria grew by 1,927%! That’s solid progress. In 2011, the total value was ₦74 billion and that grew to ₦1.5 trillion in 2020. This simply means that more people are starting to invest in mutual funds, and we have made this easier as the number 1 retailer of mutual funds. On Cowrywise, you access the highest variety of mutual funds anywhere in Nigeria.

Speaking of variety, investors now have 108 choices to pick from. In 2011, that number sat at 43. What’s more interesting? Cowrywise offers 18% of these mutual funds and we’ll add more this year. You might be wondering how people get to choose which fund to go with when they have so many options? For investors who use Cowrywise, they get to take a recommendation test for free. Based on the results, we match them with the best-fit funds.

Trivia: What was the first mutual fund in Nigeria? (Answer at the end of this section)

Answer: The Chapel Hill Denham Paramount Equity Fund was the first, and it was established in 1991

How mutual funds in 2020 performed

The star funds in terms of returns were equity and bond funds. As I stated earlier, 2020 was a year of oxymorons. When it became evident that the money market was not going to breakup its relationship with low returns, people moved towards equities and boom!

The boom was so strong that on the 12th of November, 2020, Bloomberg released an article with this headline: “Nigerian Stocks Surge Most Since 2015, Trigger Circuit Breaker”. What does this mean? There was a shocking amount of trades in the stock exchange that day. So much that the market had to take a break.

Based on this, we saw a rise in the returns of equity mutual funds. Remember, these are funds that invest in equities or stocks. They are managed by professionals who help select stocks to earn investors the best possible returns.

» Learn more: How do equity mutual funds work?

On the other hand, the consistent drop in treasury bills–a major component of money market funds–led to a drop in their returns. Imagine dropping from as high as 12% per annum to 1% per annum? You don’t need to imagine because it actually happened.

However, there was a funny moment with treasury bills last year; when the rates turned negative. One would expect that this would have chased investors away, but that didn’t happen. Rather, people were willing to pay the government to borrow from them.

In all, investors on Cowrywise earned as high as 20% on their Naira and dollar investments. Let’s see the top funds for each category in 2020.

Top Money Market Funds

Money market funds are mutual funds that invest primarily in money market instruments like treasury bills. Based on assets under management, the money market funds which grew the most were:

- FSDH Treasury Bill Fund (93% growth)

- PACAM Money Market Fund (59% growth)

- Greenwich Plus Money Market Fund (40% growth)

Based on returns, these were the top 3 money market funds:

» Learn more: The basics of money market funds

Assets under management (AUM) is the total market value of the investments that a firm manages on behalf of clients.

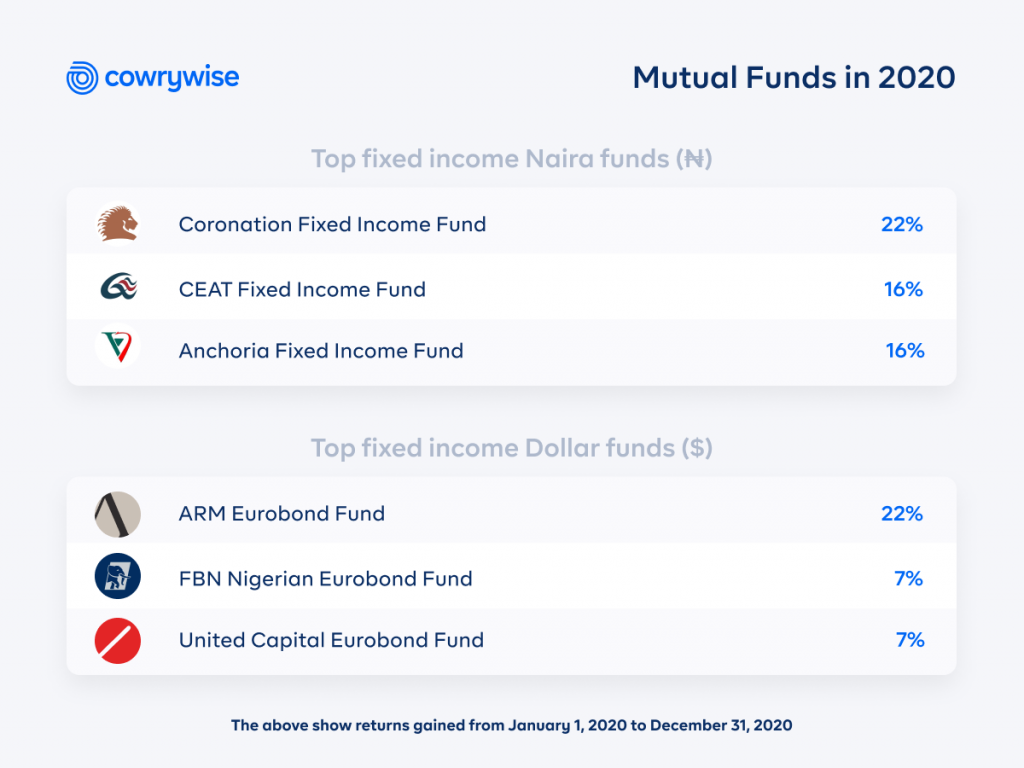

Top Fixed Income Funds

This type of mutual funds invest cash in fixed income instruments. Bonds are the most common types of fixed income funds. In this category, we have two sub categories–Naira fixed income funds and eurobonds (popularly referred to as dollar funds). Last year, the top 3 Naira bond funds, based on growth of assets, were:

- United Fixed Income Fund (grew by 2,681%)–Available on Cowrywise

- Zenith Fixed Income Fund (grew by 1,589%)

- Stanbic IBTC Bond Fund (grew by 1,189%)

While for dollar funds, the fastest growing, based on assets, were:

- United Capital Eurobond Fund (grew by 122%)–Available on Cowrywise

- FBN Nigerian Eurobond Fund (grew by 73%)

- Legacy USD Bond Fund (grew by 70%)

How did these funds perform? Check this:

Get the ARM and United Capital dollar funds here, with as low as $10

Top Mixed Funds

This is the salad of mutual funds. They usually invest in a mix of bonds and equities. For 2020, the fastest growing mixed funds, based on assets, were:

- Coronation Balanced Fund (grew by 545%)

- AIICO Balanced Fund (grew by 58%)

- FBN Nigeria Balanced Fund (grew by 42%)

And they dished out beautiful returns. Check out the top 3:

Top Equity Mutual Funds in 2020

As stated earlier, the Nigerian stock market was contrarian last year. When markets fell across the world, it picked up and in turn boosted the performances of equity mutual funds. Equity funds with the highest growth in assets were:

- AXA Mansard Equity Income Fund (grew by 102%)

- Paramount Equity Fund (grew by 94%)

- United Capital Equity Fund (grew by 66%)–Available on Cowrywise

Investors with these funds had a good year. Here are the top three funds based on earnings:

Start investing in top mutual funds with any amount here

Top Ethical Funds

These funds invest in screened instruments. For example, there are ethical funds that do not invest in the stocks of gun manufacturers. They present an ideal way for everyone to invest–including Muslims. These three ethical funds were the fastest growing in 2020:

- Stanbic IBTC Imaan Fund (grew by 38%)

- ARM Ethical Fund (grew by 34%)–Available on Cowrywise

- Stanbic IBTC Ethical Fund (grew by 30%)

Their returns were quite decent. The top 3 based on returns were:

What else happened in 2020?

- In August 2019, it cost ₦36,500 to invest $100 (excluding processing charges). By August 2020, it cost about ₦47,500 to invest the same $100–that is a 30% increase. Asides from returns, dollar investors on Cowrywise–who held their investments from August 2019 to August 2020–gained ~30% when their investments were converted back to Naira.

- We added 6 new funds to our growing list of mutual funds.

- Onions became the new gold, with prices growing by up to 285% between May and November.

? Data snap of the year

According to Munich Re., natural disasters cost the world $210 billion in 2020. In comparison to 2019, that is a 26.5% jump! For more context, that’s about two times the net-worth of Bill Gates.

Your favourite advisor,

Ope ?