In a space where the next income is not certain but is largely dependent on how well you can negotiate and how fast you can deliver high-quality jobs, investing is most likely not an option, or is it? A young freelancer, Ayomide Ajetomobi, thinks it is.

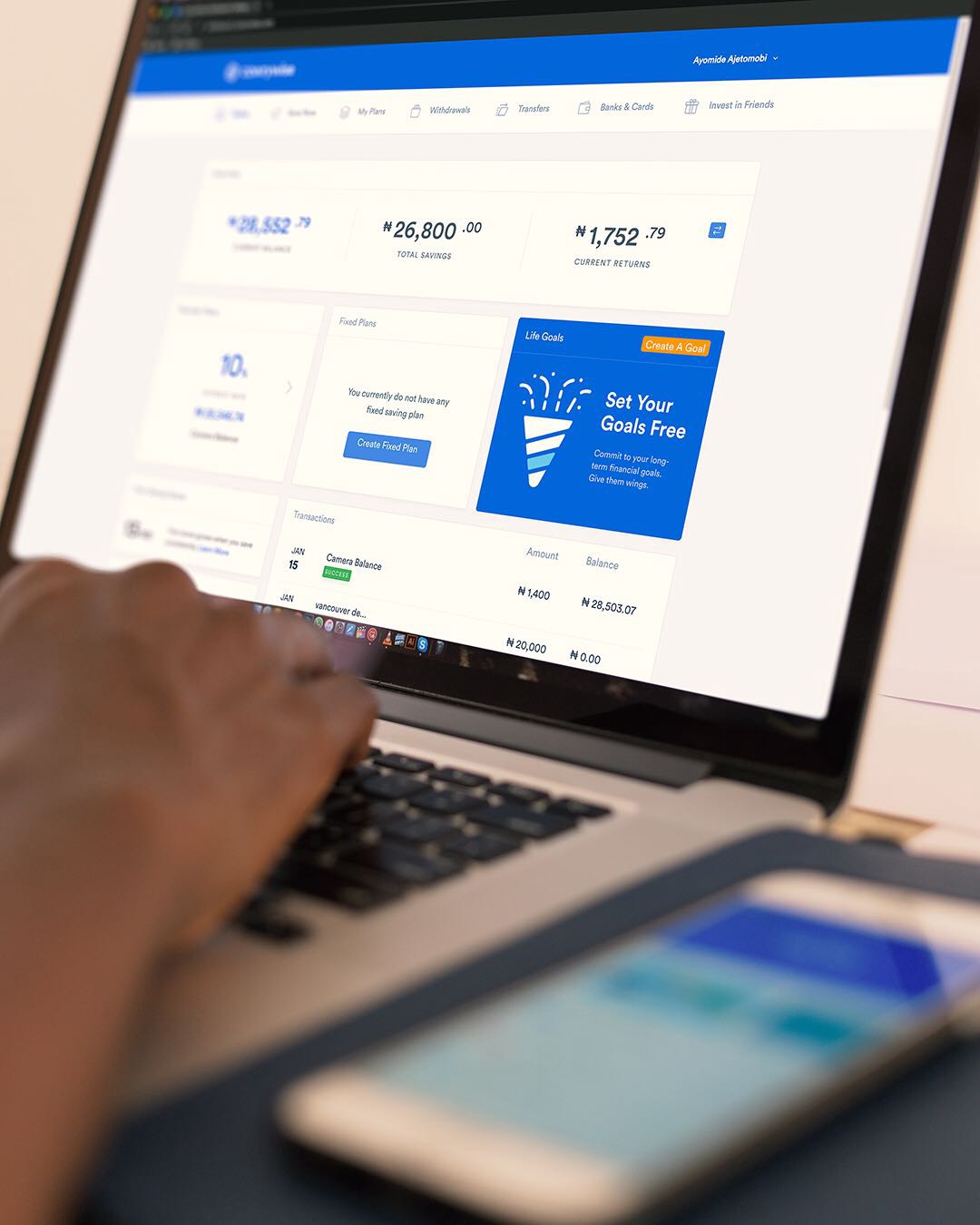

Ayomide has worked with a number of top financial brands as a freelance photographer and motion designer, Cowrywise being one of them. He shares with us the day-to-day struggles of being a freelancer, apt survival tips for the gig economy, managing barriers that come with being a Nigerian freelancer, and of course his investment strategy.

His responses serve as a guide on how freelancers can invest.

How would you describe your experience so far?

Well, as a freelancer I get to work with as many brands as I want at the same time, I am not tied down to one particular brand or company. So, in a way, it’s multiple income streams from the same source. Despite this beautiful aspect, one part I struggled with at the beginning was underpayment, and one that keeps rearing its ugly head is the struggle with data connection when I have to deliver jobs to my clients. Asides from the fact that data can really get expensive, in this line, it can also disappoint at needed times. When this happens, I just take a walk to cool off — I need a good heart to live long and enjoy my investments, so I avoid stress. (Laughs)

How do you overcome the hurdle of underpayment?

I have three key suggestions to help tackle this:

1. I am always in search of ways to upgrade my skill set. I challenge myself to always learn something I never knew existed from time to time.

2. Though I learnt the hard way that not everyone is my client, it was a good lesson. It helped me define my target clients properly and position better to attract them.

3. I discipline myself not to take more than what I can handle, it’s better to work with 3 clients than to work with 5 and mess your deliverables up. Taking up only jobs you can handle might not earn you much at the start, but that choice will earn you respect and as that compounds, you can begin to demand higher payments.

How do you manage the nationality barriers that come with seeking out gigs?

It’s really something! Most people out there have trust issues due to past experiences with fraudsters, so it takes patience to commit time and prove that you are different. You will have to make some sacrifices such as offering free gigs so as to build your portfolio. Building trust is similar to investing, with time your little actions compound into amazing results. Once you can prove you’re genuine and ready to work, it’s easy from then on.

As a freelancer, your income streams, however many, can be irregular. So how do you invest?

Given that I have worked with a couple of finance firms, it was only natural for me to think more about the long term, and I am glad about that. With my first investment, I was able to get an important gadget for my work and now I am investing in owning a studio. Once that is settled, I’ll start a retirement fund before I invest in other projects.

I’ll advise that freelancers can invest by doing the following:

- Break down their goals. Which goals are immediately important to success in your chosen field? Pick the two most important ones and save money towards them. Once they are settled, set up a retirement fund before any other goal. Commit a set percentage from investments to this every time you set aside cash to invest.

- Join a Savings Circle

- Get an investment account that allows you to put in any amount as you earn — NGN1,000 today or NGN100,000 tomorrow. I currently use Cowrywise for this, with my Cowrywise account I set up save-as-you-earn plans that allow me to top up my investments at any time. No stress.

- Invest any increase you get.

- Invest at least 20% of anything you earn.

Don’t just work hard to make money, let your money work hard to make more money for you. — Ayomide Ajetomobi

RELATED: