Investing in the equities market can be a thrilling and challenging experience. This is because the investment landscape is a very dynamic and ever-evolving one. But – as with anything in life – taking a moment to understand the basic principles and key concepts is a surefire way to gain a significant advantage and boost your chances of success over the long haul. In this write-up, we aim to equip you with the understanding needed to navigate the world of equities investing.

“Knowledge is the key that unlocks the doors to long-term success.” – Warren Buffett

What is an equity investment?

Equity is best defined as the degree of ownership held in a company or organization. It is the amount of money that a company’s owners have put into it or own. When a founder starts a business and hopes to expand, the options available to him/her are to: a) Get an expensive bank loan or 2) Invite other investors to buy shares/an equity stake in the company. These equity investors are called shareholders and have the option of selling their shares to other investors in the equities market or holding them for a longer period in hopes of a profit or dividend.

Equity investment is therefore the process in which investors buy shares in a company. This is usually done with the hope of reselling them for cash or earning a profit through a dividend.

As you must have guessed, the Equities Market is a market where equity investments are traded. The equities market however goes beyond that. For starters, the market is divided into many segments like private and public markets (or – depending on who you ask – primary and secondary markets).

In the private market, shares are traded between willing buyers and sellers. Trading in private markets is done between sophisticated investors like founders, venture capitalists, angel investors, and private equity firms. The private/niche nature of this market also means that it is usually subject to fewer regulatory requirements. Liquidity in the private equities market is also limited and this means that selling shares in a private company may require time and effort. This is because there may not be a readily available buyer for these shares.

The secondary markets, on the other hand, consist of shares of companies that are publicly traded on stock exchanges. Publicly traded companies have undergone an initial public offering, making their shares available to a broad range of investors. In the secondary market, listed companies are subject to stringent regulatory requirements, including regular financial reporting, disclosure of material information, and adherence to accounting standards which are designed to protect investors and ensure transparency. These regulatory requirements are often imposed by a market regulator and failure to adhere could lead to sanctions and in some cases forced delisting from the stock exchange.

What is a stock exchange?

A stock exchange is a specific type of marketplace where the trading of publicly listed stocks takes place. It is a centralized facility with a platform for investors to trade stocks. An example of a stock exchange is the Nigerian Exchange Group which is the largest exchange in West Africa.

Why should you invest in the stock market?

Investors can grow wealth by actively participating in the success and growth of businesses through the equities market. Though it is not without its risks, the potential for long-term wealth accumulation makes it a compelling option. Some of the many benefits of investing in the equities market include.

Inflation hedge

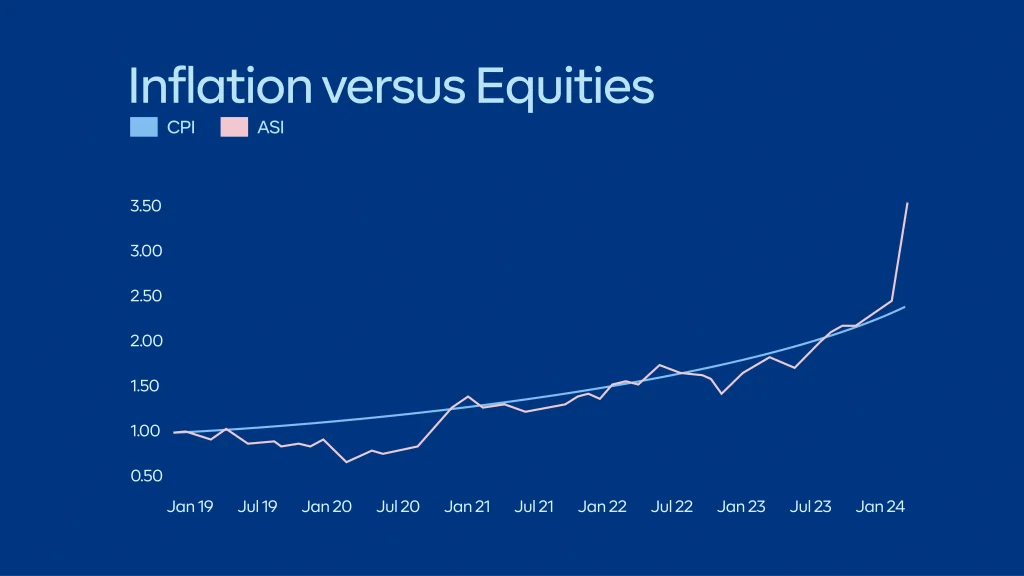

Anyone who lived in Nigeria over the past 5 years knows about inflation and reduction in purchasing power. What is less known is that the one investment vehicle that has outperformed inflation within the same period has been the equities market. Between, January 2019 and December 2023 for example, the consumer price index (which is an index that tracks the general price of goods and services in Nigeria) grew from 276.6 to 643.8 (2.4 times). In the same timeframe, the NGXASI (an index that tracks the performance of the equities market) has grown by 3.31x. And though there were times when inflation was ahead of the stock market, eventually, the stock market caught up with inflation. This supports the prognosis that the stock market is one of the best inflation hedges out there.

Passive income

Dividends are a portion of a company’s profits distributed to its shareholders as a return on their investment. Many publicly listed companies pay dividends regularly and this can be used to supplement shareholder income. Dividend-paying stocks also act as a buffer during downturns as regular income can offset market downturns. This contributes to a more stable overall portfolio.

Diversification

Equities have different risk profiles compared to other asset classes. By including stocks in a portfolio, investors can offset the risk associated with individual investments. This is because the correlation between equities and other asset classes, like bonds or real estate, is very low. This means that when one asset class performs poorly, there’s a chance that another may perform well, contributing to a more stable overall portfolio. To maximise this diversification benefit, you can for example combine one of our dollar mutual funds with an equity mutual fund in your portfolio.

How to invest in the equities market?

Investing in equities in Nigeria can generally be done in one of two ways: 1) Owning stocks directly or 2) Investing in an actively managed equity mutual fund.

Individual stock selection involves carefully choosing specific companies in which to buy shares. This approach requires a thorough analysis of a company’s financial health, growth prospects, and overall market position. While it demands more time and research compared to other investment options, the potential rewards can be significant. However, this method carries significant downside risks. This is because the fate of the investment is closely tied to the performance of individual companies.

The second way to invest in equities is through an equity mutual fund. Mutual funds are like big investment pots managed by financial institutions. They pool money from different investors and invest it in a collection of assets. In an equity mutual fund, money is invested in shares by a fund manager who makes decisions on stock selection. Fund managers invest in a diversified pool of equities to ensure that the fund is protected from downside concentration risk.

Equity funds are also very cost-effective compared to the transaction costs associated with buying and selling individual stocks. This is because fund managers usually have a higher bargaining power due to their size. This makes equity mutual funds a smart choice for investors looking to foray into the equity market. The best part is that you don’t even have to have a large sum to start your investing journey, you can invest as little as N10,000, take advantage of compounding, and watch your wealth grow.