If we were to ask our audience ‘What is Compound Interest?’ many people would have no idea. This is a financial term that many people have questions about and in this article, we explain how compound interest works in simple English.

Definition: Investopedia defines compound interest as interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit. Simply, this means earning interest on interest.

For instance, If you invest NGN100,000 to earn 10% in 1 year, you’ll have NGN110,000 in total. That is, NGN100,000 + NGN10,000 (interest). With compound interest, in the second year, you’ll earn 10% on NGN110,000 and not just the NGN100,000. You get the picture, right? Great. Let’s dig deeper.

The Power of Compound Interest

We explored this concept in our earlier article on The Richest Man in Babylon. Here is an excerpt:

Make thy gold multiply: “The gold we may retain from our earnings is but the start. The earnings it will make shall build our fortunes. Learn to make your treasure work for you. Make it your slave. Make its children and its children’s children work for you”.

The power behind compound interest and its magic is Time x Interest Rate. This is why starting savings/investments early and getting a modest interest rate on your savings and investments matter a lot. The longer you invest your savings, the more they can grow in value due to compound interest. Let’s drive home this important point with some simple numbers.

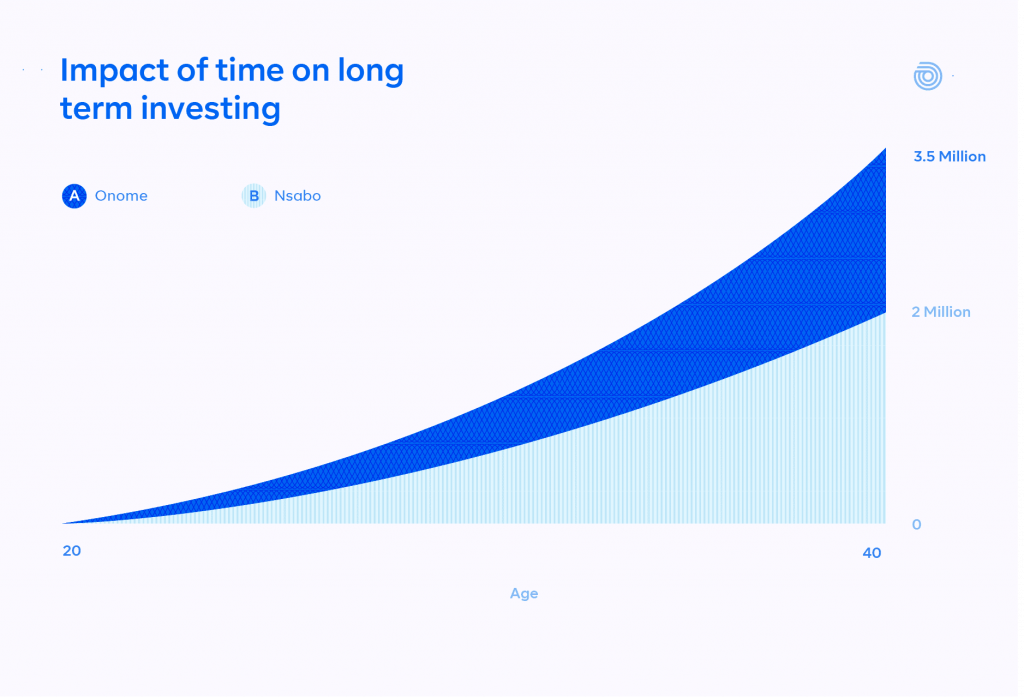

Meet Onome

Onome starts saving money for retirement at age 20 and puts in 50,000 Naira per year at 10 per cent annual interest rate into his Cowrywise Long Term Saving Plan. At age 40 (21 years down the line), Onome’s investment balance is N3.52Million, broken down into:

Savings/Investment: N1.05M

Returns: N2.47M

Meet Nasabo

At 20, Nasabo feels he has a lot of time ahead of him. He decided to delay the start of his long-term saving until his 25 birthday. Being Onome’s friend, he decides to also match his annual savings of N50,000. At age 40 (16 years down the line), Nasabo’s investment balance is N1.98Million, broken down into:

Savings/Investment: N800k

Returns: N1.18M

Conclusion

All Onome did is to save just N250k more than Nasabo and ends up having N1.2Million more in return. This is the classic power of compound interest over a period of time. It is much easier to start saving with goals. Goals will motivate you to be disciplined towards savings and investment.

So what are you waiting for! Let’s take a flight to the future by riding on the incredible power of disciplined savings and compound interest.

Also Read

The Power of Compound Returns on Long-term Investment Growth