Think about it. The one unifying consideration all institutions share — private businesses, non-profit organisations, and even governmental bodies — is the concern over liquidity management. And at the centre of this concern is Treasury Management.

As a fast-growing business, how seamless, flexible, and transparent is it to access secure and better-yielding investments to put your business’ excess cash in? The current processes available in the market are fully manual, opaque and relatively rigid, which make your business susceptible to liquidity and operational risks.

Sprout by Cowrywise is a technology-first approach to investments for fast-growing businesses.

Here are some of the key questions that Sprout answers:

- How easily can businesses access investment offerings?

- Can they find the best rates out there on their own?

- Is performing the investment transactions easy/seamless and transparent?

- Does the investment provide security of capital to avoid putting needed business cash at risk?

- How easily can the investments be liquidated?

Providing answers to these questions with a simple tool is why we built Sprout, a technology-first approach to investments for fast-growing businesses. Sprout is a corporate treasury management tool for businesses, leveraging technology and asset management solutions to help your business unlock an additional revenue stream from idle cash.

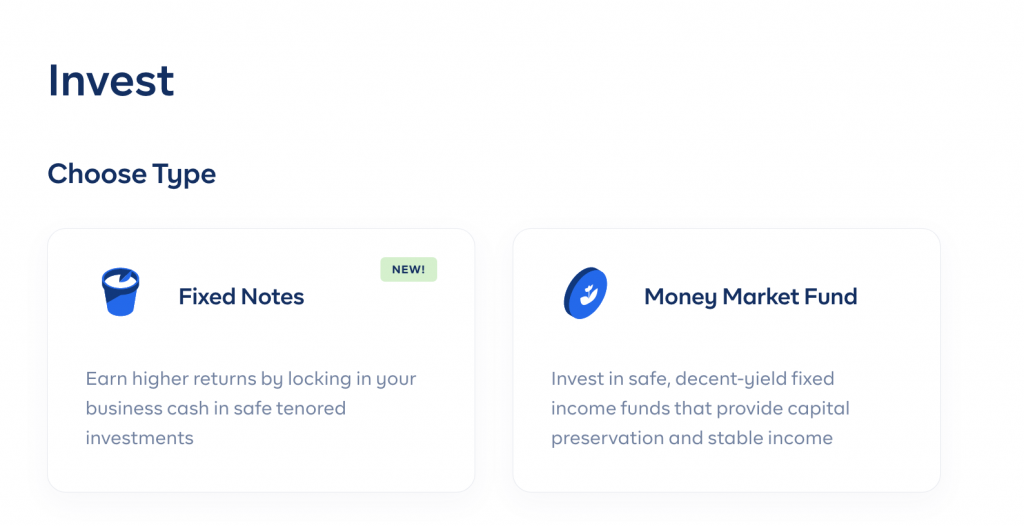

On Sprout, we offer both fixed and flexible investment assets.

Why choose Sprout for your business’ treasury management?

At Cowrywise, we’re committed to making investment easy. We started out with a focus on individuals and we’re still building that one block at a time. In addition to serving individuals, Sprout is a central platform for businesses to make and manage business investments easily. With Sprout, you enjoy:

1. Easy access to diverse, business-friendly investments from top fund managers.

With Sprout, businesses get to choose from a range of investment options with attractive yields, such as a money market index fund and several low-risk mutual funds offered by United Capital, ARM Investment, SFS Capital, Meristem, Afrinvest and other top tier fund managers in Nigeria.

2. A transparent, easy-to-use investment dashboard.

You don’t need to get a finance expert or investment manager to comprehend your transactions. Alongside the ease of investing, Sprout by Cowrywise makes it possible for businesses to easily monitor their investments and quickly understand their transactions.

With a quick glance, you get a view of your investment balance, the percentage of returns earned from your latest transactions and all investments in your portfolio. Investments for businesses have never been easier.

3. Flexible investments’ liquidation process.

With Sprout, your investments are amenable to be converted to cash — both fully and partially. We enable business owners to encash investments within 2 working days when business needs arise. Need your cash for business transactions? Make a request for it with just a few clicks. It’s that easy.

4. Capital preservation with low-risk investments.

You can’t handle the risk of losing your business cash to an aggressive investment scheme? We’ve got you! This is why we help you put your company’s cash in high-quality investment instruments that protect you from any loss.

You’ll choose from a selection of low-risk mutual funds from top tier fund managers that will grow your money steadily, and are guaranteed from any loss. Simply put, your capital is secured and guaranteed from loss.

5. Stay secured and compliant with regulations

With Sprout, your investments are automatically compliant with the highest security standards and top regulations in Nigeria. Sprout is built by Cowrywise, an investment management company licensed by the SEC in Nigeria as a fund/portfolio manager. We complement this license with PCI DSS certification, a top-notch, bank-grade security infrastructure.

We stay security-conscious and remain compliant with regulations, so businesses do not have to go through the complex process.

Get started at the speed of thought! ?

Compared to visiting your banks, submitting long forms and photocopies of all documents, and then waiting for a few days to get verified, simply create your Sprout account, tell us more about the business, submit the necessary documents online and await your verification status within an instant.

Once verified, you can immediately start growing your business’ idle cash without any hassle. Super easy.

Got questions? Reach out or leave a comment below.

Is it possible to take money from our locked savings and put it in sprout to invest before the maturity date?

Also, does the business have to be registered?

Yes, it does.

No, it’s not possible. Locked funds in Cowrywise plans are rendered inaccessible until their maturity date.

How can i start doing this as a student

You can use every option Cowrywise offers right now. Sprout is for startups and high-growth businesses only.

Can I invest from my already locked savings before the maturity date?

No, it’s not possible. Locked funds in Cowrywise plans are rendered inaccessible until their maturity date.

Can I use from my locked savings to invest?

No. Locked funds in Cowrywise plans are rendered inaccessible until their maturity date.

Can a business that’s not registered participate in sprout? And what’s the minimum if yes.

How can I register my business ope. Please help me out. I have paid someone to register it for me but since she has been unavailable

Please I need to access my locked funds before its maturity date. I’m in dire need of funds for medical reasons.