If you’re looking to start your investment journey or grow your wealth, you’ve probably heard a lot about fixed-income investments. These investments are hugely popular in Nigeria, attracting all kinds of investors – from everyday people to high-net-worth individuals (HNIs) and big institutions. Over the past decade, they’ve delivered solid returns, making them a trusted choice for many.

But what makes fixed-income investments so appealing? And how can you use them to your advantage? Let’s go over it in detail together.

What Are Fixed-Income Investments?

The name says it all: fixed-income investments give you regular, predictable income, usually as interest. Think of them as a way to grow your money steadily without taking too much risk. They include things like:

1. Government Bonds

This is when the government (federal or state) borrows money from investors. In return, it promises to pay interest regularly and return your initial investment after a set period. Bonds are usually long-term investments, lasting anywhere from 5 to 20 years.

2. Treasury Bills (T-Bills)

T-Bills are also issued by the Federal Government, but unlike bonds, they are short-term. The maximum duration is one year (365 days), and they’re perfect for people who don’t want to lock up their money for too long.

3. Corporate Bonds

These are like government bonds, but instead of being issued by the government, they come from companies. Businesses use corporate bonds to raise money for big projects, like building factories or buying equipment. They usually last between 3 and 10 years.

4. Money Market Instruments

Think of these as short-term corporate versions of Treasury Bills. Companies issue Commercial Papers (a type of money market instrument) to cover short-term cash needs. These are great for investors looking for quick returns with manageable risks.

A comprehensive guide to understanding what fixed-income instruments are all about can be found here

Why Are Fixed-Income Investments So Popular in Nigeria?

Fixed-income investments dominate the Nigerian market for several reasons. Let’s look at the most important ones:

1. High Inflation Makes Them Attractive

Nigeria has always dealt with high inflation, which reduces the value of money over time. To fight this, the Central Bank of Nigeria (CBN) often raises interest rates. When this happens, fixed-income investments – like T-Bills and government bonds – offer higher returns. This makes them a smart choice for investors.

Here’s an example:

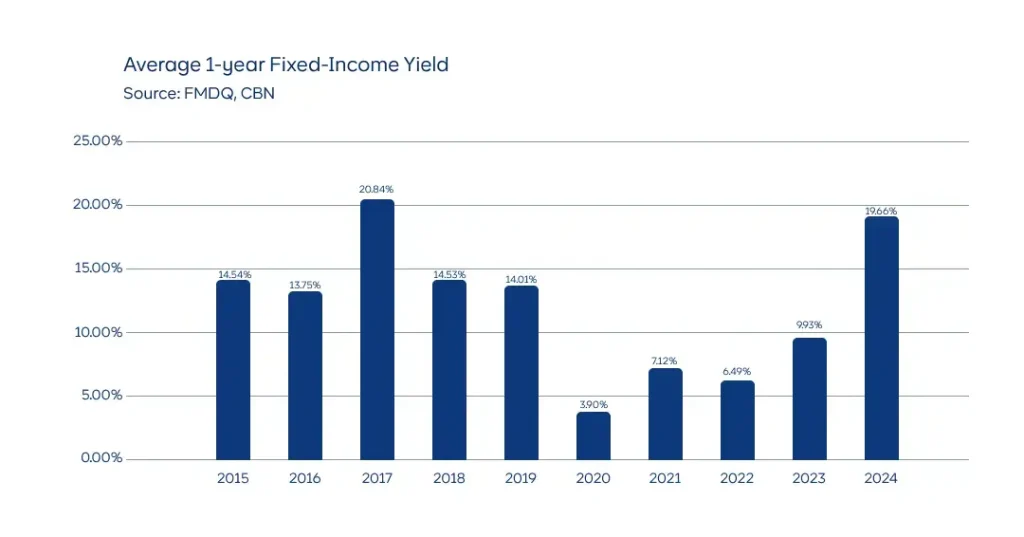

Historically, the returns (or ‘yields’) on fixed-income investments in Nigeria have ranged from 10% to 20%, depending on market conditions. That’s significant compared to other investments, especially during times of high inflation—like now, with inflation hovering around 34%. These returns can help offset rising living costs and preserve the value of your money.

2. They’re Safer Than Other Investments

Fixed-income investments are considered one of the safest options available. Why? Because they’re backed by the government (in the case of T-Bills and government bonds) or established companies (for corporate bonds). Compared to stocks, which can go up or down unpredictably, fixed-income instruments offer more stability.

3. A Reliable Source of Income

One major appeal of fixed-income investments is the steady income they provide. You get paid regular interest – whether monthly, quarterly, semi-annually, or annually – making them a great choice if you’re looking for a predictable cash flow.

What Investors Stand to Benefit from Fixed-Income Investments

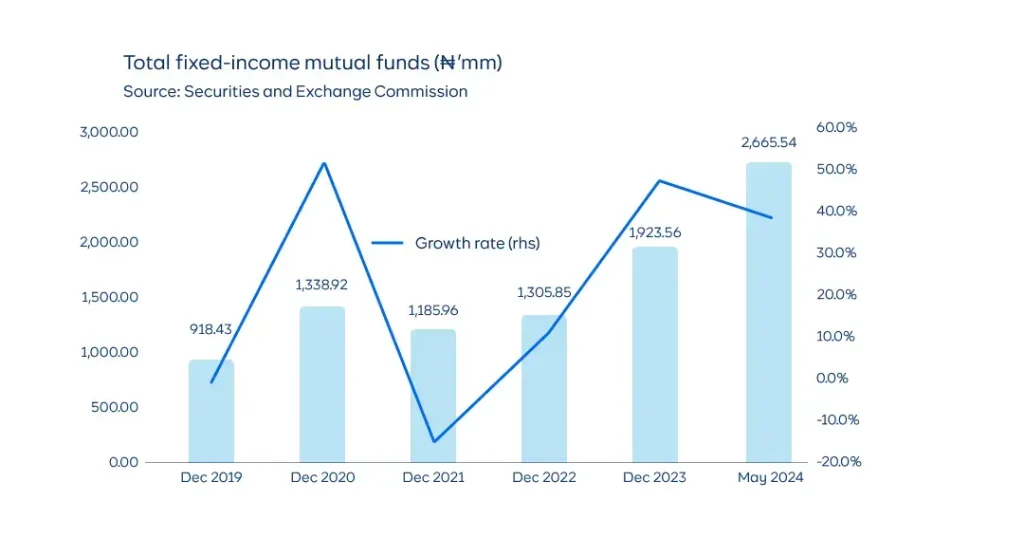

Fixed-income investments are incredibly popular in Nigeria, and for good reason. For context, the total fixed-income mutual funds have grown by 27% compound annual growth rate between December 2019 to May 2024. Fixed-income investments offer a lot of benefits that make them a reliable and attractive option for anyone looking to grow their wealth. Some of the benefits include:

1. Predictable Income

Fixed-income investments provide steady and reliable income. With these instruments, you’ll receive regular interest payments – whether monthly, quarterly, semi-annually, or annually. This predictability makes them ideal if you want to plan ahead, whether it’s for daily expenses, savings goals, or reinvesting for more growth.

2. Capital Preservation

If your priority is to protect your money, fixed-income investments are a smart choice. They are less risky compared to stocks, making them an excellent way to preserve your capital. Government-backed options like Treasury Bills are considered some of the safest investments because they are backed by the government itself. With these, you can rest easy knowing your money is in a secure place.

3. Diversification

You’ve probably heard the saying, “Don’t put all your eggs in one basket.” This is also very relevant when it comes to investing. Adding fixed-income assets to your portfolio helps balance out riskier investments like stocks or cryptocurrencies. This balance reduces the chances of major losses and gives your portfolio more stability, especially when markets are volatile.

4. Inflation Protection (To Some Extent)

Inflation is a big challenge in Nigeria, eating away at the value of your money. But fixed-income investments can help you fight back. Their high yields often outpace the low returns of traditional savings accounts. While they may not completely offset inflation, they can at least help your money keep up better than letting it sit idle in cash.

If you had invested ₦100 in fixed-income investments back in 2014, it would have grown to ₦320.47 by now. In comparison, the same amount left in a bank savings account would have earned 30% less (₦223.89) over the same period.

Challenges in Accessing Fixed-Income Investments

Fixed-income investments offer plenty of benefits, but there are still some challenges that can make it difficult for investors to take full advantage of them. Some of those challenges are:

1. Accessibility

For a long time, fixed-income investments were seen as something only wealthy investors could afford. Many people assumed that you needed a lot of money to get started, so they never even considered these options. Fortunately, that’s starting to change. Today, thanks to digital solutions, even small investors can access fixed-income instruments with as little as ₦5,000. This shift is making these investments more inclusive and easier to access for everyone.

2. Interest Rate Risk

The returns on fixed-income investments are closely tied to interest rates, which can go up or down depending on the economy. When interest rates rise, the value of existing investments can drop, which is something to keep in mind if you plan to sell before maturity. However, if you hold the investment until it matures, you’ll still receive your full principal and agreed-upon interest.

3. Credit Risk

Government debt instruments, like Treasury Bills and bonds, are considered very safe because they’re backed by the government. But with corporate debt instruments, there’s something called credit risk. This means that if the company issuing the bond runs into financial trouble, it might not be able to meet its obligations. As an investor, it’s important to carefully evaluate the company’s financial health before investing in its bonds.

Retail and Young Investors Can Access Fixed-Income Investments on Cowrywise

Fixed-income investments are a great starting point for young Nigerians who want to grow their wealth steadily and predictably. The good news is that you don’t need a lot of money or experience to get started. Here are some simple ways to access fixed-income investments:

1. Money Market Mutual Funds

One of the easiest ways for retail and young investors to access Treasury Bills (T-Bills) and other fixed-income instruments is through money market mutual funds. These funds pool money from many investors and invest it in safe, short-term assets like T-bills and commercial papers.

The best part? It’s hassle-free. You don’t have to worry about managing the investments yourself—the fund manager handles everything. Cowrywise is Nigeria’s largest mutual fund aggregator, making it easy for anyone to invest in these funds with just a few clicks.

Also, mutual funds invest in portfolios of securities, spreading investments across multiple issuers. Even if one issue defaults, the impact is minimized because the fund holds numerous assets. In addition, certain mutual funds, such as money market funds or funds focused on government bonds, invest in low-risk securities.

2. Digital Asset Management Platforms

Thanks to technology, investing in fixed-income instruments has become more accessible than ever. Cowrywise allows retail investors to get started with small amounts of money. On Cowrywise, individuals can pool funds, which allows accessibility to higher-yield investments that might not be directly available to them. You can invest in fixed-income instruments easily, track your progress in real time, and earn predictable returns – all from your smartphone.