You can bet that most of the financial advice you know today wasn’t taught in school. Schools don’t teach us much, if anything, about wealth building unless you studied a course related to finance.

Another thing is this: While growing up, most kids were never particularly drawn to books about wealth. Can’t blame anyone though; with the plethora of romance and fiction novels available, who cares about wealth right? Lol.

However, now that you’re grown, the need for proper financial knowledge has become more urgent. Fortunately, we can stand on the shoulders of giants who have had noteworthy experiences in building wealth, and leverage their knowledge while picking essential lessons.

In this article, we highlight seven books you must read about wealth.

This list is not in any particular order.

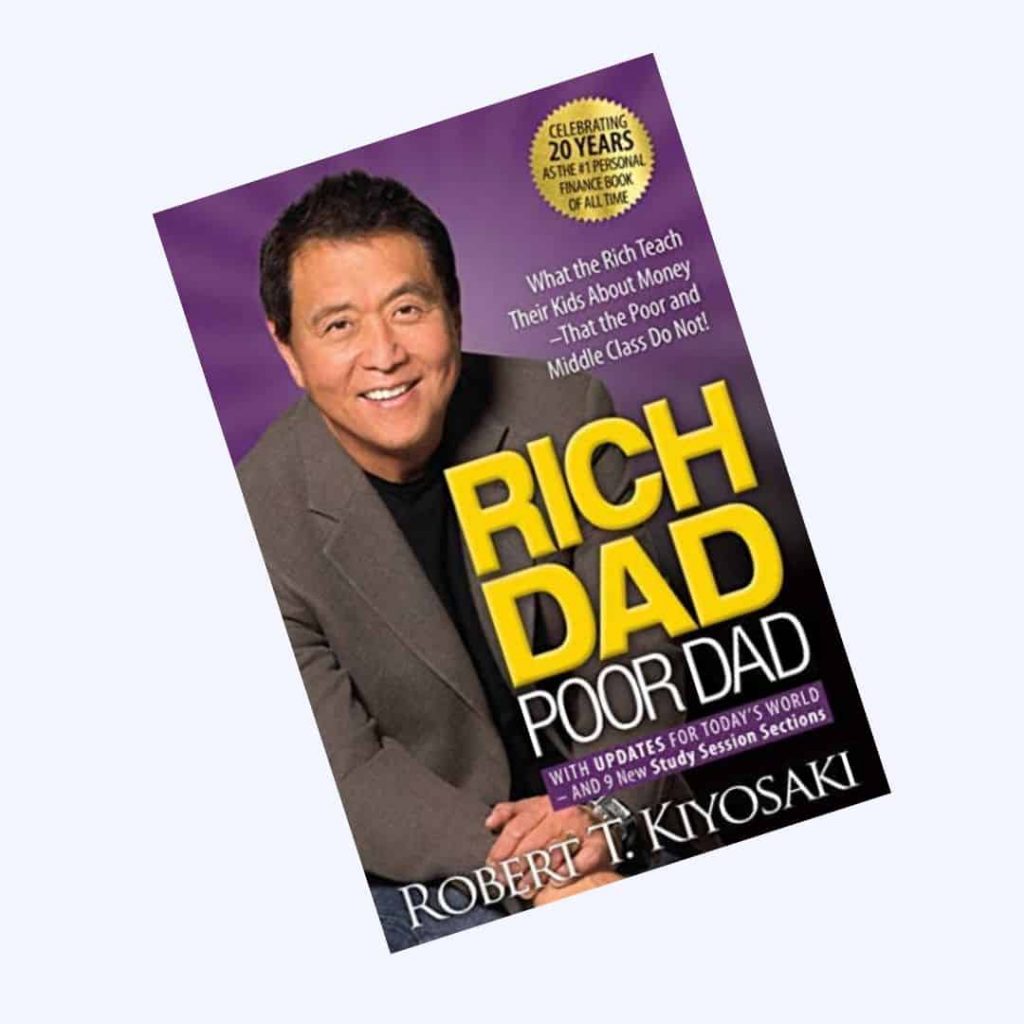

1. Rich Dad, Poor Dad by Robert T. Kiyosaki (1997)

This is one of the most popular books about money.

In the book, the author talks about what he learned from his biological dad (Poor dad) and his friend’s father (Rich dad).

He talks about the differences between these fathers despite his “poor” dad’s hard work, and his friend’s dad is a school dropout but still one of the wealthiest men.

A key takeaway from the book is that it touches on the importance of financial literacy, generational wealth, and the difference between asset and liability.

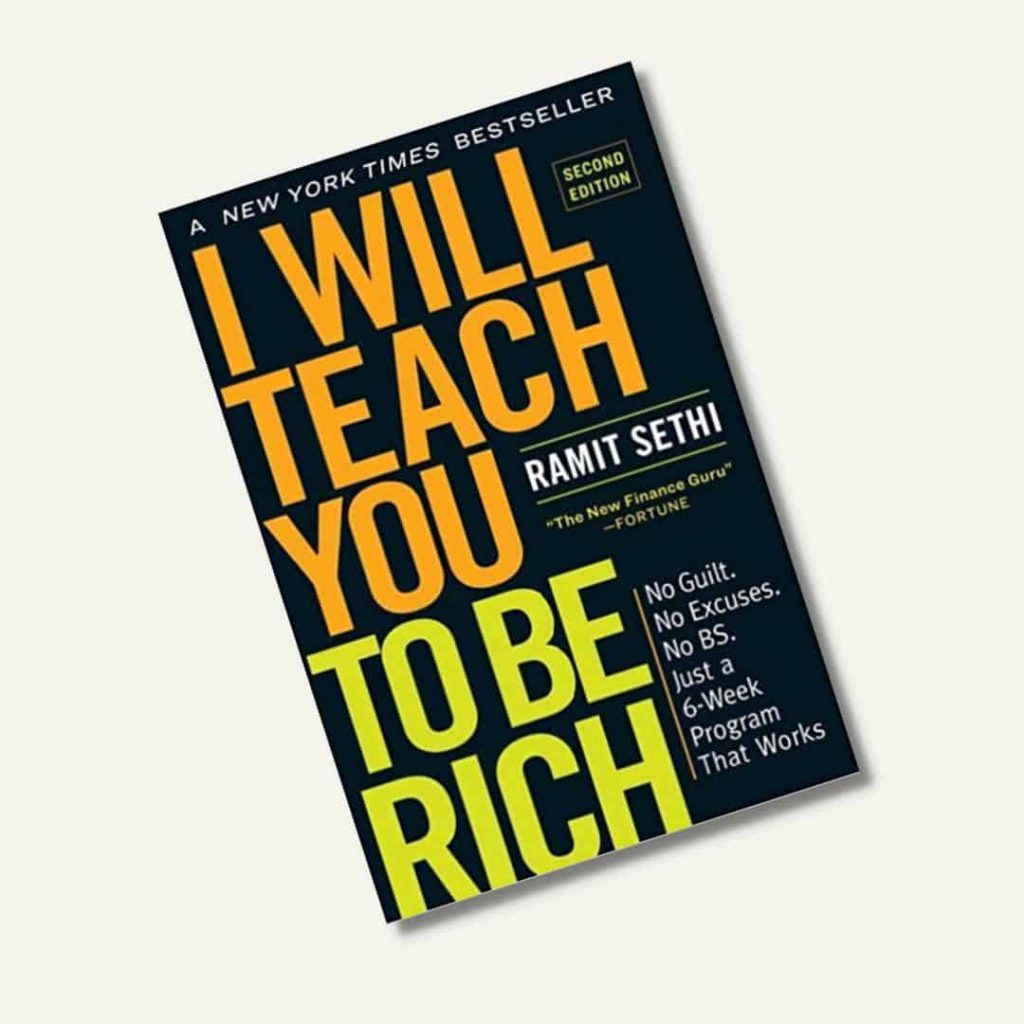

2. I will Teach You to Be Rich by Ramit Sethi (2009)

In this book, Ramit gives a lot of unconventional advice on money management and using money to your advantage as well as budgeting, saving, and investing, and how to better optimize your finances.

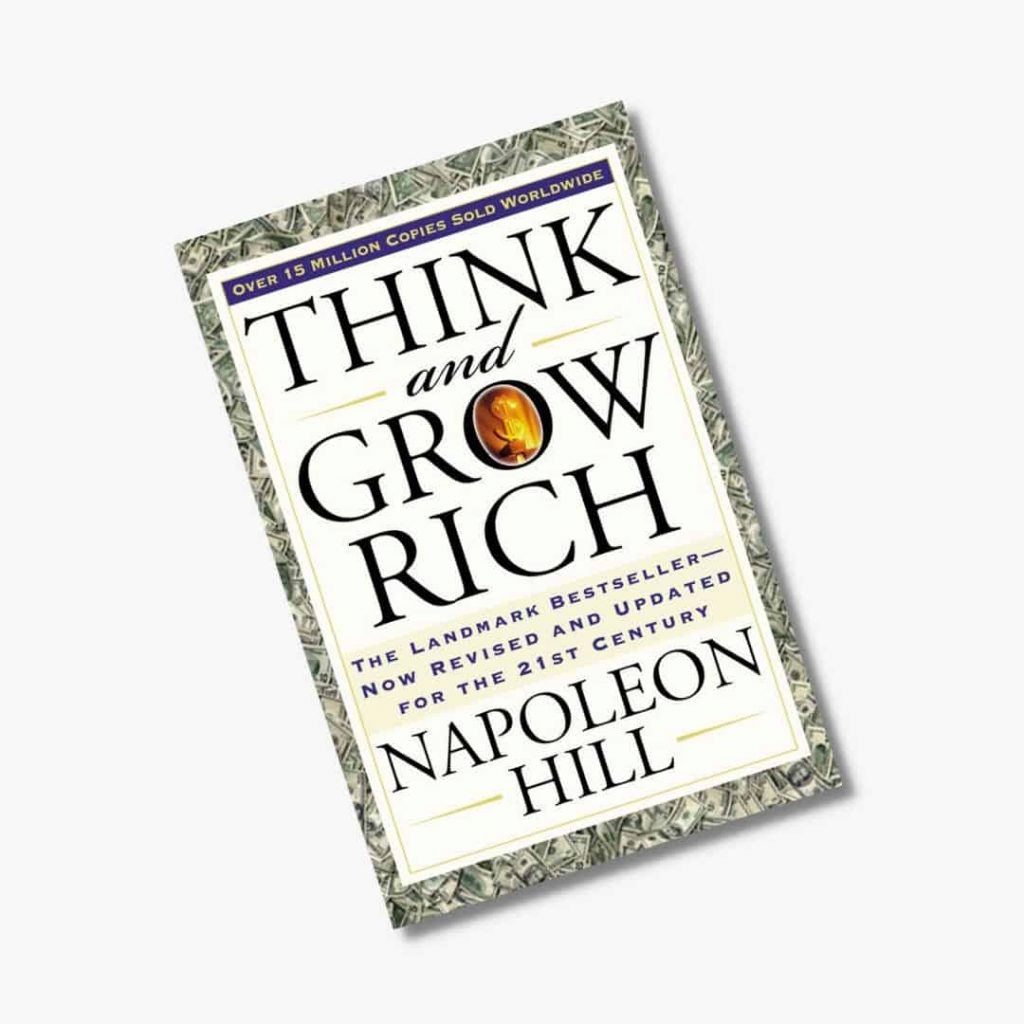

3. Think and Grow Rich by Napoleon Hill (1837)

This book is one of the major literacy pillars.

The author interviewed over 500 wealthy people that built their wealth from scratch like Henry Ford, and Rockefeller to mention a few.

He found similarities and secrets among them and used these as a blueprint for how anyone can become rich.

The book explains how you should begin preparing by determining your goal and desired income level.

Everything starts with the power of your thoughts, followed by action.

4. The Little Book of Common Sense Investing by John C. Bogle (2007)

This book talks about the easy way to grow your wealth through investing in low-cost funds like index funds.

The author was the creator of the world’s first index funds.

He discusses the pros of investing in low-cost index funds, how to avoid the stock market hurdles, diversification, and why it’s better to have multiple investments rather than an individual stock.

5. The Automatic Millionaire by David Bach (2003)

The author David Bach is a self-made millionaire, and this book is one of the best-selling financial books of all time.

The Automatic Millionaire encourages readers how to make small, automatic changes to their financial habits and even their lives.

The book transmits the message that the secret to being wealthy is “paying yourself first” and automating the process by employing the money market and automatically funded retirement accounts to protect the future and pay for the present.

The premise of the book is: Once done, the rest happens on its own.

6. The Richest Man in Babylon by George S. Clason (1926)

This book has risen to become one of the most popular personal finance books that offer financial guidance through a series of parables based in ancient Babylon and set 4,000 years ago.

It really touches on the point of personal finance and wealth creation.

Here, we wrote about 7 money nuggets to glean from this book.

7. Cash Flow Quadrant by Robert T. Kiyosaki (1998)

Cash flow is a sequel to his first book “Rich Dad, Poor Dad”.

In this book, Kiyosaki lays out the cash flow quadrants: E, B, S, I.

E stands for employee, B for the business person, S for self-employed, and I stands for investors.

He talks about each quadrant and how to switch quadrants to become more financially secure.

Bottom line

Financial literacy is crucial; it is literally one of the major differences between the rich and the poor.

Reading books on wealth shifts your perception of living from paycheck to paycheck to letting your money work for you.

Besides changing your mindset about money, reading books about wealth can positively impact your relationship with money and help you make better rational financial decisions.

RELATED

5 Wealth-Building Tips from “The Millionaire Next Door”

How Do Wealthy People Spend Time?