Remember when you had to travel from Lagos to visit your bank’s branch 130km away in Ibadan, just because you need to withdraw cash? If you are less than 25, this may not resonate well with your recollected experience but that was how Nigerians and the most developing world lived less than 20 years ago.

In the financial services industry, service delivery models are changing from interpersonal to personal, from paper-based to electronic records, and from branches to branchless. These new models are feasible today because a new, cheaper and dynamic financial infrastructure is being built which when combined with the growing smartphone-empowered population, accords the new models a fair chance. The good news is: we are just at the tipping point. Over the next 10 to 20 years, it is conceivable to see core financial services delivered as a bundled, on-the-go experience: banking, insurance and investment management. The traditional financial infrastructure may at best serve as a wholesale channel, if not completely overhauled.

Let’s look at an important component of traditional commercial banking in Nigeria as of today and why banking the retail market is an expensive proposition.

A cash mobilizing relic

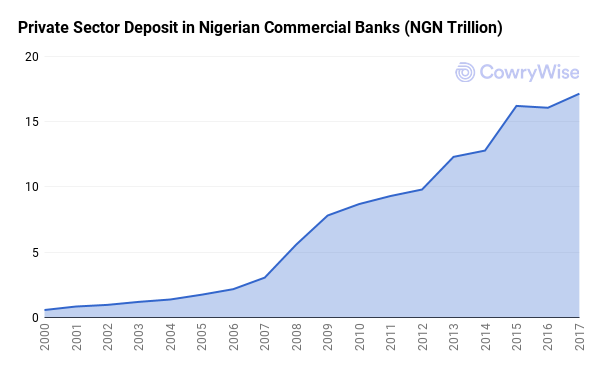

Since the turn of the century, private sector deposit in the Nigerian commercial banking industry has been growing at a decent level of 22% per annum rising from N600Bln in the year 2000 to N17Trillion as of May 2017. While this deposit growth looks impressive, much more is still achievable as more than 40 million Nigerian adults are financially excluded and the majority of the currently banked are underbanked.

As of May 2017, this deposit base is split across the following accounts types:

Savings Accounts, 27% share:

Banks are mandated by CBN to pay savings account holders an interest of 4.2% per annum (30% of MPR). However, once you withdraw 4 times from this account in a month, you forfeit the interest for that month. You can easily say banks pay close to nothing in interest on this type of account as a majority of savings accounts are “spending accounts”.

Current Accounts, 45% share:

Banks usually pay no interest on this type of account. Instead, account holders are charged a maintenance fee currently capped at N1 for every N1,000 transferred from that account to a third-party account within the bank or outside the bank.

Time Deposit: 28% share:

This is the most expensive deposit for banks and is reserved for corporates, HNIs or upper-middle-class or anyone who can place a large sum of money for a fixed period of time.

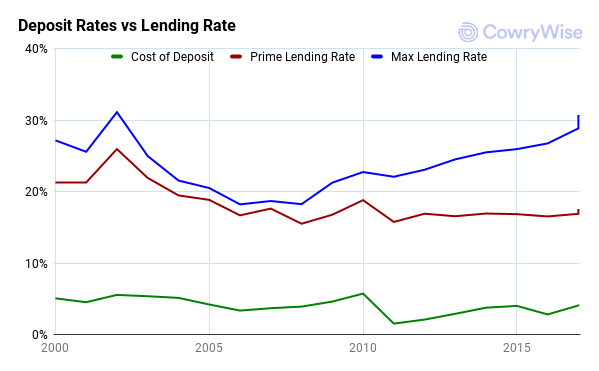

Overall, traditional banks pay close to nothing in interest on 70% of their deposit base. Banks call this cheap deposit the CASA Ratio (Current Account, Savings Account) and has remained at that 70% level for the past 17 years. The higher this ratio, the better for the banks’ overall profitability. In simple terms, Nigerian banks pay a combined interest rate of just 4% per annum on their total deposit base. If depositors earn this low, how come the lending rate is courting 30% per annum? We will come to that in a bit. Be patient.

The costly side effects

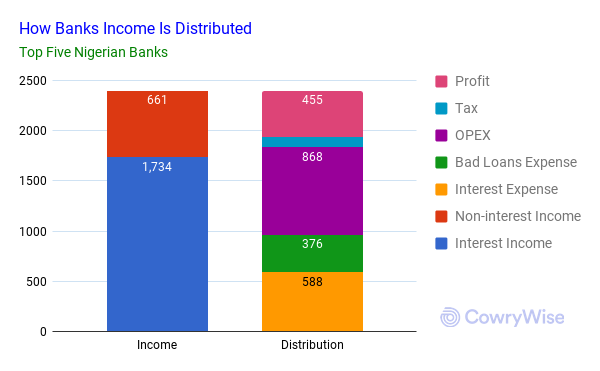

Much of the growth seen in deposit mobilization over the past 17 years has been powered by the traditional financial infrastructure — think of regulatory requirements, brick-and-mortar branches and legacy IT systems. These are not just difficult to build but also expensive to maintain. The top five Nigerian banks carry an OPEX of N350 million to maintain a branch or N500 million if we include the provision for bad debt. Hence, banking the poor and lower-middle-class customers is an expensive proposition.

Traditional banks can’t court the unbanked population with the current banking cost structure: it is frustrating (to users) and expensive (to the traditional financial institutions) to achieve the financial inclusion goal.

Aside from cash cost to the banks, customers also bear bad user experience in financial services born mostly out of a combination of factors ranging from not-so-friendly regulatory requirements to ignorantly sacrificing customer satisfaction for the “security” of the same customer. I can’t find better words to capture the sad state of user experience in the banking sector than the tweet below. This is true for most other financial service providers as well: insurance, asset and wealth management.

Nigerian banking sacrifices user experience for the theater of security.

— Victor Asemota (@asemota) July 17, 2017

There is a disconnect between what the growing number of smartphone-wielding customers want and what the current system can offer. How difficult is it to execute a secure user experience? This may sound simple on the surface and it is rightly simple if you were building a new financial service delivery platform that has user experience at the core of service delivery. This is not so easy for a traditional banking system whose definition of customer experience is woven around thousands of loss-making branches.

By default, banks formulate strategies that revolve around optimizing their branch footprint, which averages 500 branches for each of the top 5 Nigerian banks. These branches become less useful as financial services become more personal. Why not shut down the branches? Well, bankers know too well how difficult it is to get approval to shut down a branch. As a bank, you are locked in with hundreds of high-cost branches around which your overall operational strategies revolve. This will take a while to unwind.

So, you guessed right. The reason banks lend at 30% while paying 4% on combined deposits is the traditional banking system’s cost structure. You can feed your curiosity with the graph below which shows how the top 5 Nigerian banks generate and spend their incomes over the trailing 12 months ending in March 2017 (First Bank’s numbers are trailing 12 months ending in June 2017).

Looking into the future

Outside the obvious profitability of the banking sector, there are lots of value destruction not just to the banks, but more importantly to the customers.

In the future, which continues today, financial services will remain. What will change dramatically are delivery structures and channels. Forces such as cheap technology, growing technology-aware demographics, internet penetration and smartphone adoption are contributing to the birth of personalized financial services and financial democracy.

The next lap of the effect of these combined forces is the enablement of bundled financial service delivery which is currently delivered as disparate financial products such as banking, insurance, asset management and wealth management. The walls between these services are breaking down. The bundled product will not only be delivered to the banked but also to the unbanked population at a low cost-to-serve. Regulation has to be progressive or at worst play catch up to these innovative forces. While slow regulatory adaptation can slow innovation, it has always given way.

This future is unravelling already and is at the core of Cowrywise ambition. We are contributing in our little way to building a low-cost, user-focused, personalized and trust-laden financial delivery model with the customers as important beneficiaries of financial services. Trust is an important element in financial services and understandably so. Lines of weakness range from system integrity to people to unsustainable business models, such as Ponzi schemes. We believe trust is earned and we have to stick our necks out to deserve it. We just started an interesting journey. We hope you join us.

Cowrywise is a personal finance platform that empowers everyone to automate their savings while earning a decent return on such savings. It currently operates with a cooperative license layered with Trust Partnership with Meristem Trustees, an SEC-regulated company, who holds in custody Cowrywise invested assets to ensure the safety of savers’ funds.

Why not visit www.cowrywise.com to feel the pulse of the experience we offer.

This write-up was put together with input from friends. Everything good about it I owe it to them. For every error (if you see one), I take personal responsibility.

Razaq Ahmed, CFA, Co-founder & CEO, Cowrywise

RELATED