In July, we experienced a 150% growth in the creation of our dollar fund plans. To be clear, this happened within one month. How? Simple answer: by separating our funds. When we launched the dollar fund, it was lumped with other mutual funds. But we changed that with an update that separated dollar and Naira mutual funds.

Jump to:

Background: A “hidden” dollar fund

Making things seamless is a common way customers describe us. Hence, it became a cause for concern when people couldn’t find our dollar mutual fund offering in the app.

Regardless of the intensity, feature discovery campaigns will deliver fewer results if target features are poorly positioned.

The First Experiment

If there’s a growth mantra at Cowrywise, it is that you experiment as fast as possible and ship. With this in mind, we tried a quick approach of adding a dollar sign to the fund card but that didn’t work efficiently.

Another option we considered was to change the name from the Nigerian Eurobond fund to include Dollar in it. Sadly, we couldn’t do that due to some industry rules laid by the Securities and Exchange Commission (SEC). Funds have to be displayed with only their registered names.

Given the growing desire for dollar-denominated investments, we needed an option that will fix this and also accommodate future dollar funds.

Product Differentiation Scope

Typically our experiments begin with defining what we want to achieve. This is then tied to metrics. In this case, an increase in the contribution of the dollar funds to our assets under management (AUM).

To be honest, I was inspiration dry and completely clueless when I first kicked off work on it. Any significant progress required me to first understand the problem and gather insights on it. Only then could I clarify action points for the team to work on.

Solution Design Process

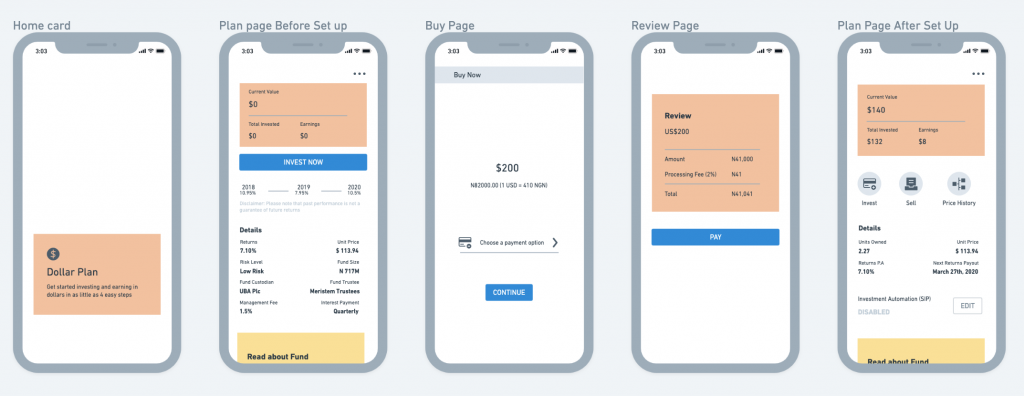

Clarity Through Wireframes

For a start, I made a decision to draw wireframes. The goal was to simplify the dollar plan. With that in mind, I went on whimsical (an online tool used to draw flowcharts, wireframes or mind maps) and drew out a simple wireframe.

This helped. Drawing the wireframe helped me rethink things, gave me perspective and the spark I needed. (It’s always a good idea to draw out your process especially when you feel stuck.)

Customer Service Interactions

Once I had this, I went into digging out data. I looked through support tickets on Intercom, reviews on the app stores.

There’s so much insight you can pick from these two data sources before you even jump on surveys or calls. What I like about looking in there is how you get to see users express themselves. They describe their issues as it is at that moment which I believe is beneficial to data gathering. After this, I spoke with members of our brand engagement and customer support teams as well as some of our customers.

There’s rich data in support tickets. As a product manager, you should read through them consistently

Based on these, I was able to grasp what some of the problems were and what we needed to focus on for our next update. I put this together in a scope document and shared it with the customer-facing teams first to get their feedback. I wanted to make sure I had properly understood what customers’ issues were and was communicating clearly. Once we were aligned on the solution, the next thing was a conversation with design and engineering.

Design and Engineering Relations

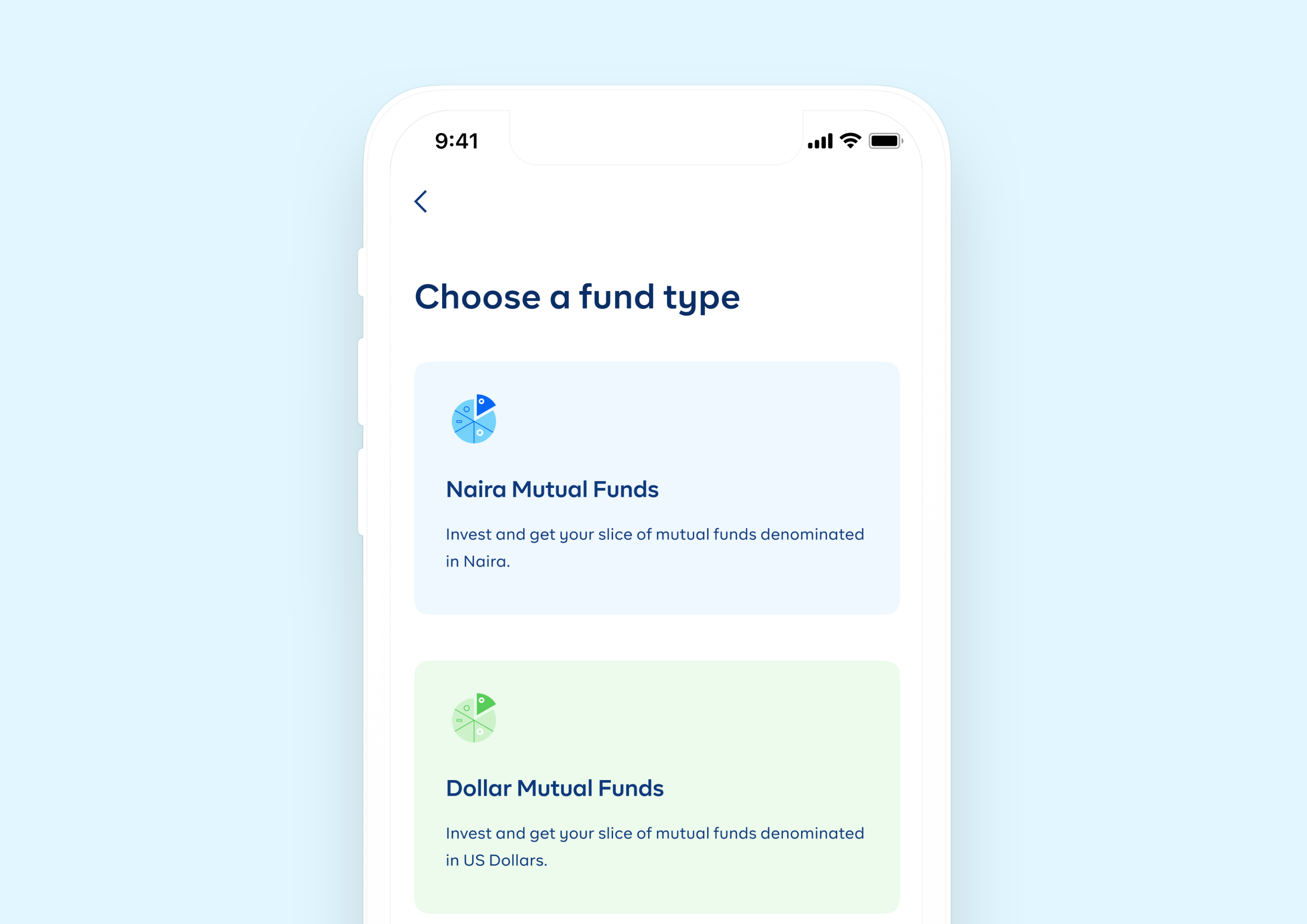

At this stage, we started to dig into solutions and worked on understanding the problems even more as well as constraints. Many conversations led us to separate the dollar mutual funds from the Naira mutual funds, which is what you’ll see in the Cowrywise app now. If we couldn’t rename, we could at least cluster similar funds.

Impact: 150% Growth

The result of that seemingly simple solution was a 150% increase in the creation of dollar plans. It also led to the longest growth stretch we’ve experienced for the fund since inception. It goes to show that the most powerful solutions sometimes come from the little and simple changes we make.

As with all things in life, there’s still a lot to be done, changes will occur. So we’re not done yet. My team and I will keep working towards simplifying wealth management for African millennials.

In the meantime, if you don’t have a dollar fund, waste no time. Tap this link to invest in the dollar fund on Cowrywise. It is important to always have some investments in stable currencies like the dollar.

While you’re at it, feel free to shoot me an email if you have feedback, suggestions, questions or you just want to chitchat. I’m here for it all: yami@cowrywise.com.

Get started with dollar funds here